How to Become a Financial Planner: Your Vanika Guide (2025)

Find out how to become a licensed financial planner with clear steps, essential certifications, and tips for lasting career success.

Key Takeaways

- Financial planner licensing requirements vary based on services offered, with some advisors needing multiple securities licenses while others may need none

- Essential licenses include Series 6, 7, 63, and 65, with each serving specific purposes from selling securities to providing fee-based advice

- The complete licensing process typically takes 18-24 months and costs between $1,500-$5,000, depending on chosen certifications and exam preparation

- CFP certification is the gold standard requiring education, experience, examination, and ethical standards compliance

- Most financial planners need sponsorship from FINRA-affiliated firms to take certain licensing exams

I’ll be honest with you—when I first started exploring how to become a licensed financial planner, I thought it’d be straightforward. You know, like getting a driver’s license but for money stuff. Boy, was I wrong! The financial planning industry is absolutely booming (we’re talking 13% job growth through 2032—nearly double the average), but here’s the kicker: the licensing landscape is more complex than trying to understand your teenager’s latest TikTok obsession.

Unlike becoming a CPA or CFA where there’s a pretty clear roadmap, financial planning licensing is like a choose-your-own-adventure book. Some advisors juggle multiple securities licenses like they’re running a circus act, while others operate successfully without any licenses at all. It’s enough to make your head spin faster than a variable annuity prospectus (and trust me, those things are dizzy-inducing).

But don’t worry—I’ve been down this rabbit hole, and I’m here to walk you through every twist and turn. From figuring out which licenses you actually need to navigating the step-by-step process that’ll set you up for success in this incredibly rewarding field.

Understanding Financial Planner Licensing Requirements

Here’s something that’ll probably surprise you: anyone can call themselves a “financial planner” without any licenses whatsoever. Seriously! The title isn’t legally protected, which means your neighbor who’s really good at budgeting for vacation trips could technically hang out a shingle tomorrow.

But here’s where reality kicks in—the moment you want to actually help clients in meaningful ways, you’re going to need some credentials. Want to sell investment products? License required. Planning to provide investment advice for compensation? Yep, another license. Thinking about selling insurance? You guessed it—more licensing.

I’ve seen too many eager new advisors get tripped up because they didn’t understand this fundamental truth: the licensing requirements depend on three critical factors—what services you’ll provide, how you’ll get paid, and where you’ll do business. It’s like building a house; you need the right permits for each type of work you’re planning to do.

The financial industry regulatory authority (FINRA) oversees most securities licensing, while states handle insurance licenses and some advisory activities. This dual regulatory system means many advisors end up needing multiple licenses to serve their clients completely—kind of like needing both a fishing license and a hunting license if you want to do both activities.

Here’s what really matters for your compensation structure: fee-based advisors who charge clients directly typically need different licenses than commission-based advisors who earn money from product sales. A fee-focused advisor might only need a Series 65 license, while someone planning to sell mutual funds and provide comprehensive services could need Series 7, 63, and insurance licenses. It’s like choosing between being a consultant who bills for time versus a retailer who sells products—different business models, different rules.

Operating without proper licensing isn’t just risky—it’s potentially career-ending. I’ve watched promising careers derailed by hefty fines, and that’s not even considering the criminal charges or reputation damage that can follow. Most reputable companies won’t even look at candidates without proper licensing for securities or advisory positions.

Educational Foundation Requirements

Let me start with some good news: you don’t need a finance degree to become a successful financial planner. I’ve met incredibly successful advisors who started with degrees in everything from education to engineering. What matters more is your willingness to learn and your ability to connect with people about their money (which, let’s face it, can be scarier than talking about relationship issues).

That said, having the right educational foundation makes everything else significantly easier. A bachelor’s degree is pretty much the baseline for most serious financial planning positions, especially if you’re eyeing that certified financial planner (CFP) designation down the road.

The most relevant degree programs include finance, business administration, economics, accounting, and mathematics. These give you the analytical foundation to understand investment analysis, risk management, tax laws, and those broader economic factors that keep your clients up at night worrying about their retirement.

But here’s where I want to give hope to all the career changers out there—don’t panic if your undergraduate degree was in medieval literature or marine biology. The financial planning field absolutely welcomes people from completely different backgrounds, and honestly, some of the best advisors I know bring unique perspectives from their previous careers.

For CFP certification (and we’ll dive deep into this later), there are specific coursework requirements regardless of what you studied in college. The CFP Board requires completion of a college-level program covering financial planning, insurance, investment planning, income tax planning, retirement planning, and estate planning. These courses can be taken through traditional universities or specialized continuing education providers.

The rise of online education has been a game-changer here. I’ve watched working professionals complete their CFP coursework through accredited online programs while maintaining their current careers—no more choosing between paying the bills and pursuing your dreams. Most programs recommend 12-18 months for completion, which is totally doable if you’re strategic about your time.

Here’s a little-known secret: some professionals with existing credentials can skip portions of the coursework. CPAs, CFAs, attorneys, and people with doctoral degrees in relevant fields often get credit for previous education, potentially cutting down the requirements significantly.

Essential Securities Licenses for Financial Planners

Okay, let’s talk about the alphabet soup that is securities licensing. When I first encountered terms like Series 6, Series 7, and Series 65, I thought someone was just making up random combinations of words and numbers. But each license actually serves a specific purpose, and understanding which ones you need starts with getting crystal clear on your business model.

FINRA administers most securities licenses, and each comes with its own prerequisites, exam requirements, and ongoing maintenance obligations that’ll follow you throughout your career. The key is figuring out your business model first, then getting the right licensing to support it—not the other way around.

Most financial planners end up needing some combination of these licenses, and the requirements have evolved quite a bit over the years. New prerequisites and continuing education requirements are designed to protect consumers and ensure advisor competence (which honestly, is a good thing for everyone involved).

Series 6 License: Entry-Level Securities Authorization

The Series 6 license is often where new financial advisors get their feet wet, especially those working for insurance companies or focusing on packaged securities like mutual funds and variable annuities. Think of it as your learner’s permit for the securities world—it lets you sell mutual funds, variable life insurance, and other packaged investment products, but specifically prohibits you from selling individual stocks or bonds.

Since October 2018, you’ve got to pass the Securities Industry Essentials (SIE) exam before you can even think about Series 6. It’s an extra step, sure, but it actually provides a solid foundation in basic securities concepts that’ll serve you well. The Series 6 exam itself consists of 100 questions with a 70% passing score requirement, and most candidates spend about 4-6 weeks preparing.

The exam covers investment company products, variable contracts, retirement plans, securities markets, and regulatory requirements. While it’s less comprehensive than Series 7, you’ll still need a solid understanding of mutual fund structures, share classes, and suitability requirements.

Cost-wise, you’re looking at a $40 exam fee plus study materials ranging from $200-500. Many advisors use this as a stepping stone, gaining experience with packaged securities before pursuing the broader Series 7 authorization.

But here’s the reality check: Series 6 comes with significant career limitations. You can’t sell individual stocks, bonds, options, or many other securities that clients might actually need. Most financial planners eventually upgrade to Series 7 to expand their service capabilities and open up better career opportunities.

Series 7 License: General Securities Representative

If Series 6 is your learner’s permit, then Series 7 is your full driver’s license for the securities world. This comprehensive license authorizes the sale of virtually all securities products except commodities and futures. We’re talking individual stocks, bonds, options, municipal securities, packaged securities, and most other investment products your clients might need.

The exam format includes 125 questions administered over 3 hours and 45 minutes, with a 72% passing score requirement. The material is substantially more comprehensive than Series 6, diving deep into equity securities, debt securities, options, municipal securities, investment company products, and securities markets.

Since October 2018, you need to pass the SIE exam before tackling Series 7. Most candidates spend 6-12 weeks preparing, often using intensive review courses or comprehensive self-study programs. I always tell people to budget more time than they think they need—this isn’t the kind of exam you want to wing.

Here’s the catch: you must be affiliated with a FINRA member firm to take the Series 7 exam. This means finding employment or an independent contractor relationship with a broker-dealer before you can even start your licensing journey. Most companies provide study materials and support because, frankly, your success benefits everyone.

The Series 7 license opens up significantly more career opportunities than Series 6. You can work with clients needing comprehensive investment services, sell individual stocks and bonds, and qualify for higher-level positions at most financial services firms.

Series 63 License: State Securities Law Requirements

The Series 63 license is like the fine print of securities licensing—it focuses on state securities laws and ethical practices rather than product knowledge. Most states require this license for anyone selling securities to residents, making it essential if you’re planning to work with clients across state lines.

The exam consists of 60 questions covering state securities regulations, ethical practices, and administrative provisions. With a 75-minute time limit and 72% passing score, it’s one of the more manageable licensing exams, though the legal focus requires careful study of regulations and case studies.

You must hold Series 6 or Series 7 concurrently with Series 63—they complement each other rather than stand alone. Series 63 doesn’t authorize product sales; it authorizes compliance with state laws governing those sales.

State-by-state variations add some complexity here. While most states accept the uniform exam, some impose additional requirements like ethics courses, background checks, or continuing education beyond FINRA standards. I always recommend researching your target states’ specific requirements early in the process.

This license is particularly important for advisors planning to work with clients in multiple states or those considering independent practice. Larger firms often handle multi-state registration automatically, but independent advisors have to navigate these requirements themselves.

Series 65 License: Investment Adviser Representative

Now we’re getting into the advisory world. The Series 65 license authorizes fee-based investment advice and financial planning services, making it essential for anyone planning to charge clients directly for advice rather than earning commissions from product sales. This license allows you to provide investment advice, develop financial plans, and charge advisory fees for your services.

The exam includes 130 questions covering investment principles, laws and regulations, ethics, and fiduciary responsibilities. With a three-hour time limit and 72% passing score, you’ll need substantial preparation—typically 6-10 weeks of intensive study. The material emphasizes portfolio theory, asset allocation, client suitability, and regulatory compliance.

Here’s what’s different about Series 65: unlike other securities licenses, it doesn’t require sponsorship from a FINRA member firm. You can take this exam independently, which makes it attractive for entrepreneurial advisors planning fee-based practices. However, you’ll still need to register with appropriate regulatory authorities to actually conduct business.

There are some alternative pathways for Series 65. If you hold CFP, CFA, ChFC, or certain other credentials, you might qualify for the license without taking the exam. Additionally, many states accept the CFP credential in lieu of Series 65 for state-registered investment advisers.

The Series 65 license comes with significant fiduciary responsibilities. Unlike brokers operating under suitability standards, investment adviser representatives must act in their clients’ best interests at all times. This higher standard affects everything from fee disclosure to investment recommendations and ongoing client management.

Series 66 License: Combined Agent and Adviser Representative

Think of the Series 66 license as the Swiss Army knife of securities licensing—it combines elements of Series 63 and Series 65, allowing holders to both sell securities and provide investment advice. This dual capability makes it attractive for advisors wanting maximum flexibility in their service offerings and compensation structures.

The exam format includes 100 questions administered over 2 hours and 30 minutes, covering state law, investment adviser law, ethics, and economic principles. The 72% passing score and comprehensive material require 6-8 weeks of preparation for most candidates.

There’s a key prerequisite here: you must hold a Series 7 license before you can take Series 66. This requirement makes Series 66 the logical choice for general securities representatives who want to add advisory capabilities to their practice.

The benefits include the ability to earn both commissions and advisory fees, depending on the client relationship and services provided. This flexibility allows advisors to tailor their compensation to each client’s preferences and needs—some clients prefer paying fees, while others are more comfortable with commission-based relationships.

State filing requirements vary significantly for Series 66 holders. Some states require additional documentation, background checks, or continuing education beyond FINRA standards. The ongoing compliance obligations can get pretty complex, especially if you’re working across multiple states.

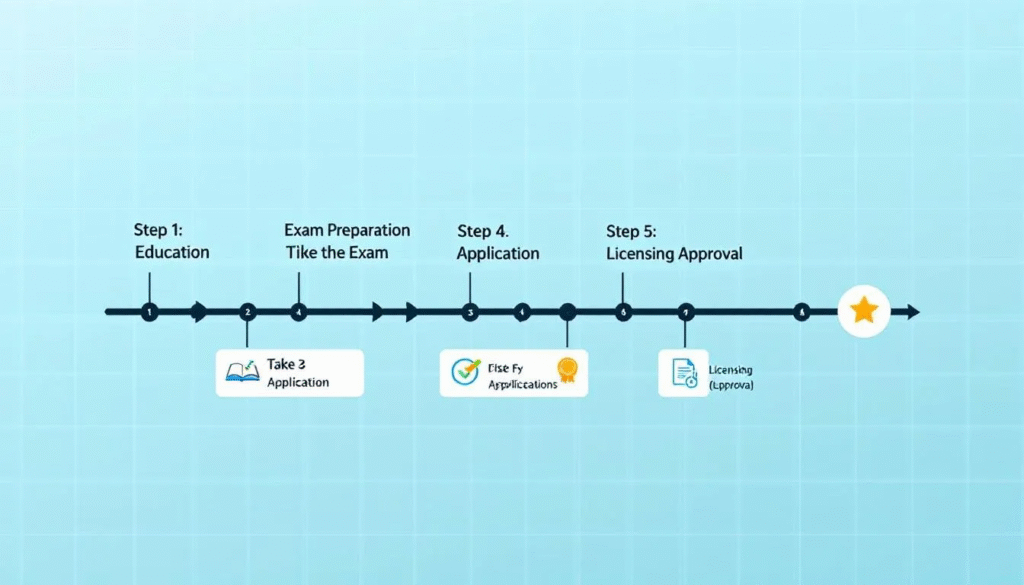

Step-by-Step Licensing Process

Alright, let’s break this down into bite-sized, manageable steps. Understanding how to become a licensed financial planner means taking this journey one step at a time rather than trying to tackle everything at once. The typical timeline ranges from 12-36 months, depending on your chosen path, study pace, and whether you’re working while pursuing licensing.

The priority order for taking exams really depends on your career goals and employment situation. I’ve seen people follow two main pathways: the securities sales route (SIE → Series 7 → Series 63) or the advisory route (SIE → Series 65 → state registration). Some choose the comprehensive path (SIE → Series 7 → Series 66) for maximum flexibility.

Documentation requirements are pretty thorough—you’ll need education transcripts, employment history, residence history, and detailed disclosure of any regulatory, criminal, or financial issues. The background check process is no joke, and honesty is absolutely crucial here. I’ve seen people get denied licenses for trying to hide relatively minor issues that would’ve been fine if disclosed upfront.

Common roadblocks include failing to secure proper sponsorship, underestimating study requirements, or rushing through the process without adequate preparation. The good news? Most of these problems are totally preventable with proper planning and realistic timelines.

Step 1: Complete Educational Requirements

Your educational foundation impacts every single step that follows, so it’s worth getting this right from the start. While a bachelor’s degree isn’t required for all licenses, it’s essential for CFP certification and strongly preferred by most employers. The good news is you can often begin licensing while completing degree requirements—it doesn’t have to be an either-or situation.

For those pursuing CFP certification, the bachelor’s degree requirement is pretty flexible—any field from an accredited college works. However, the CFP Board-approved coursework must be completed before taking the CFP exam. These courses cover financial planning principles, insurance planning, investment planning, income tax planning, retirement planning, and estate planning.

Alternative education providers have really expanded in recent years. You’ve got major universities, community colleges, and specialized financial planning programs all offering coursework. Online options have absolutely exploded, giving working professionals the flexibility to complete requirements while keeping their day jobs.

Timeline considerations vary quite a bit based on your starting point and study schedule. Full-time students can often knock out CFP coursework in 12-18 months, while working professionals typically need 18-24 months. The key is choosing a program format that actually matches your schedule and learning style, not the one that looks best on paper.

Step 2: Pass the Securities Industry Essentials (SIE) Exam

The Securities Industry Essentials (SIE) exam is your foundation for all FINRA licensing—kind of like learning basic grammar before you write poetry. This 75-question exam covers basic securities concepts, market structure, regulatory framework, and prohibited practices. With a 105-minute time limit and 70% passing score, it’s designed to ensure you understand fundamental concepts before pursuing specialized licensing.

Here’s what I love about the SIE exam: no sponsorship required! You can take it independently while job searching or preparing for a career transition. The exam fee is $80, and results stay valid for four years, giving you plenty of flexibility in timing your next steps.

Study materials range from comprehensive textbooks to online courses and practice exams. Most candidates spend 2-4 weeks preparing, depending on their background in finance and investments. The material includes basic investment products, market participants, regulatory bodies, and ethical standards.

The SIE exam is basically your entry ticket into FINRA’s licensing system. Passing it demonstrates basic competency and qualifies you to pursue specialized licenses like Series 6, 7, or others. I often recommend that people take SIE early in their career transition to show potential employers they’re serious about the field.

Step 3: Secure Sponsorship and Take Required Series Exams

Here’s where things get interesting (and sometimes frustrating). Sponsorship from a FINRA member firm is required for most securities licenses beyond SIE. This creates what I call the “chicken-and-egg problem”—you need a job to get licensed, but many jobs require licensing. The solution? Finding employers willing to sponsor promising candidates or exploring internship and apprenticeship programs.

Many larger firms have structured training programs that include sponsorship, study materials, and mentoring. These programs often require commitments of 2-3 years, but they provide comprehensive support through the licensing process. Smaller firms might offer sponsorship on a case-by-case basis for candidates with relevant experience or strong potential.

Independent contractor arrangements with broker-dealers also provide sponsorship opportunities. These relationships offer more flexibility but typically come with less support and training. I always tell people to research potential sponsors carefully, considering their reputation, training programs, and long-term career opportunities.

The application process includes extensive background documentation, fingerprinting, and regulatory filings. Allow 2-4 weeks for processing before you can schedule your exam. Many firms expedite this process for new hires, but independent contractors might experience longer delays.

Scheduling and taking Series exams requires careful planning. Exam appointments are available year-round, but popular time slots fill up quickly. Most advisors schedule exams 4-6 weeks in advance, allowing time for final preparation while ensuring availability at their preferred testing center.

Step 4: Obtain State-Level Licenses

State licensing requirements vary more than pizza preferences across the country. Securities sales typically require Series 63 in addition to Series 6 or 7, while advisory services might require Series 65 or state-specific examinations. Some states have reciprocity agreements, while others impose completely unique requirements that’ll make your head spin.

State registration applications require detailed personal and professional information—we’re talking education history, employment history, and disclosure of any legal or regulatory issues. Background investigations and fingerprinting are standard, and some states require additional documentation like personal financial statements.

The fee structure varies by state, typically ranging from $50-200 per state for initial registration. Renewal requirements include continuing education (usually 12-24 hours every two years) plus renewal fees. Multi-state practice significantly increases ongoing compliance obligations and costs—something to keep in mind when planning your business model.

Ongoing renewal requirements demand careful attention to deadlines and continuing education obligations. Most states provide online tracking systems, but the responsibility for compliance rests squarely on your shoulders. Missing renewal deadlines can result in license suspension and potential client disruption—not exactly a career highlight you want on your resume.

CFP Certification: The Gold Standard Path

When people ask me about the certified financial planner (CFP) credential, I like to think of it as the black belt of financial planning. While you don’t legally need it to provide financial planning services, CFP certification significantly enhances credibility, earning potential, and client trust. The CFP Board reports that CFP professionals earn an average of 26% more than their non-certified counterparts—and who doesn’t want a 26% raise?

The “Four Es” framework—Education, Examination, Experience, and Ethics—creates a comprehensive standard for financial planning competency. This rigorous process ensures CFP professionals possess both the technical knowledge and ethical grounding necessary for true fiduciary responsibility.

Professional recognition extends way beyond higher compensation. Many larger RIA firms prefer or require CFP certification for senior positions, and clients increasingly seek out certified professionals. The credential provides national recognition without the hassle of state-to-state transfer complications.

CFP Education and Examination Requirements

The education requirement includes both a bachelor’s degree and completion of CFP Board-approved coursework covering comprehensive financial planning topics. The bachelor’s degree can be in any field from an accredited college—yes, even that medieval literature degree I mentioned earlier—but it must be completed either before taking the CFP exam or within five years afterward.

CFP coursework covers 72 specific topics across six main areas: professional conduct and regulation, general principles of financial planning, investment planning, tax planning, retirement savings and income planning, and estate planning. The integrated curriculum builds from basic concepts to complex planning strategies and real-world case studies.

The CFP exam consists of 170 questions administered over two sessions totaling six hours. The examination integrates multiple financial planning disciplines, requiring candidates to analyze complex scenarios and make appropriate recommendations. The format includes case studies, calculations, and application of planning principles to realistic client situations—basically, they want to see if you can actually help real people, not just memorize textbook definitions.

First-time exam takers achieve approximately 66% pass rates, making thorough preparation absolutely essential. The CFP Board provides detailed topic outlines, practice questions, and recommended study resources. Most candidates spend 3-6 months preparing, often using review courses, study groups, or comprehensive self-study programs.

The exam fee is $825, but total costs including education range from $4,000-20,000 depending on the program you choose. Many employers provide tuition reimbursement or study support, recognizing the value of having CFP professionals on staff.

Professional Experience and Ethics Standards

The experience requirement ensures CFP professionals understand real-world financial planning beyond theoretical knowledge—because let’s face it, textbook scenarios never quite capture the complexity of helping a panicked client whose investment account just dropped 20% in a market downturn.

Candidates must complete either 6,000 hours of qualifying financial planning experience over at least three years, or 4,000 hours through an approved apprenticeship pathway. Qualifying experience includes providing financial planning advice to clients, supervising financial planning activities, or teaching financial planning at the college level.

The experience can be gained before, during, or after completing education and examination requirements, providing flexibility for career changers. I’ve seen people start their experience clock while they’re still working on education requirements—it’s all about strategic planning.

The apprenticeship pathway offers an alternative for new graduates or career changers. These programs provide structured mentoring under experienced CFP professionals, with specific requirements for client interaction and planning skill development. Apprenticeship experience typically leads to faster career advancement and stronger professional networks.

The Ethics Declaration requires candidates to disclose any criminal, civil, self-regulatory, or governmental proceedings. The CFP Board conducts thorough background investigations, and honesty is absolutely crucial throughout this process. Most issues can be resolved through the fitness determination process, but trying to conceal information typically results in denial.

Ongoing continuing education requires 30 hours every two years, including at least two hours focusing on ethics and professional responsibility. This requirement ensures CFP professionals stay current with evolving planning techniques, regulations, and ethical standards throughout their careers.

Investment and Timeline Considerations

Let’s talk money—specifically, how much this journey is going to cost you and what kind of return you can expect on your investment. Understanding the financial commitment required for financial planning licensing helps you budget appropriately and evaluate potential return on investment.

Realistic timelines depend on numerous factors including your current education level, available study time, employment status, and chosen licensing path. Full-time pursuit of licensing can be completed in 12-18 months, while part-time study typically extends the timeline to 24-36 months.

ROI analysis shows strong potential returns for financial planning licensing, particularly when pursuing advanced certifications. The Bureau of Labor Statistics reports median annual wages for personal financial advisors at $87,850, with top earners exceeding $200,000 annually. When you compare that to the investment required for licensing, the math starts looking pretty attractive.

Cost Analysis by Licensing Path

Basic securities licensing represents the most affordable entry point, typically costing $500-2,000 for Series 6 or 7 plus Series 63. This includes exam fees, study materials, and initial registration costs. Many employers provide study materials and exam fee reimbursement, significantly reducing out-of-pocket expenses.

The investment adviser path costs slightly more, typically $1,000-3,000 for SIE plus Series 65 and state registration. The higher cost reflects more comprehensive study materials and potentially higher state registration fees. However, this path offers more flexibility for independent practice down the road.

CFP certification represents the highest initial investment, ranging from $4,000-20,000 depending on education provider and study methods. University programs typically cost $8,000-15,000, while specialized providers might charge $3,000-7,000. Additional costs include exam fees, study materials, and ongoing continuing education.

Here’s where hidden costs often surprise new advisors: background check and fingerprinting fees range from $100-300 per license. State registration fees vary widely, and multi-state practice multiplies these costs. Professional liability insurance, required for most advisory practices, costs $1,000-5,000 annually depending on coverage and assets under management.

Annual maintenance costs include license renewals, continuing education, and professional memberships. Budget $200-1,000 annually for basic licensing maintenance, with higher costs for multiple licenses or advanced certifications. The CFP Board charges $355 annually for certification maintenance, plus continuing education costs.

Timeline Expectations and Planning

The fast track option appeals to career changers or recent graduates who can dedicate full-time effort to licensing. This pathway typically requires 6-12 months for basic securities licensing or 12-18 months including CFP certification. Success depends on intensive study schedules and passing exams on the first attempt—no pressure, right?

The comprehensive path balances licensing with other life responsibilities, typically requiring 18-24 months from start to full licensing including CFP certification. This timeline allows for part-time study, potential exam retakes, and coordination with employment opportunities. Most working professionals choose this approach because, frankly, bills don’t pay themselves while you’re studying.

Extended timelines of 3-4 years accommodate the CFP experience requirement while pursuing other aspects of certification. This pathway allows candidates to gain relevant professional experience while completing education and examination requirements. It’s particularly attractive for those changing careers gradually rather than making a dramatic leap.

Several factors can accelerate or delay your timeline. Prior finance experience reduces study time, while employment sponsorship streamlines the process. Conversely, exam failures, documentation delays, or personal circumstances can extend timelines significantly. I always recommend building buffer time into your planning—life has a way of throwing curveballs when you least expect them.

Strategic scheduling minimizes career disruption while maximizing momentum. Many candidates take SIE during career transition periods, secure employment with exam sponsorship, and complete remaining licenses during their first year. Coordinating with employer training programs often provides additional support and resources that can make the whole process smoother.

Building Your Licensed Financial Planning Career

Successfully obtaining your licenses is just the beginning of building a thriving financial planning career—kind of like getting your driver’s license is just the start of becoming a skilled driver. The employment landscape offers diverse opportunities, from traditional wirehouses to independent RIA firms, each with distinct advantages and requirements for newly licensed advisors.

Employment options span the entire spectrum from large institutional firms to solo practices. Wirehouses like Morgan Stanley and Bank of America offer structured training programs, comprehensive support systems, and established client bases. These firms typically require multiple securities licenses and provide extensive mentoring for new advisors—it’s like having training wheels while you learn the ropes.

Regional and independent broker-dealers offer middle-ground options, combining institutional resources with more entrepreneurial culture. These firms often specialize in specific market segments or service models, allowing advisors to develop expertise in particular areas while building their practices.

RIA firms represent the fastest-growing segment of financial advisory services, emphasizing fee-based relationships and fiduciary responsibility. Many RIAs seek advisors with CFP certification and Series 65 licenses, prioritizing planning skills over product sales experience.

Client acquisition strategies for newly licensed planners often begin with personal networks and community involvement. Many successful advisors build their initial client bases through referrals from friends, family, and professional contacts. Community activities, professional organizations, and continuing education events provide networking opportunities—and honestly, these relationships often turn into lifelong friendships as well as business connections.

Specialization opportunities allow advisors to differentiate themselves and command premium fees. Popular niches include retirement planning for federal employees, financial planning for healthcare professionals, or serving specific demographic groups. Developing niche expertise typically requires additional education, but it can significantly accelerate career growth and make you the go-to expert in your chosen area.

Technology tools and practice management systems have completely revolutionized financial planning delivery. New advisors should expect to master CRM systems, financial planning software, and digital communication platforms. Many firms provide training on their preferred technology stack, but basic comfort with digital tools is pretty much essential in today’s environment.

Salary Expectations and Career Progression

Entry-level financial planner salaries typically range from $45,000-65,000, depending on location, firm size, and specific role. Trainee programs at larger firms often provide base salaries plus incentive opportunities, while smaller firms might offer lower bases with higher upside potential.

The median annual wage for personal financial advisors reached $87,850 according to the Bureau of Labor Statistics, but there’s significant variation based on experience, credentials, and business model. Fee-based advisor compensation often includes salary plus bonuses based on assets under management or client acquisition—essentially, the more successful your clients become, the more successful you become.

CFP professionals command premium compensation, with industry surveys showing average incomes ranging from $121,000-190,000 depending on experience and practice type. The certification provides significant leverage in salary negotiations and client acquisition efforts—it’s like having a prestigious degree that clients actually understand and value.

Location significantly impacts earning potential, with major metropolitan areas typically offering higher compensation to offset living costs. However, lower-cost markets might provide better lifestyle balance and potentially higher net income after adjusting for expenses. It’s worth considering what kind of life you want to build, not just what kind of paycheck you want to earn.

Long-term earning potential in financial planning is substantial for those who build successful practices. Many senior advisors and practice owners earn well into six figures, with top performers reaching seven-figure incomes. However, success requires years of relationship building, continuous learning, and business development skills that go well beyond basic licensing.

Career progression typically follows predictable patterns, though everyone’s journey is unique. Junior advisors focus on learning and supporting senior team members while building their knowledge and client relationships. Mid-career professionals take on more complex planning cases and begin developing specializations. Senior advisors often transition to practice management, business ownership, or specialized consulting roles.

The job growth projections for financial planning remain strong, driven by aging demographics, growing wealth accumulation, and increased awareness of professional financial advice benefits. More clients are recognizing the value of comprehensive financial planning beyond simple investment management—and frankly, it’s about time!

Frequently Asked Questions

Can I become a financial planner without any licenses?

Yes, you can legally call yourself a “financial planner” without any licenses, since the title isn’t regulated. However, your ability to provide real value to clients will be severely limited—kind of like calling yourself a chef when all you can do is make toast. You cannot sell investment products, provide investment advice for compensation, or sell insurance without appropriate licensing. Most clients expect their financial planners to offer comprehensive services, making licensing practically necessary for career success and client satisfaction.

How long does it take to become fully licensed as a financial planner?

The timeline varies significantly based on your chosen pathway and study schedule. Basic securities licensing can be completed in 6-12 months, while comprehensive licensing including CFP certification typically takes 18-24 months. If you need to complete a bachelor’s degree first, add 2-4 years to the timeline. Working professionals often take 2-3 years to complete all requirements while maintaining their current careers—and honestly, that’s perfectly normal and reasonable.

Do I need a sponsor to take all financial planning licensing exams?

No, sponsorship requirements vary by exam, which can be confusing at first. The Securities Industry Essentials (SIE) and Series 65 exams can be taken independently without sponsorship—these are your “free agents” of the licensing world. However, Series 6, 7, 63, and 66 require sponsorship from a FINRA member firm. This creates a challenge for career changers, but it also motivates employers to hire promising candidates and support their licensing journey.

What’s the difference between securities licenses and the CFP certification?

Securities licenses are regulatory requirements that authorize specific activities like selling investment products or providing investment advice. They’re administered by FINRA or state regulators and focus on legal compliance and product knowledge—think of them as your permission slips for various activities. CFP certification is a professional credential demonstrating comprehensive financial planning competency and ethical standards. It’s voluntary but highly valued by employers and clients, often leading to higher compensation and better career opportunities. It’s like the difference between having a driver’s license and being a certified professional driver.

Can I practice in multiple states with my financial planning licenses?

Multi-state practice requires careful attention to each state’s specific requirements—and trust me, they’re all different enough to keep you busy. Securities licenses typically require Series 63 registration in each state where you conduct business, with separate applications and fees for each state. Investment adviser representatives might need Series 65 registration or state-specific licensing depending on the size of their practice and number of clients. Some states have reciprocity agreements that make things easier, while others impose unique requirements that’ll have you wondering why you didn’t just become a tax preparer instead. Research each target state’s rules carefully and budget for multiple state registrations and ongoing compliance obligations—it’s part of the cost of doing business across state lines.

One Comment

Comments are closed.