Mistakes to Avoid in Retirement Planning

Table of Contents

Introduction

Ah, the golden years! A time when you should be sipping cocktails on a beach, not fretting about finances. But to ensure those cocktails are well-funded, you need to dodge a few pitfalls in retirement planning. Think of it as a game of financial hopscotch, where the goal is to land safely without toppling over.

The Landscape of Retirement Planning

Understanding the basics of retirement planning is like understanding the rules of a board game. You need to know the moves, the challenges, and the end goal. But unlike a board game, the stakes are real. And trust me, the common retirement errors can make you feel like you’ve landed on the ‘Go to Jail’ square in Monopoly.

Common Pitfalls in Retirement Planning

Not Starting Early Enough: Remember the tale of the tortoise and the hare? Slow and steady wins the race, especially when compound interest is involved. The earlier you start, the more you accumulate.

Overlooking Inflation: Ah, inflation! That sneaky little gremlin that eats away at your savings. It’s like the slow leak in an inflatable mattress – you don’t notice it until you’re uncomfortably close to the ground.

Planning Misconceptions: Thinking you’ve saved enough? Or that you can rely solely on your pension? These misconceptions can lead to a rude awakening. It’s like thinking you’ve baked a cake long enough, only to find it’s still gooey in the middle.

The Role of Financial Advisors

Navigating the financial maze can be daunting. That’s where financial advisors come in, like navigators with a treasure map. They can guide you, help you avoid common retirement errors, and ensure you’re on the right path. And speaking of paths, ever thought of documenting your financial journey on a blog? With AI tools, it’s a breeze!

Misconceptions in Retirement Planning

“I Don’t Need to Plan Yet” Syndrome: Procrastination might work when you’re delaying laundry, but with financial planning? Not so much.

The “I’ll Rely on Social Security” Belief: Social security can be a safety net, but relying solely on it is like using an umbrella full of holes in a downpour. You’re bound to get wet!

Embracing Modern Tools and Technology

Welcome to 2023, where there’s an app for everything – including retirement planning. These digital tools can help you sidestep pitfalls and keep you on track. And if you’re feeling tech-savvy, why not start a blog about your financial journey? With AI, setting up and maintaining a blog is easier than ever!

Conclusion

Retirement planning is more than just numbers; it’s about ensuring a comfortable and enjoyable future. By avoiding common pitfalls and staying informed, you can pave the way for a golden retirement.

And as you navigate this journey, consider sharing your insights on a blog. After all, in 2023, blogging isn’t just a pastime; it’s a potential goldmine! Cheers to a financially secure retirement!

Frequently Asked Questions

I’ve already made some of these retirement mistakes. Is it too late for me to correct them?

It’s never too late to make adjustments. While earlier actions might have yielded better results, taking corrective steps now can still make a significant difference.

How do I know if I’m saving enough for retirement?

A good rule of thumb is to aim for 70-80% of your pre-retirement income. However, consulting with a financial advisor can give you a clearer picture tailored to your specific needs.

Can I rely solely on Social Security for my retirement?

While Social Security can provide a base, it’s risky to rely solely on it. Diversifying your income sources ensures a more comfortable retirement.

How can I protect my savings from inflation?

Investing in assets that historically outpace inflation, like stocks or real estate, can help. Also, consider Treasury Inflation-Protected Securities (TIPS).

What’s the biggest misconception about retirement planning?

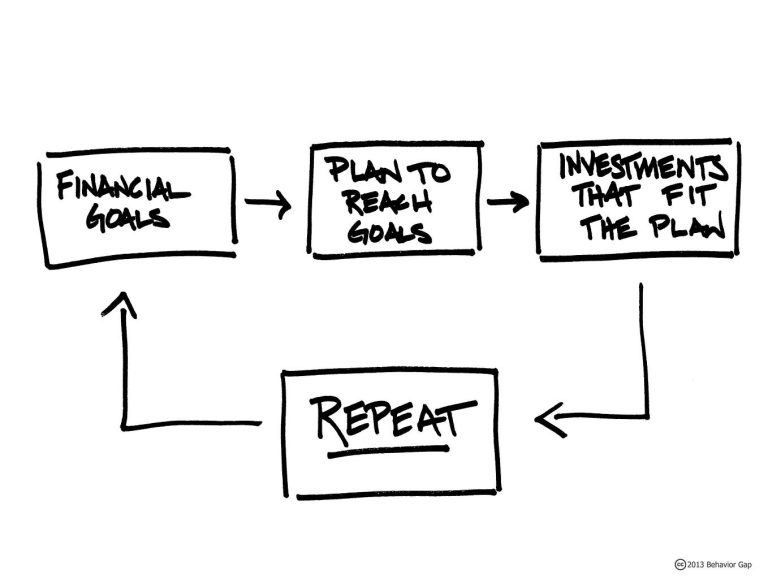

That it’s a one-time task. Retirement planning is ongoing. As life changes, so should your plan.

How often should I review my retirement plan?

Ideally, once a year. However, if there are significant life changes, such as marriage, buying a home, or changing jobs, it’s wise to revisit sooner.

Are there any tools or apps you’d recommend for retirement planning?

There are many! Some popular ones include Personal Capital, Mint, and Betterment. And if you’re into sharing, why not blog about your experiences using them?

I’ve read about the FIRE movement. What is it?

FIRE stands for “Financial Independence, Retire Early.” It’s a movement focused on extreme savings and investments to retire much earlier than the traditional age.

How do taxes play into retirement planning?

Taxes can significantly impact your retirement savings. Consider tax-efficient investment strategies and be aware of potential tax liabilities in retirement.

I’m considering starting a blog about my retirement journey. Any tips?

Absolutely! Choose a niche, be consistent, engage with your audience, and consider using AI tools to help with content creation and optimization. Your journey can inspire and guide others!

What’s the most overlooked aspect of retirement planning?

Diversification. It’s essential to spread your investments to minimize risks.

How can I avoid common retirement planning errors?

Stay informed, be proactive, and don’t shy away from seeking professional advice.

Are there tools that can help me in retirement planning?

Absolutely! From budgeting apps to AI-driven platforms, there’s a tool for every need.

How do I know if I’m on the right track with my retirement plan?

Regularly review your goals, track your progress, and adjust as necessary. And remember, it’s a journey, not a destination.