The Golden Years Without the Tax Bite: A Guide to What States Have No Income Tax on Retirement

Wondering what states have no income tax on retirement? Discover the top tax-free havens to protect your Social Security, pensions, and 401(k) savings.

Finding the perfect place to retire is a bit like dating in your sixties—you’re looking for a great personality, a nice view, and someone who isn’t going to constantly reach into your wallet. When I started looking into the financial side of my own future “permanent vacation,” I realized that where you park your lawn chair matters just as much as how much you’ve saved. If you’re wondering what states have no income tax on retirement, you’re essentially asking how to give yourself an immediate raise without having to go back to work.

Discover which U.S. states offer the best tax breaks for seniors, helping you protect your Social Security, pensions, and 401(k)s from state-level taxes.

I’ve always believed that a great retirement shouldn’t feel like a math test you’re failing. Yet, for many of us, the “tax man” remains the uninvited guest at the retirement party. Whether you’re dreaming of a Florida beach or a quiet cabin in Wyoming, understanding the tax landscape is the difference between sipping top-shelf margaritas and sticking to the house-brand lime juice. In this guide, we’re going to break down the states that let you keep your hard-earned cash, how they define “income,” and why your choice of zip code might be the best investment you ever make.

The “Big Nine”: States Where the Income Tax Doesn’t Exist

Let’s start with the heavy hitters. There are currently nine states that don’t have a traditional state income tax. For a retiree, this is the equivalent of finding a “Buy One, Get One Free” coupon for the rest of your life. If there’s no state income tax, the state simply doesn’t have a mechanism to take a bite out of your 401(k) or your pension.

Florida: The Classic Choice

I visited Sarasota last year, and I was amazed by how many people seemed… well, happy. It’s not just the Vitamin D. Florida is the poster child for what states have no income tax on retirement. They don’t tax Social Security, they don’t tax your private pension, and they don’t care how much you pull out of your IRA. It’s a “what you see is what you get” state, which is refreshing when you’re living on a fixed budget.

Texas: Big Land, No Tax

Texas is another giant in the tax-free world. While the property taxes can be a bit “everything is bigger in Texas,” the lack of state income tax means your monthly distributions stay whole. I’ve found that for folks who want a lower cost of living combined with major city amenities, Texas is hard to beat.

Nevada: More Than Just Neon

Nevada is a sleeper hit for retirees. Beyond the Las Vegas strip, you have beautiful areas like Lake Tahoe and Henderson. Because Nevada relies heavily on gaming and tourism taxes, they leave your retirement checks alone. It’s a great place to live if you want your biggest gamble to be which golf course to play, not how much the state will take from your pension.

Alaska and Wyoming: The Rugged Frontiers

If you don’t mind a little snow (or a lot of it), Alaska and Wyoming are tax havens. Alaska actually goes a step further and pays you through the Permanent Fund Dividend. Wyoming, meanwhile, has some of the lowest overall tax burdens in the country. I’ve always thought that if you can handle the wind, Wyoming offers a level of financial freedom that’s hard to find elsewhere.

The Rest of the Pack

South Dakota, Washington, and Tennessee also round out this list. Tennessee is particularly popular lately because they officially finished phasing out their tax on dividends and interest in 2021. It’s now a fully tax-free haven for retirees who rely on investment income.

Defining the “Retirement Pot”: What Exactly Are We Taxing?

When we talk about what states have no income tax on retirement, we have to look at what the states consider “income.” It’s not just a paycheck from a 9-to-5 anymore. For most of us, retirement income is a “cocktail” of different sources:

- Social Security: The bedrock of most plans.

- Pensions: Those rare and beautiful unicorns from former employers.

- 401(k) and IRA Distributions: The money you’ve been diligently tucking away while your friends were buying jet skis.

- Investment Dividends: The “passive” income that feels like winning a tiny lottery every quarter.

In states like Florida or Nevada, the definition is simple: none of it is taxed. However, in other states, the rules get a bit “fine print-y.” Some states might tax your IRA but leave your Social Security alone. Others might tax your out-of-state pension but exempt a local government one. This is why choosing a state with zero income tax is the “Easy Button” of retirement planning. It removes the guesswork.

The Social Security Patchwork: A State-by-State Mystery

It’s a bit of a head-scratcher, but even though you’ve paid into Social Security your whole life, some states still want a piece of it when it comes back to you. Currently, 37 states (plus D.C.) do not tax Social Security.

If you’re looking at what states have no income tax on retirement, you’ll find that the “no-tax” states we mentioned earlier are obviously on this list. But even some states with an income tax, like Pennsylvania and Mississippi, have decided to leave Social Security alone.

On the flip side, if you’re eyeing Montana, Vermont, or Nebraska, you need to do some math. These states may tax a portion of your benefits depending on your total income. It’s like the state is saying, “Congratulations on reaching 65! Now, give us a slice of that cake.” Personally, I prefer states that let me eat the whole cake.

Pensions and 401(k)s: The Hidden Erosion

This is where things get spicy. If you have a healthy 401(k) or a solid pension, a 5% or 6% state tax can feel like a slow leak in a tire. Over twenty or thirty years of retirement, that “leak” can add up to tens of thousands of dollars.

In states like New York or California, the tax bite can be significant. But when you look at what states have no income tax on retirement, you realize that moving across a state line can be the equivalent of a massive market gain. I remember talking to a friend who moved from Illinois to Florida; he calculated that the tax savings alone paid for his HOA fees and his golf club membership. He didn’t have to “earn” more; he just had to “keep” more.

Why Tax Policy Should Be Your New Best Friend

I know, I know. Reading about tax policy is about as exciting as watching a documentary on the history of drywall. But for retirees, this is the stuff that dreams are made of.

Higher Take-Home Income

The most obvious benefit of living in a state with no income tax is the immediate boost to your cash flow. When you’re on a fixed income, every dollar has a job. If that dollar isn’t going to the state capital, it can go toward a flight to see the grandkids or a better bottle of wine.

The “Retiree Magnet” Effect

States that don’t tax retirement income tend to attract… well, retirees. This creates a virtuous cycle. These states often have better-developed senior services, more specialized healthcare, and communities designed for active aging. When I visited a 55+ community in Texas, I realized that the “tax-free” status was just the bait; the real catch was the lifestyle built around people in the same stage of life.

Research and the “Foot Voting” Phenomenon

There’s actually a lot of academic weight behind this. A study titled “State taxes have a negligible impact on Americans’ interstate moves” (2014) suggested that while young people move for jobs, retirees are much more sensitive to tax burdens. They have the “discretionary mobility” to pick up and leave. Essentially, retirees “vote with their feet.” If a state makes it too expensive to stay, they head for the sun and the tax breaks.

The “Total Tax” Trap: Looking Beyond Income Tax

Now, I have to be the “responsible friend” for a second. Just because a state has no income tax doesn’t mean it’s “free” to live there. States have to get their money from somewhere—they have roads to pave and schools to run.

When researching what states have no income tax on retirement, you have to look at the “Big Three”:

- Income Tax: (The one we’re avoiding).

- Property Tax: (The one that can sneak up on you).

- Sales Tax: (The one that nibbles at you every time you buy bread).

For example, New Hampshire has no income tax and no sales tax, but their property taxes are high enough to make a grown man cry. Texas also has higher-than-average property taxes. On the other hand, a state like Alabama has a low income tax and incredibly low property taxes.

I’ve always said that you have to run your own “personal inflation index.” If you own a $1 million home but have a small pension, a high-property-tax state might hurt you more than a high-income-tax state. But if you have a massive IRA and want to rent a condo, the no-income-tax state is your best friend.

Recent Trends: The Great Retiree Recruitment War

Believe it or not, states are actually competing for you. You are a “low-impact, high-value” resident. You don’t put kids in the school system, you don’t commit many crimes (usually), and you spend money locally.

Because of this, we’re seeing a trend where states are actively slashing taxes to lure seniors. Georgia is a great example. Research in “Retiree-attraction policies for rural development” (1998) highlighted how Georgia used tax breaks to revitalize rural areas. By making it cheap for retirees to live there, they brought in “gray gold”—steady spending power that supports local businesses.

As we head into 2026, keep an eye on states like West Virginia and South Carolina. They’ve been making noise about further exempting Social Security or increasing retirement income deductions. The “tax-free” club is growing, and that’s great news for your bank account.

How to Maximize Your Tax-Free Life

If you’re ready to make the jump to one of the what states have no income tax on retirement winners, don’t just pack the U-Haul and leave tomorrow. You need a strategy.

1. The “Residency” Test

You can’t just buy a P.O. Box in Florida and keep living in New Jersey. High-tax states are like clingy exes; they don’t want to let you go. You usually need to spend 183 days a year in your new state to be considered a resident for tax purposes. I’ve known people who keep a “logbook” of their days just to prove to the auditors that they were actually in the sunshine.

2. Strategic Withdrawals

If you’re moving from a high-tax state to a no-tax state, wait until after you’ve officially moved to take that big “bucket list” distribution from your IRA. Why give the state 6% of your trip to Italy if you don’t have to?

3. The Roth Conversion Play

If you’re still a few years away from retirement, consider a Roth conversion while you’re still working, or wait until you move to a tax-free state to do it. Converting a Traditional IRA to a Roth is a taxable event. Doing that in a state with no income tax can save you a fortune.

Common Questions About Tax-Free Retirement

“Does ‘no income tax’ mean I don’t file a return?” In most cases, yes! If you live in Florida or Texas, you can say goodbye to that April 15th headache at the state level. You still have to deal with the IRS (sorry, I can’t help you there), but the state-level paperwork disappears.

“What if I work part-time in retirement?” In a no-income-tax state, your “fun job” at the hardware store or your consulting gig is also tax-free at the state level. This is a huge perk for the “semi-retired” crowd.

“Are these states more expensive in other ways?” Sometimes. As I mentioned, property taxes or insurance rates (looking at you, Florida homeowners insurance) can be higher. It’s all about the “net” gain. I always suggest doing a “dry run” budget for any state you’re considering.

The Jon Acuff Perspective: Why We Overthink the Move

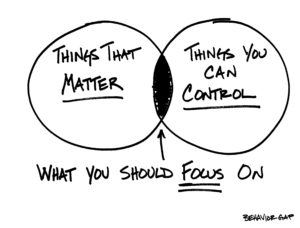

We tend to treat the question of what states have no income tax on retirement like we’re launching a space shuttle. We analyze every decimal point and worry about “optimizing” to the nth degree.

But here’s the truth: retirement is about freedom. If you move to a state just for the taxes but you hate the weather and have no friends there, you’ve made a bad trade. The goal is to find the “sweet spot”—a place where the taxes are low enough to give you peace of mind, but the lifestyle is high enough to make you glad you’re alive.

I’ve seen people stay in high-tax states because “that’s where the grandkids are,” and that’s a perfectly valid reason. But if you’re staying just because you’re afraid of the paperwork of moving, you’re leaving a lot of “margarita money” on the table.

Final Thoughts: Your Roadmap to a Tax-Free Horizon

Deciding what states have no income tax on retirement is one of the few times in life where you get to choose your own adventure. Whether it’s the coastal breeze of Florida, the rugged independence of Wyoming, or the bustling energy of Texas, these states offer a path to a more secure financial future.

Remember, the best time to plan your move was ten years ago; the second best time is today. Take a look at your current state tax bill. Now, imagine that number is zero. What would you do with that extra money? Would you travel more? Spoil the grandkids? Finally take those pottery classes?

Retirement isn’t the end of the book; it’s just a very expensive new chapter. By choosing a state that respects your savings, you’re ensuring that the “happily ever after” part isn’t interrupted by a tax bill. So, grab a coffee, pull up a map, and start looking for your tax-free haven. You’ve earned it.

Frequently Asked Questions

What are the benefits of relocating to a state with no income tax on retirement income? The primary benefit is an immediate increase in your disposable income. Without a state tax skimming 3% to 13% off your top line, you have more flexibility for healthcare, travel, and daily living. Additionally, these states often have robust infrastructure tailored to retirees.

How do state tax policies affect the decision to retire in a specific state? Tax policy acts as a “multiplier” for your savings. If you have a modest nest egg, a tax-friendly state can make it feel much larger. Conversely, high-tax states can force retirees to downsize their lifestyle or return to work part-time to cover the gap.

Are any states considering changes to their tax laws for retirees? Yes, state tax law is a moving target. Many states are currently debating “Social Security carve-outs” to keep seniors from moving away. It’s always wise to check the latest legislative updates or consult a pro before you sign a lease.

What types of retirement income are typically exempt from state taxes? In the “Big Nine” states, all of it—Social Security, 401(k)s, IRAs, and pensions. In other states, it’s a mix. Some might exempt the first $20,000 of a pension, while others only exempt Social Security.

How can retirees strategically plan their withdrawals to minimize taxes? The “Golden Rule” is to time your largest withdrawals for when you are a resident of a low-tax or no-tax state. Also, consider the “sequence of returns”—drawing from taxable accounts first while in a tax-free state can be a very savvy move.

What resources are available for retirees to learn about state tax policies? Start with the official Department of Revenue website for the state you’re eyeing. Sites like AARP and various retirement-focused financial blogs also provide great “at-a-glance” comparisons. Just make sure the info is current—tax laws change faster than my nephew’s favorite band.