What Taxes Will You Pay in Retirement? A Complete Guide to Retirement Income Taxation

Vanika retirement guide to what taxes will you pay in retirement—Social Security, 401(k)s, IRAs, pensions, state taxes, and Medicare costs.

If retirement is the “golden years,” taxes are the little flecks of glitter that somehow end up everywhere. On your hands, your clothes, your plans. And look—taxes in retirement aren’t automatically bad news. But they are different, and the difference matters.

In this Vanika retirement guide, I’m going to walk you through what taxes you’ll pay in retirement in plain English: Social Security, 401(k)s and IRAs, pensions, state taxes, and a few healthcare-related surprises that can sneak into your budget. The vibe here is “coffee chat,” not “accounting lecture.”

We’ll keep this comprehensive, easy to scan, and actually readable. Consider it your go-to retirement guide for the moments when you’re thinking, “Okay… so which of these checks is taxable again?”

What Taxes Will You Pay in Retirement? Are Social Security Benefits Taxable in Retirement?

Social Security benefits may be partly taxable depending on your total income. The IRS uses a “combined income” calculation—your adjusted gross income (AGI) plus nontaxable interest plus half of your Social Security benefits—to decide whether any portion of your benefits is subject to federal income tax.

I know, I know. It’s not intuitive. You’d think the question would be “How big is your Social Security check?” but the IRS is more like, “Let’s talk about everything else, too.”

How Does Federal Income Tax Apply to Social Security Benefits?

The portion of Social Security benefits that becomes taxable depends on where your combined income lands.

- In the middle tier, up to 50% of your benefits can be taxed.

- Above the higher threshold, up to 85% can be taxed.

Quick sanity-saver (because this trips up almost everyone): “Up to 85% taxable” does not mean the government takes 85% of your Social Security benefits. It means up to 85% of your benefits may be included as taxable income—and then you pay your normal income tax rate on that amount.

If you’re trying to estimate what taxes you’ll pay in retirement, this is one of the first levers to understand, because extra income (even “good” income) can make more of your Social Security taxable.

What Are the Income Thresholds for Taxing Social Security?

The IRS thresholds that determine taxability are:

Single filers:

- Up to $25,000: No tax on benefits

- $25,000–$34,000: Up to 50% taxable

- Over $34,000: Up to 85% taxable

Married filing jointly:

- Up to $32,000: No tax on benefits

- $32,000–$44,000: Up to 50% taxable

- Over $44,000: Up to 85% taxable

Here’s the practical takeaway in this retirement guide: if you’re near those thresholds, small moves can matter. A little extra IRA withdrawal, a chunk of capital gains, or even nontaxable interest can nudge your combined income upward and change how much of Social Security is taxed.

How Are 401(k) and IRA Withdrawals Taxed After Retirement?

Withdrawals from traditional 401(k)s and IRAs are generally taxed as ordinary income. That means they’re taxed like wages—not like capital gains.

This is the part where retirement can feel like a sequel you didn’t ask for: you got a tax break while contributing (nice!), but now the bill comes due when you withdraw (less nice!).

If you’re mapping out what taxes you’ll pay in retirement, the “ordinary income” label is huge, because it plugs directly into your tax bracket.

What Tax Rates Apply to 401(k) and IRA Distributions?

Distributions are taxed at your ordinary income tax rate—the bracket that applies to your taxable income for that year.

So if your taxable income places you in the 12% bracket, that’s typically the rate that applies to the next dollars you pull from a traditional IRA/401(k). But if you take a large withdrawal, you can push yourself into a higher bracket.

A real-life-ish example (numbers simplified):

Say you and your spouse have a calm, predictable year—Social Security plus a small pension. Then you decide to withdraw a big amount from your traditional IRA to renovate the kitchen. Great! New cabinets! Soft-close drawers! You’ll feel like a millionaire every time you put away a spatula.

But the tax side is: that big distribution stacks on top of your other income. It can:

- bump you into a higher federal bracket, and/or

- make more of your Social Security taxable, and/or

- increase income-based Medicare premiums (more on that later).

That’s why “timing” is a theme you’ll keep seeing in this retirement guide. The same dollars can cost you different amounts in tax depending on when you take them.

When Do Required Minimum Distributions Begin and How Are They Taxed?

Required minimum distributions (RMDs) are taxable as ordinary income. Think of them as the IRS saying, “We’ve waited patiently. Now it’s our turn.”

The SECURE 2.0 Act changed the RMD timeline:

- If you turned 72 after December 31, 2022, RMDs must begin by April 1 of the year after you turn 73.

- If you turned 72 before 2023, RMDs must begin by April 1 of the year after you turned 72.

Missing an RMD used to come with a famously brutal penalty. Under the updated rules, the penalty on missed RMDs can be as much as 25% of the amount not withdrawn (reduced from the previous 50% in many cases).

This matters for what taxes you’ll pay in retirement because RMDs can force taxable income onto your return even if you don’t “need” the cash that year.

SECURE 2.0 Act: RMD Age Changes for Retirement Planning

SECURE 2.0 raises the required minimum distribution age to 73 in 2023 and to 75 in 2033.

What Taxes Apply to Pension Income During Retirement?

Pension checks are typically treated as taxable income at the federal level, though the details can vary by pension type and by state.

If you have a pension, you already know the emotional benefit: it’s steady, predictable income. (Predictability is wildly underrated.) Tax-wise, the main point is: your pension usually behaves like a paycheck on your tax return.

Are Pension Payments Subject to Federal and State Income Taxes?

In most cases, pension payments are subject to federal income tax. State treatment varies, and it can range from “fully taxed” to “partially excluded” to “not taxed at all,” depending on where you live and what kind of pension it is.

This is a key part of what taxes you’ll pay in retirement—because two retirees with the same pension can have different net income simply based on state rules.

How Do Different States Tax Pension Income?

State treatment of pension income varies widely:

- States without an income tax (like Florida and Texas) don’t tax pension income at the state level.

- Other states tax pension payments as ordinary income.

- Some states offer exclusions, credits, or special treatment for certain retirement income.

If you’re using this as a Vanika retirement guide, here’s my friendly nudge: don’t assume your state taxes retirement income the same way your friend’s state does. States love being unique. It’s their whole brand.

State Tax Exclusions for Retirement Income

A comparative table (Table 2, page 10) summarizes basic exclusion amounts across different types of retirement income.

How Do State Taxes Affect Retirement Income?

State tax rules can change the picture of your retirement cash flow. Rates, exemptions, and the treatment of Social Security and pensions vary, so your state of residence can meaningfully affect what taxes you’ll pay in retirement.

This section is not here to start a “move to Florida” campaign. (Although if you love humidity and golf carts, I won’t stand in your way.) It’s here because state taxes are often overlooked until someone does their first “retirement year” tax return and says, “Oh. That’s… more than I expected.”

Which States Tax Social Security and Retirement Income?

State policies differ on Social Security and retirement income. A few examples:

- California: Does not tax Social Security benefits, but taxes other forms of retirement income

- New York: Exempts Social Security from state income tax but taxes some other retirement income

- Illinois: Does not tax Social Security or pension income

Even if you never move, understanding your state’s approach helps you budget and plan. If you might move, it gives you better “apples-to-apples” comparisons.

What Are the Variations in State Retirement Tax Brackets?

State tax systems range from no income tax to flat rates to progressive brackets. States with no income tax can preserve more of your retirement dollars. States with higher rates or narrower exemptions can reduce your net retirement income.

This is why I keep calling this a retirement guide: the goal isn’t to memorize tax law. It’s to plan your real life—how much money comes in, how much you keep, and how confident you feel spending it.

What Tax Planning Strategies Can Retirees Use to Minimize Taxes?

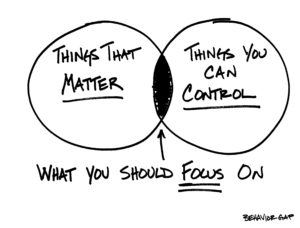

Thoughtful tax planning can lower what you pay in retirement. Most strategies focus on timing income, balancing account types, and using deductions/credits where they apply.

A lot of “retirement tax planning” sounds fancy, but the core idea is simple: try to avoid accidentally creating a high-income year unless you mean to.

How Can Timing of Withdrawals Reduce Tax Burden?

When you take withdrawals matters.

- Pulling funds in lower-income years can help keep you in a lower bracket.

- Large withdrawals in one year can push you into a higher bracket.

- Spreading withdrawals across years can sometimes reduce lifetime taxes.

Build a withdrawal plan that considers your expected income, RMDs, and other taxable events.

Based on a 2020 paper by J. DiLellio explored methods for computing tax-efficient withdrawals across tax-deferred, tax-exempt (Roth), and taxable accounts – the main reason this matters is that switching between account types at the right times can reduce overall tax costs—not by magic, but by avoiding avoidable bracket spikes.

Optimize Retirement Withdrawals for Tax Efficiency

We develop an approach that computes tax-efficient annual withdrawals from tax-deferred, tax-exempt, and taxable accounts for U.S. retirees. That method helps identify optimal switching times between account types to reduce overall tax costs.

Toward constructing tax efficient withdrawal strategies for retirees with traditional 401(k)/IRAs, Roth 401(k)/IRAs, and taxable accounts, J. DiLellio, 2020.

What Tax Deductions and Credits Are Available for Seniors?

Seniors may qualify for deductions and credits that lower taxable income. Common examples include:

- Medical expenses: Deductible to the extent they exceed 7.5% of adjusted gross income

- Property taxes: Deductible for homeowners, subject to the SALT cap of $10,000

- Standard deduction: Eligible seniors may be able to claim a larger standard deduction

One note from personal experience: the “big” tax savings often come from small habits—like keeping a clean record of medical expenses or double-checking whether you’re taking the best deduction option for your situation. It’s not glamorous. But it can pay for an actually-glamorous thing later, like a weekend trip or a fancy dinner where nobody asks you to split the check.

How Do Medicare and Other Healthcare Taxes Impact Retirement Income?

Healthcare costs—including Medicare premiums and out-of-pocket care—can take a significant bite out of retirement income. It’s important to factor Medicare premiums, supplemental coverage, and likely medical expenses into your cash-flow and tax planning.

This section exists because healthcare is the one budget category that can go from “fine” to “whoa” without asking for permission.

What Are the Medicare Tax Implications for Retirees?

Medicare taxes are generally paid during your working years, but retirees still face ongoing costs: Part B and Part D premiums, supplemental insurance, and out-of-pocket expenses.

Some Medicare premiums increase with higher income levels, so taxable income can indirectly affect what you pay for Medicare coverage. Translation: the decisions you make about IRA withdrawals can ripple into healthcare costs.

If you’re trying to predict what taxes you’ll pay in retirement, it’s worth remembering that “taxes” and “income-based premiums” can feel like cousins at a family reunion: technically different, but they show up together.

How Do Healthcare Costs Affect Tax Planning in Retirement?

Health expenses affect taxes in several ways. High medical costs may be deductible when they exceed the applicable AGI threshold. Premiums and supplemental insurance also affect disposable income.

Include realistic healthcare cost estimates when you model retirement income so you don’t end up surprised later. (Surprises are great for birthdays. Not for budgets.)

Frequently Asked Questions

What is the impact of state taxes on retirement savings?

State taxes can materially change how much of your retirement savings you keep. Some states tax pensions and withdrawals; others do not. Differences in state tax rates, exemptions, and credits may influence where you choose to live or how you withdraw funds.

Check your state’s rules when estimating after-tax retirement income.

How can retirees benefit from tax credits?

Eligible retirees can use tax credits to lower their tax liability. Examples include the Credit for the Elderly or the Disabled and state-level property tax credits for seniors.

These credits can provide meaningful relief for lower-income retirees and should be considered when planning.

What are the tax implications of withdrawing from a Roth IRA in retirement?

Qualified withdrawals from a Roth IRA are generally tax-free if the account has been open at least five years and the account owner is 59½ or older. Because Roth contributions are made with after-tax dollars, qualified distributions can be a valuable tax-free source of income in retirement.

How do capital gains taxes affect retirees?

Selling investments or property can trigger capital gains taxes. Long-term capital gains (on assets held more than a year) are usually taxed at lower rates than ordinary income, but those gains still count toward your total income and can affect your tax bracket and Medicare premium calculations.

Plan sales and timing carefully to manage tax impact.

What role do tax-deferred accounts play in retirement planning?

Tax-deferred accounts like traditional IRAs and 401(k)s let investments grow tax-deferred until withdrawal, when distributions are taxed as ordinary income. These accounts can be advantageous if you expect to be in a lower tax bracket in retirement, but you must plan for RMDs and the tax consequences of large withdrawals.

Are there specific tax strategies for couples in retirement?

Couples can coordinate withdrawals and tax decisions to reduce combined taxes. Filing status, timing of distributions, and use of deductions and credits can all affect a couple’s tax picture.

Communicating openly and planning jointly often leads to better tax outcomes.

Conclusion

Understanding how different income sources are taxed is a key part of retirement planning. When you see how Social Security, retirement account withdrawals, pensions, state taxes, and healthcare costs interact, you can make choices that protect more of your income.

If you want the shortest possible takeaway on what taxes you’ll pay in retirement, it’s this: your tax bill depends on where your income comes from, when you take it, and where you live.

Use these guidelines as a starting point, and consult your tax or financial advisor to tailor a plan that fits your situation. The earlier you plan, the fewer “well, that’s annoying” moments you’ll have later—because retirement should come with more peace of mind than paperwork.

If you found this helpful, consider bookmarking it as your go-to retirement guide (or sharing it with the friend who keeps saying, “Taxes won’t matter when I retire.” That friend is adorable… and also wrong.)