What is a way to stay accountable to reaching your financial goals?

Table of Contents

Staying on the Financial Straight and Narrow: Accountability in Your Golden Years!

Introduction

Ah, goals. Remember setting that New Year’s resolution to finally use that gym membership? Or the pledge to eat fewer cookies (which lasted all of two days)?

Financial goals, especially during retirement, can feel a bit like that. But with the right strategies, you can stick to them better than a toddler to a candy store.

The Importance of Financial Accountability

The Ripple Effect

One small financial misstep can create ripples throughout your retirement plan. Think of it as dropping your ice cream cone on a hot day; the mess spreads quickly!

Peace of Mind

There’s a unique kind of sleep you get when you know your finances are in order. It’s the kind of rest where you dream of beaches, not unpaid bills.

The Joy of Achieving

Remember that feeling when you finally nailed a recipe or finished a jigsaw puzzle? Achieving financial milestones feels even better. Plus, you can celebrate with cake!

Tried and True Methods for Financial Accountability

Buddy System

Find a friend with similar goals. Check in, share tips, and maybe have a friendly wager on who can save more in a month.

Professional Guidance

Financial advisors are like personal trainers for your wallet. They’ll whip your finances into shape and help you dodge those money-eating pitfalls.

Tech to the Rescue

There’s an app for everything, including keeping your finances on track. And no, I’m not talking about the one that orders pizza.

The Blogging Advantage

Documenting the Journey

Starting a blog about your financial journey is like making a public pledge. It’s harder to buy that unnecessary golf club set when you’ve told the world you’re saving for a cruise.

Community Feedback

Your readers can be your cheerleaders, advisors, and occasionally, the voice of reason (do you really need another garden gnome?).

AI Insights

With tools like ChatGPT in 2023, you can get insights tailored to your financial situation. It’s like having a crystal ball, but for your bank account.

Common Pitfalls and How to Dodge Them

Impulse Purchases

That sale might be tempting, but will you really use that inflatable kayak?

Neglecting the Budget

“I’ll check it later” often turns into “Oops, I overspent.” Regularly review your budget, even if it’s less fun than a dentist appointment.

Falling for Fads

The latest investment trend might sound exciting, but always do your research. Remember the pet rock fad?

Conclusion

Navigating the financial seas of retirement can be challenging, but with the right tools, strategies, and a sprinkle of humor, you can sail smoothly.

Here’s to staying accountable, dodging those financial icebergs, and cruising into a sunset of success. And remember, if all else fails, there’s always cake!

Frequently Asked Questions

Why is financial accountability more crucial during retirement?

During retirement, you’re typically working with a fixed income or savings.

Ensuring you stick to your financial goals helps prolong the longevity of your funds and maintain your desired lifestyle.

How can I resist impulse purchases, especially with online shopping being so easy?

Consider implementing a “cooling-off” period. If you see something you want, wait 48 hours before purchasing.

Often, the impulse will pass. Also, unfollow or unsubscribe from tempting marketing emails.

Are budgeting apps safe to use?

Most reputable budgeting apps prioritize user security. However, always read reviews, check their security measures, and use strong, unique passwords.

How can I motivate myself to stick to my financial goals?

Visual aids can help. Create a vision board, set milestones, and reward yourself (within budget!) when you achieve them.

Also, regularly remind yourself of the bigger picture and the peace of mind that comes with financial stability.

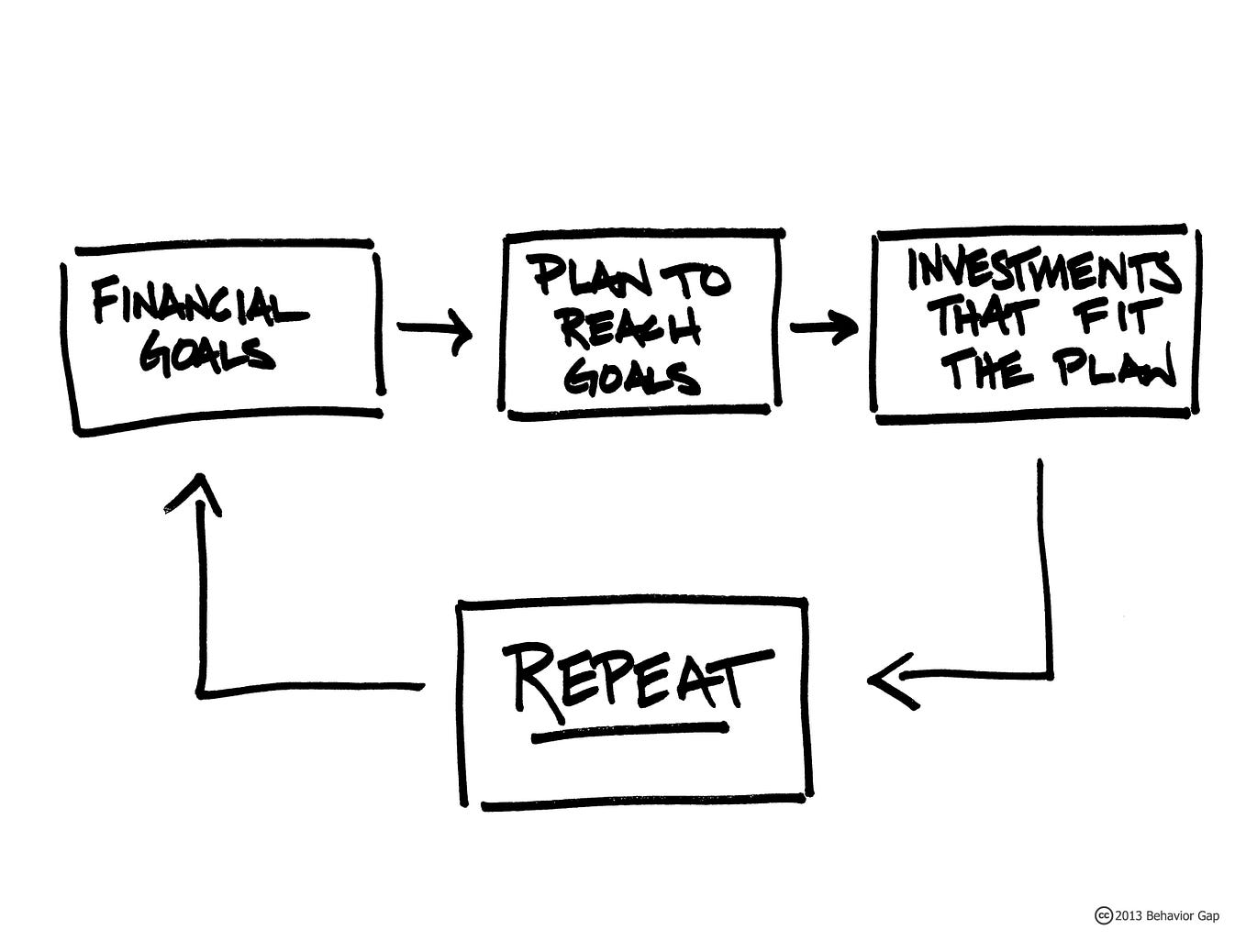

Can I adjust my financial goals during retirement if circumstances change?

Absolutely! Life is unpredictable. It’s essential to review and adjust your goals as needed, ensuring they align with your current situation.

How do I handle unexpected expenses during retirement?

An emergency fund is crucial. If you don’t have one, start building it. For large unexpected expenses, consider consulting with a financial advisor to explore your options.

What if my partner/spouse has different financial goals?

Communication is key. Sit down, discuss your individual goals, and find a middle ground. Consider creating separate “fun money” accounts for personal spending.

How can blogging help with my financial accountability?

Blogging provides a platform for reflection, commitment, and community feedback. Sharing your journey holds you accountable and can even offer insights or tips from readers.

How often should I meet with a financial advisor during retirement?

At least annually. However, if there are significant changes in your financial situation or the market, consider more frequent check-ins.

I’m not tech-savvy. Can I still use AI tools to help with my finances?

Yes! Many AI tools, like ChatGPT, are designed with user-friendliness in mind. Plus, there are numerous online communities and tutorials to guide you.

How do I handle financial mistakes or setbacks?

First, don’t be too hard on yourself. Everyone makes mistakes. Assess the situation, learn from it, adjust your strategy, and move forward. Consider it a learning opportunity, not a failure.

How often should I review my financial goals?

Ideally, give them a glance every quarter. It’s like checking your car’s oil; regular maintenance can prevent bigger issues.

Can I really trust AI tools with my financial data?

Most AI tools today prioritize top-notch security. But always do your homework and ensure you’re using reputable platforms.

Is a financial advisor really necessary?

Not mandatory, but they can offer valuable insights, especially if finances aren’t your forte.

How can blogging help if I’m not tech-savvy?

Modern platforms are user-friendly, and the blogging community is always eager to help. Plus, AI can guide you through the techy bits.