Savings and Budgeting in Retirement: Making Every Penny Count (and Then Some!)

Table of Contents

Introduction

Ah, retirement! The time when every day feels like a weekend, and every penny… well, it needs to stretch just a bit further.

But fear not, dear retiree, because we’re diving deep into the world of savings and budgeting. And trust us, it’s more exciting than a senior’s discount at the movies!

The Art of Creating a Budget

Retirement brings about a shift in our income streams. Gone are the days of the monthly paycheck, replaced by pensions, savings, and maybe a bit of freelance work (because who can resist?). So, how do we manage?

- Understanding Income Streams: First, list down all your sources of income. Pensions, annuities, rental incomes, and that secret stash under the mattress (just kidding about the last one).

- Breaking Down Monthly Expenses: From utilities to that monthly magazine subscription, jot down every expense.

- The Importance of Flexibility: As the saying goes, “Life happens!” Be prepared to adjust your budget as needs change.

- Witty Remark: “Budgeting: It’s like dieting for your wallet. And just like diets, cheat days are allowed (occasionally)!”

The Safety Net: Building Your Emergency Funds

Life’s little surprises don’t stop at retirement. That leaky roof or unexpected medical bill? They need attention.

- Why It’s Crucial: An emergency fund acts as your financial buffer.

- How Much is Enough?: Aim for 3-6 months of expenses. It sounds like a lot, but it’s worth the peace of mind.

- Tips for Growing This Fund: Consider high-yield savings accounts or even short-term investments.

- Humorous Note: “Think of your emergency fund as a parachute. You hope you never need it, but boy, is it good to have when you do!”

Smart Saving Tips for the Modern Retiree

- Automate Savings: Set up automatic transfers to your savings account. It’s like a pleasant surprise every month!

- Exploring High-Yield Options: Look into high-yield savings accounts or CDs.

- Avoiding Unnecessary Expenses: Do you really need that magazine subscription or the premium cable package?

- Witty Remark: “Saving money is like finding extra fries at the bottom of the bag. Every little bit is a delightful surprise!”

Frugal Living: Luxury Experiences on a Budget

- Travel Hacks: Consider off-season vacations. Fewer crowds and more savings!

- DIY Projects: From gardening to crafting, there’s joy in creating.

- Dining In: Who needs a fancy restaurant when you can have gourmet meals at home?

- Humorous Note: “Being frugal isn’t about living less; it’s about living smart. And who said champagne tastes can’t come on a lemonade budget?”

The Digital Age of Savings and Budgeting

The world’s gone digital, and so has budgeting!

- Modern Tools: Apps like Mint or YNAB can help you track and save.

- Online Communities: Join forums or Facebook groups where people share budgeting tips.

- Subtle Mention: “Ever thought of sharing your frugal finds or budgeting blunders on a blog? With AI tools in 2023, it’s easier than ever to share, connect, and even earn a little on the side!”

Conclusion

Embrace the golden years with financial confidence. Dive into savings and budgeting, and remember, every penny counts!

So, as you sip on that early morning coffee, think about the financial freedom that’s just a budget away. Cheers to a secure, sun-soaked retirement!

Frequently Asked Questions

I’ve just started budgeting in retirement. Is it too late?

It’s never too late to start budgeting! Every step you take towards managing your finances now will benefit you in the long run.

How can I differentiate between essential and non-essential expenses?

Essential expenses cover basic needs like housing, utilities, food, and healthcare.

Non-essentials might include entertainment, dining out, or luxury purchases. Review your expenses and ask yourself what you can live without.

I’ve heard about the 50/30/20 rule. Is it applicable in retirement?

The 50/30/20 rule is a guideline where 50% of income goes to needs, 30% to wants, and 20% to savings.

In retirement, this might shift, especially if you have a fixed income. It’s a good starting point, but adjust based on your unique situation.

What’s the best way to track my expenses?

There are various methods, from traditional pen-and-paper to digital apps like Mint or YNAB. Choose what you’re comfortable with and stick to it.

How can I cut down on healthcare expenses in retirement?

Are there any budgeting workshops or classes I can attend?

Many community centers and online platforms offer financial workshops tailored for retirees. Websites like Coursera or Udemy often have courses on personal finance.

How do I budget for leisure and travel in retirement without breaking the bank?

Plan trips during off-peak seasons, look for senior discounts, and consider more local or less expensive destinations. Remember, it’s about the experience, not the price tag!

I want to leave an inheritance. How does this factor into my budgeting?

It’s a noble thought. Consider consulting with a financial planner to ensure you’re saving adequately for your heirs while also maintaining your lifestyle.

How can I make my home more budget-friendly?

Consider downsizing, or making energy-efficient upgrades. Also, review any services or subscriptions you might not need.

With inflation, how should I adjust my budgeting strategy?

It’s essential to review and adjust your budget annually. Take into account rising costs and consider investments that outpace inflation.

I’ve accumulated debt. How do I incorporate debt repayment into my budget?

Prioritize high-interest debts and consider allocating a specific portion of your monthly budget towards repayment. Every bit counts!

I’m considering starting a blog about my budgeting journey in retirement. Any tips?

That’s a fantastic idea! Choose a user-friendly platform, be consistent, and share both your successes and challenges.

With AI tools in 2023, setting up and managing a blog is easier than ever. Plus, it’s a great way to connect with others and even earn a bit on the side.

How often should I review and adjust my budget?

Ideally, every month. But at a minimum, quarterly reviews can help keep you on track.

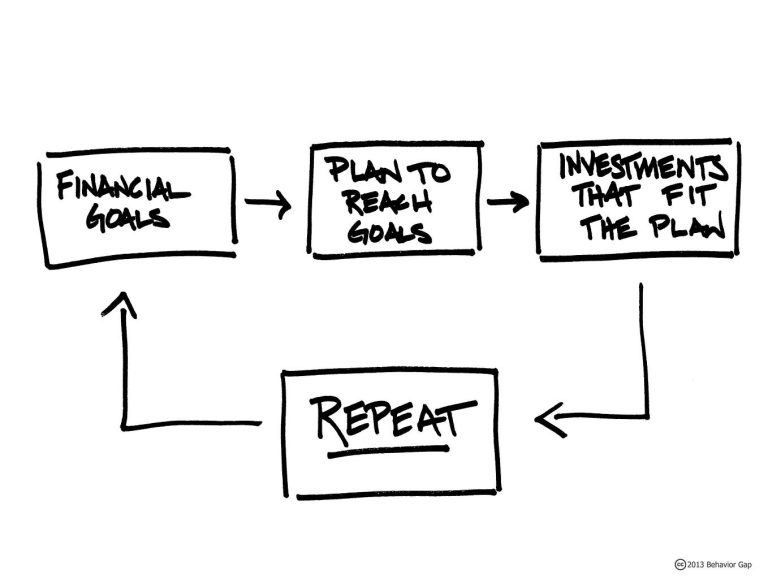

Can I still invest while focusing on savings and budgeting?

Absolutely! It’s all about balance. Consider speaking to a financial advisor to find investments that align with your risk tolerance and goals.

How can I save when I’m already on a tight budget?

Focus on small changes. Even saving a tiny amount consistently can add up over time.

Are there specific budgeting methods you recommend for retirees?

The envelope system can be effective, as can zero-based budgeting. It’s about finding what works for you.