Retirement Planning Guide for Seniors in 2026

- Introduction

- Why Financial Planning is Essential for Seniors

- Financial Advisors for Seniors: Why You Need One

- How to Choose the Best Financial Planning and Advisors

- Free Financial Planning and Advisors: Is It Worth It?

- Finding a “Financial Planner Near Me”: Tips and Tricks

- Do I Need a Financial Planner or Advisor?

- Financial Advisor: What to Expect?

- Conclusion

- Frequently Asked Questions

Introduction

Ahoy, savvy seniors and older adults! Welcome to “Financial Planning and Advisors” – the treasure map of your golden years. Set your sails and together, let us navigate the high seas of financial planning!

Achieving financial security is a key goal for older adults, and careful planning can help ensure stability and peace of mind in retirement. There are many resources available to help older adults and their caregivers make informed financial decisions. So, grab your captain’s hat and your favorite beverage—be it coffee, tea, or something a bit stronger (we’re not here to judge)—and let’s navigate these financial waters together.

Why Financial Planning is Essential for Seniors

Financial planning isn’t just for the young and restless; it’s a lifelong journey. Personal finance for seniors encompasses budgeting, savings, and income management, all of which are crucial for long-term financial well-being. And let’s face it, as you age, your financial landscape starts to look more like a rollercoaster than a serene countryside. You’ve got retirement funds, savings for future expenses, healthcare costs, and maybe even a grandkid’s college tuition to think about.

Managing income sources in retirement is an important part of financial planning. That’s why having a financial plan is like having a GPS for this crazy journey called life, providing security and peace of mind. Health care planning is also an essential aspect of financial planning for seniors, ensuring you’re prepared for medical expenses as you age.

Financial Advisors for Seniors: Why You Need One

Think of a financial advisor as your financial therapist. They listen to your woes, nod sympathetically, and then tell you how to make it all better. Financial advisors build long-term relationships with their clients, providing personalized advice tailored to each client’s unique needs and goals.

Jokes aside, a financial advisor can help you navigate the complexities of investments, tax planning, and estate matters by offering professional guidance that helps clients make informed decisions. Throughout the planning process, advisors offer ongoing support to clients and their loved ones, creating a strong support system.

Working with a financial advisor can give clients confidence in their financial future, knowing they have expert guidance and a trusted relationship to rely on. They’re like the Gandalf guiding your Frodo Baggins through the treacherous realm of finance.

How to Choose the Best Financial Planning and Advisors

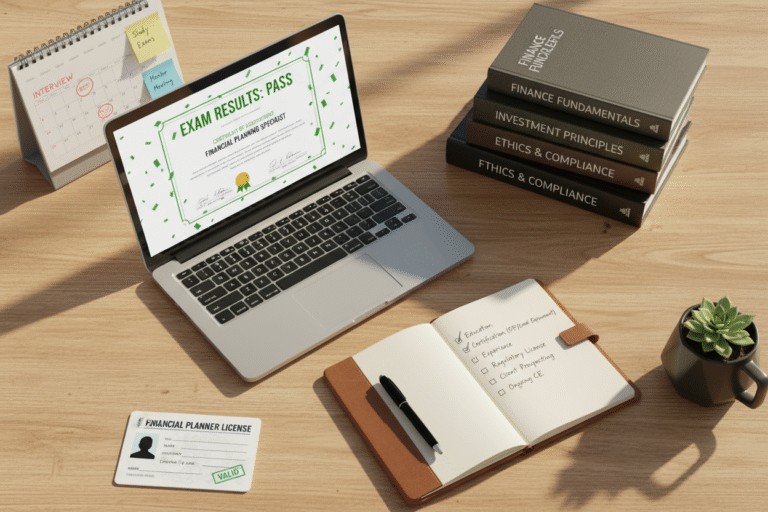

Choosing a financial advisor is like dating. You need chemistry, trust, and preferably, no nasty surprises. The process of selecting a financial advisor should include steps such as conducting interviews, performing background checks, and comparing different candidates to ensure the best fit. It’s also crucial to consider your personal circumstances—such as your financial goals, family needs, and unique situation—when choosing an advisor. Look for certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst). A good advisor clearly outlines their services and planning steps, providing transparency and helping you understand what to expect. Read reviews, ask for references, and don’t hesitate to play the field before settling down.

Free Financial Planning and Advisors: Is It Worth It?

Free advice is often worth what you pay for it, but not always. There are different service models available for financial planning, including free options from non-profit organizations and paid services from professional advisors and robo-advisors. Some non-profit organizations offer free financial planning services, especially for seniors, and may also provide assistance to help seniors access essential financial planning resources. Having access to reliable financial advice is crucial, regardless of your ability to pay. Free services can be a good option if you cannot afford comprehensive paid plans. However, remember that you often get what you pay for. If your finances are complex, it might be worth investing in a paid advisor.

Finding a “Financial Planner Near Me”: Tips and Tricks

In the age of Google, finding a local financial advisor is as easy as typing “Financial Planner Near Me” and hitting search. But don’t just go with the first name that pops up. It’s important to verify the background of the person you are considering as your financial advisor. Check their credentials, read reviews, and maybe stalk them a little online (for research purposes, of course). Use FINRA’s BrokerCheck to review the advisor’s credentials, employment history, and any disciplinary actions. Make sure the advisor is registered to offer securities such as stocks and bonds, and if you are interested in mutual funds, confirm they are authorized to sell mutual funds as well.

Do I Need a Financial Planner or Advisor?

Ah, the age-old question. A financial planner helps you create a financial plan (duh!), while an advisor offers more comprehensive services like investment management. An advisor often acts as a partner in your financial journey, working collaboratively to help you achieve your goals. For example, a financial planner might help you set a retirement savings target, while a financial advisor could recommend specific investment products and manage your portfolio to reach that target. Think of it as the difference between a cook and a chef. Both can feed you, but one can make it a culinary experience.

Financial Advisor: What to Expect?

Expect to bare your financial soul. A good advisor will want to know everything—your assets, debts, and how many times you eat out per week. They’ll review your financial situation in detail to ensure their recommendations are accurate and personalized. Understanding and managing your wealth is a key part of the advisory process, regardless of its size. A financial advisor will also help you protect your assets and financial future through careful planning. They’ll tailor their advice to fit your lifestyle, whether you’re a frugal Freddie or a spendy Sally.

Conclusion

Financial planning and advisors aren’t just for the young or the wealthy; they’re for anyone who wants to take control of their financial future. So, what are you waiting for? Book that consultation and take the first step towards financial freedom.

Frequently Asked Questions

What’s the difference between a financial planner and a financial advisor?

A financial planner focuses on creating a financial plan, while an advisor offers a broader range of services, including investment management.

How do I choose the right financial advisor for my retirement planning?

Evaluate credentials, experience, and fee structure. Opt for a Certified Financial Planner (CFP) specializing in retirement. When comparing advisors, consider whether they charge an hourly rate, a flat fee, a percentage of assets, or commissions. Ensure they’re a fiduciary, putting your interests first.

What’s the Difference Between Financial Planning and Financial Advising?

Ah, the age-old question! Think of financial planning as the blueprint of your financial house, while a financial advisor is the architect who helps you build it. You need both to create a sturdy, comfortable living space for your retirement years.

How Do I Choose the Right Financial Advisor?

Great question! Look for someone with credentials, experience, and a personality that meshes with yours. After all, you wouldn’t go on a road trip with someone who makes you want to jump out of the car, would you?

Are Free Financial Planning Services Worth It?

Free is always tempting, isn’t it? But remember, you often get what you pay for. Free services can offer basic guidance, but for a tailored plan, it’s often worth investing in a paid advisor.

What Questions Should I Ask a Potential Financial Advisor?

Ah, the interview stage! Ask about their experience with seniors, their fee structure, and their investment philosophy. Don’t forget to ask about their approach to insurance products—do they recommend specific types of insurance, such as life insurance or long-term care insurance, as part of their planning? It’s like dating but for your wallet.

Do I Really Need a Financial Advisor, or Can I Go It Alone?

You can absolutely go it alone if you’re financially savvy. But even the best sailors sometimes need a co-captain. An advisor can offer a second opinion and might see financial opportunities or pitfalls you’ve missed.

How Often Should I Meet with My Financial Advisor?

At least once a year for a financial check-up. Think of it as your annual “wallet wellness” visit. More frequent meetings may be necessary during significant life changes.

What’s the Deal with Robo-Advisors?

Ah, the robots! They’re not just for vacuuming your house anymore. Robo-advisors are digital tools that can help manage your investments and financial planning. They can be a cost-effective way to manage your investments, but they lack the personal touch. Good for basics, but maybe not for the complexities of senior financial planning.

Can Financial Advisors Help with Estate Planning?

Absolutely, many financial advisors are well-versed in estate planning. They can guide you through the labyrinth of wills, trusts, and all those fun legal terms that sound like they’re from a medieval drama.

It’s important to update your estate planning documents after major life events such as a change of address, marriage, or divorce to ensure your assets and wishes are properly managed. Comprehensive estate planning should also include provisions for medical decisions and care.

How Do Financial Advisors Charge for Their Services?

Fees can be hourly, flat, or based on a percentage of your assets. Make sure to ask upfront so you’re not surprised later. Nobody likes a surprise bill, especially not in retirement!

How do I know if a financial advisor is trustworthy?

Look for certifications, read reviews, and trust your gut. If something feels off, it probably is.

Can I do my own financial planning?

Absolutely, but a financial advisor can offer expert insights that DIY internet research can’t provide.