Which of the Following Are Benefits of Building Financial Plans? A Friendly Guide to Getting Your Money Together

Discover which of the following are benefits of building financial plans and how they can boost your financial confidence, reduce stress, and help you reach your goals.

Let’s be honest here: building a financial plan isn’t just for those folks sipping champagne on their yachts or the Wall Street types who speak in acronyms. Nope. It’s for you, me, and literally anyone who’s ever stared at their bank account and thought, “Well, that’s… concerning.” In this article, I’ll walk you through which of the following are benefits of building financial plans — with a healthy dose of humor, some brutally honest talk, and yes, actual research that’ll make you feel smart at dinner parties.

Why Bother with a Financial Plan Anyway?

Before we dive into the good stuff, let’s get something straight: a financial plan is basically your GPS for money. And trust me, without it, you’re essentially driving around with a blindfold on, hoping you don’t crash into the nearest Starbucks and spend your entire emergency fund on overpriced coffee drinks. I’ve been there — we’ve all been there.

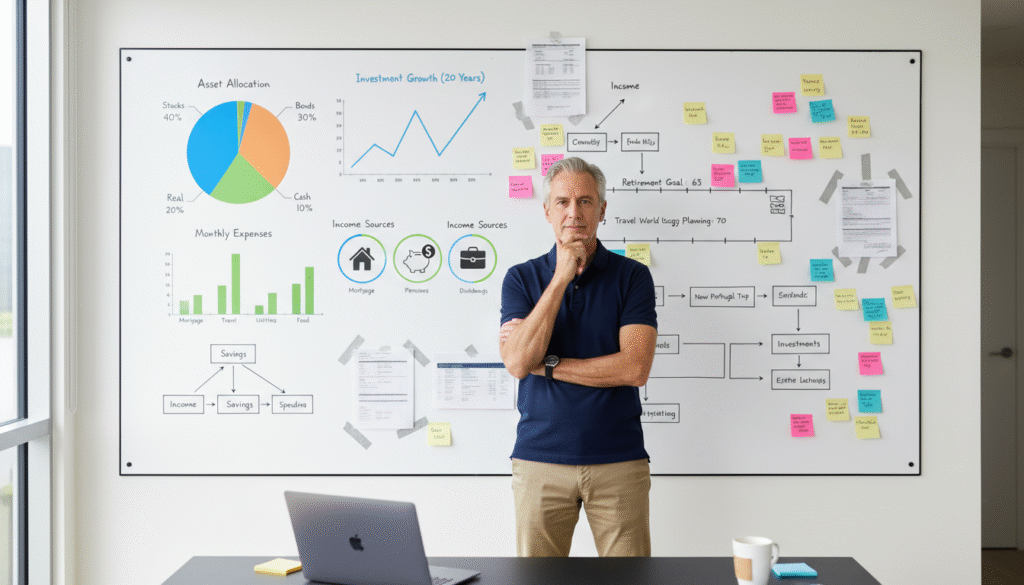

A solid financial plan helps you map out your income, expenses, savings, investments, and yes, even those debts that follow you around like an overly attached ex. All while keeping your long-term goals in sight, which is surprisingly harder than it sounds when Amazon keeps suggesting things you “need.”

Now, you might be wondering, “Which of the following are benefits of building financial plans?” Great question, and I’m glad you asked. The answer might actually blow your mind because it’s not just about hoarding money like some financial dragon (though that’s a nice side effect). It’s about clarity, confidence, and control — three things that are shockingly rare in adult life.

The Big Picture: Seeing Your Financial Situation Clearly

One of the first benefits of financial planning is finally getting a bird’s-eye view of your money situation. Think of it as Marie Kondo-ing your finances — except instead of asking if something sparks joy, you’re asking if it sparks bankruptcy.

When I finally wrote out a financial plan, it was like turning on the lights after years of guessing in the dark. My income, expenses, debts, assets, and investments were all right there—organized, not overwhelming. That view makes it way easier to spot the leaks and find simple places to save or invest better.

Maybe you’ll discover you’re spending an embarrassing amount on food delivery (I once calculated I could’ve bought a small car with my DoorDash expenses), or that your insurance coverage has more holes than Swiss cheese. A financial planner can help you catch these blind spots and suggest adjustments that actually make sense. It’s like having a financial GPS that doesn’t just tell you where you are, but also recalculates when you inevitably take a wrong turn.

Financial Planning Helps You Set and Achieve Financial Goals

Ever tried to hit a bullseye while wearing a blindfold? That’s basically what setting financial goals feels like without a plan. I learned this the hard way when I decided I wanted to “save more money” — which is about as specific as saying you want to “be healthier” while eating pizza for breakfast.

A financial plan transforms those vague hopes into concrete, achievable goals — whether you’re saving for a house down payment, planning for retirement, or finally conquering that credit card debt that’s been giving you stress nightmares.

Here’s where it gets interesting: a 2019 study from the University of California found that people with written financial plans are 42% more likely to feel confident about their finances and 36% more likely to actually save money regularly. That’s not luck — that’s the power of having a roadmap instead of just wandering around the financial wilderness hoping for the best.

Staying on Track: Your Financial Plan as a Roadmap

Life has this adorable habit of throwing curveballs at the worst possible moments — unexpected car repairs, job changes, or market volatility that makes your investment portfolio look like it’s doing interpretive dance. I’ve watched my retirement account go up and down more times than a toddler on a trampoline.

But here’s the thing: a financial plan helps you stay focused through all this chaos. It keeps your priorities straight and your eyes on the long-term prize, even when short-term distractions are practically screaming for your attention.

This is where working with a good financial planner becomes a total game-changer. They help you figure out your risk tolerance and adjust your plan accordingly. So when the market decides to have a dramatic meltdown, you don’t panic-sell everything and hide your money under your mattress. Instead, you stick to your strategy with the confidence of someone who actually knows what they’re doing.

Stress Reduction: Peace of Mind is Priceless

Money stress is painfully real, and if you’ve ever lost sleep worrying about your finances, you’re definitely not alone. The American Psychological Association dropped some sobering news in their 2022 survey: 64% of Americans report money as a major source of stress. That’s more than half the country lying awake at night, probably calculating whether they can afford both groceries and gas this week.

Here’s where financial planning becomes your financial therapist: a written plan reduces that gnawing uncertainty and doubt that keeps you up at night. When you know exactly where you stand and what steps to take next, sleeping becomes significantly easier. Plus, having an emergency fund and proper insurance built into your plan means you’re actually prepared for life’s inevitable curveballs, which dramatically reduces the “what if” anxiety spiral we all know and love.

Smart Spending and Saving: Control Over Your Cash Flow

A financial plan helps you track your cash flow — basically the money coming in versus the money flying out faster than you can say “impulse purchase.” It’s like having a really honest best friend who’ll tell you when you’re about to make a questionable financial decision.

I’ve found that regularly reviewing my financial situation helps me catch unnecessary expenses before they multiply like rabbits. That $12 monthly subscription you forgot about? The fancy coffee habit that’s costing more than your car payment? Your financial plan will shine a spotlight on these budget vampires so you can redirect that money toward goals that actually matter to you.

It’s all about working smarter today so you can actually enjoy life tomorrow — without the crushing guilt of wondering where all your money went.

Wealth Management and Investment Strategy

Here’s a more human, conversational rewrite that keeps your structure and tone, just tighter and more relatable:

Building a financial plan isn’t about stuffing cash under a metaphorical mattress. It’s about growing your money on purpose. With a solid plan, you’re making investment decisions that fit you—your goals, your timeline, and your tolerance for watching your portfolio do gymnastics on a Tuesday.

A good financial advisor is basically your investment translator. They help you diversify, manage risk, and aim for better returns—without you needing a PhD or a second browser tab for every acronym. The point isn’t luck. It’s strategy. You’re not crossing your fingers; you’re building wealth your future self is going to high-five you for.

Preparing for the Future: Retirement and Beyond

One of the biggest wins of financial planning is that you actually prepare for the future—instead of just hoping it sorts itself out. Whether your version of retirement is traveling, tinkering, volunteering, or leaving something meaningful for your family, a plan turns “someday” into a timeline.

Retirement planning is really about the math of your life: what money comes in, what goes out, and what you’ll need when you’re not trading hours for income anymore. A solid plan keeps you on track so you have enough when it matters most—and avoids that nightmare scenario of “still breathing, savings not.” It’s peace of mind, on paper.

Business Financial Planning: The Backbone of Success

If you’re running a business, you already know that a solid business plan includes detailed financial planning. This isn’t just paperwork for the sake of paperwork — it helps you set clear company goals, manage cash flow like a pro, allocate budgets wisely, and eliminate costs that aren’t pulling their weight.

Financial planning in business also helps you prepare for inevitable crises and challenges — because let’s face it, every business hits speed bumps that feel more like mountains. Having a financial plan means you’re not just surviving whatever life throws at you; you’re steering your business toward genuine growth and success.

Taking Action: How to Start Your Financial Planning Journey

Feeling inspired yet? Good! Starting your financial planning journey can be as simple as listing your income, expenses, debts, and goals on a piece of paper. From there, you can create a written financial plan yourself or get help from a financial planner who knows their stuff.

Remember, the best financial plan is one you’ll actually stick to and update regularly. It’s a living document that grows and evolves with you, adapting to life’s constant changes and surprises.

Wrapping It Up: Which of the Following Are Benefits of Building Financial Plans?

So, which of the following are benefits of building financial plans? The answer is basically all of them and then some. From gaining that crystal-clear view of your finances and setting achievable goals, to reducing stress, managing wealth strategically, and preparing for whatever the future throws your way — financial planning helps you take control of your money and, ultimately, your life.

If you’re ready to stop guessing and start planning with purpose, take that first step today. Your future self will absolutely thank you — and might even send you a postcard from that dream vacation you’ve been systematically saving for.

There you have it: a genuinely friendly, confidence-building guide to the many benefits of financial planning. Now go forth and plan with purpose — your bank account will thank you later.

One Comment

Comments are closed.