Basics of Financial Planning: Charting Your Golden Years with a Silver Lining!

Table of Contents

Ah, retirement! The time to kick back, relax, and… dive deep into financial planning? That’s right! Retirement isn’t just about hammocks and holidays.

It’s about ensuring those hammocks don’t come with a side of financial stress.

So, let’s dive into the world of financial planning for a retirement that’s as smooth as your dance moves at the grandkids’ birthday party.

1. Introduction to Financial Planning

Financial planning isn’t just for the suit-wearing, briefcase-toting crowd. It’s for anyone dreaming of a stress-free retirement.

Think of it as a roadmap, guiding you through your golden years. And why start now? Well, it’s like planting a tree. The best time was 20 years ago.

The second best time? Today! And hey, it’s never too late to start anything new. Be it a new hobby, a dance class, or even… a blog!

2. Financial Planning 101: The Essentials

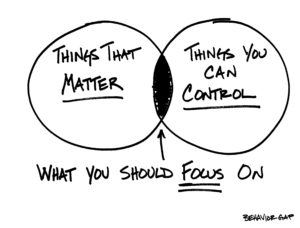

Setting Clear Goals: Whether it’s a dream vacation in the Bahamas or simply spoiling the grandkids rotten, having clear financial goals is the first step.

Understanding Your Financial Health: It’s time to play detective! Assess your assets, liabilities, income, and expenses.

Risk Management: Insurance isn’t just a buzzword. It’s about ensuring you’re covered for life’s little (or big) surprises.

And speaking of surprises, remember when we thought AI would only be about robots cleaning our homes? Now, they’re helping us blog and plan our finances!

3. Why is Financial Planning Important?

Peace of Mind: Sleep better knowing you’ve got your finances sorted.

Making the Most of Your Money: It’s not just about saving; it’s about growing your wealth smartly.

Leaving a Legacy: Ensure your loved ones are taken care of, even when you’re busy dancing in the clouds.

And just a thought: “Just like you wouldn’t sail without a map, you shouldn’t retire without a financial plan. Unless you’re planning to find a treasure island!”

4. The Digital Age of Financial Planning

Gone are the days of dusty ledgers and calculators. Welcome to the age of digital financial planning! With a plethora of tools at our fingertips, managing finances has never been easier.

And with AI on the rise, making informed decisions is a breeze. Ever thought of starting a blog? With AI, it’s easier than ever in 2023.

Share your retirement adventures, financial tips, or even that secret pie recipe. And guess what? It’s a nifty way to make some extra cash!

5. Getting Started with Financial Planning

Seeking Professional Help: Sometimes, it’s okay to ask for directions. Consulting with a financial advisor can offer clarity.

DIY Financial Planning: For those who prefer the hands-on approach, there are countless resources available.

Continuous Learning: Stay updated. Financial trends change, just like fashion. (Although, bell-bottoms, anyone?)

Conclusion

So, there you have it! The basics of financial planning, served with a sprinkle of humor and a dash of modern flair.

Dive into financial planning with the same enthusiasm as a midnight snack raid. After all, your golden years deserve nothing but the best!

Frequently Asked Questions

What exactly is financial planning?

Think of financial planning as a roadmap for your money. It’s a strategy to manage your finances so you can achieve your life goals, be it buying that beach house or ensuring you have enough for those salsa classes!

Is financial planning just about saving money?

How often should I review my financial plan?

Ideally, once a year. But if there are significant changes in your life, like selling a property or a grandchild on the way, it’s good to revisit sooner.

Can I do financial planning on my own, or do I need an advisor?

While many resources can guide you, an advisor can offer personalized advice. It’s like DIY home repair vs. hiring a professional. Both work, but one might save you from unexpected leaks!

How do I choose a good financial advisor?

Research, reviews, and recommendations. And trust your gut. If they promise the moon, remember, they might not be an astronaut!

I’ve heard about robo-advisors. Are they reliable?

Robo-advisors, powered by AI, are great for basic financial planning. But for more complex situations or if you prefer the human touch, traditional advisors are there.

What’s the biggest mistake people make in financial planning?

Not starting early enough. But remember, it’s never too late. Like joining a gym, the best time is now!

How do I account for inflation in my financial plan?

What about unexpected medical expenses in retirement?

Ah, the curveballs of life! That’s where emergency funds and insurance come into play. Always plan for rainy days, even if you’re an eternal optimist.

I’ve got a decent pension coming. Do I still need to plan?

Speaking of blogs, how can I start one in 2023?

With AI tools today, it’s a breeze! Choose a niche, get a platform, and start writing. And who knows? Your insights on retirement might just be the next big hit!

How do I ensure my loved ones benefit from my financial planning?

That’s where estate planning comes in. Wills, trusts, and discussions with your family ensure your hard work benefits them too.

Lastly, any golden rule for financial planning in retirement?

Spend time on it, like you would on a hobby. And remember, it’s not just about money, but living your golden years with a silver lining!

Is it too late to start financial planning in my 60s?

Ever heard of late bloomers? Financial planning welcomes them with open arms!

How do I know if I’m on the right track with my financial plan?

Regular check-ins, adjustments, and perhaps a celebratory dance or two!

I’ve heard a lot about starting a blog in 2023. Can it really help financially?

In the age of AI and digital wonders, blogging isn’t just fun; it’s potentially profitable!

One Comment

Comments are closed.