How to Calculate My Retirement: A Practical Guide to Savings and Income Planning

Learn how to calculate your retirement with clear steps for savings targets, Social Security timing, inflation, returns, and withdrawals.

If you’ve ever opened a retirement calculator, stared at the numbers, and thought, “Cool… so I’m retiring at age never,” you’re not alone. Learning how to calculate your retirement isn’t about finding one magical number carved into a stone tablet. It’s about building a plan that actually fits your life—your spending, your health, your goals, and yes, your very human tendency to underestimate how expensive “just a few trips a year” can get.

I like to think of retirement planning the way I think of packing for a trip: you’re trying to bring enough, without hauling around a suitcase full of “what if” anxiety. This guide will walk you through how to calculate your retirement step-by-step—estimating expenses, projecting income (including Social Security), adjusting for inflation, and choosing a withdrawal strategy that won’t make you flinch every time the market sneezes.

Let’s make this practical, a little funny, and most importantly: usable.

How to Calculate Your Retirement (The Big Picture)

At its core, how to calculate your retirement comes down to one equation:

Retirement Income Needed = Retirement Spending – Reliable Retirement Income

Your job is to estimate:

- What you’ll spend each year in retirement

- What income you’ll receive from sources like Social Security, pensions, and part-time work

- What your savings must cover through withdrawals

And then test the plan against real-world villains: inflation, market swings, healthcare costs, and longevity (aka “surprise, you’re living to 97”).

Step 1: Estimate Your Retirement Spending (Without Guessing Wildly)

If you want to know how to calculate your retirement, start with spending—because spending is the engine that drives everything else.

A simple way to forecast retirement expenses

I usually tell people to start with today’s spending, not today’s salary. Income is what you earn. Spending is what you live on. Retirement replaces spending.

Here are three practical approaches:

1) The “current spending” method (my favorite starting point)

Track what your household spends in a typical year, then adjust:

- Subtract things that may disappear: commuting, payroll taxes, retirement contributions

- Add things that may increase: healthcare, travel, hobbies, helping family

If you don’t track spending, don’t panic. Look at 3–6 months of bank/credit card statements and categorize them. It’s not glamorous, but neither is working forever because Excel scared you.

2) The “percentage of income” method (quick, but rough)

A common rule of thumb is 70%–90% of pre-retirement income. It’s not terrible as a first draft, but it can be wildly wrong if:

- You plan to travel more

- Your house won’t be paid off

- Healthcare will be significant

- Your current lifestyle is already lean (or already… ambitious)

3) The “budget-by-category” method (best for accuracy)

Break spending into buckets:

- Housing (mortgage/rent, taxes, insurance, repairs)

- Food (groceries + dining out)

- Transportation

- Healthcare (premiums, out-of-pocket, dental/vision, long-term care planning)

- Discretionary (travel, hobbies, gifts)

- “Life happens” fund (home repairs, family support, emergencies)

Don’t ignore healthcare (seriously)

Healthcare is one of the biggest “oops” categories. Premiums, deductibles, prescriptions, dental work—these tend to rise as birthdays pile up.

You don’t need to predict the exact dollar amount. You do need a realistic line item and a plan to revisit it.

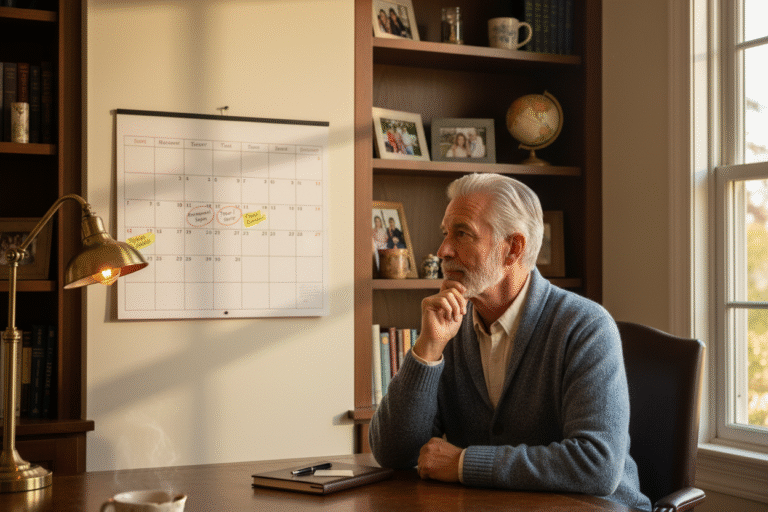

Step 2: Decide Your Retirement Age (It Changes Everything)

When people ask me how to calculate your retirement, I usually ask a question back: When do you want work to become optional?

Because retirement age impacts:

- How many years you’ll save

- How many years you’ll withdraw

- Your Social Security benefit amount

- Whether you’ll need to buy healthcare before Medicare (in the U.S.)

Even shifting retirement by 1–3 years can dramatically change the math—often more than squeezing an extra 1% return out of your portfolio.

Step 3: Estimate Social Security (And Use Claiming Age Strategically)

For many households, Social Security is the backbone of retirement income. If you’re serious about how to calculate your retirement, you can’t treat Social Security like a mystery prize.

How claiming age affects your benefit

In general:

- Claiming early means a smaller monthly benefit

- Claiming at Full Retirement Age gives you your baseline benefit

- Delaying past full retirement age increases your monthly amount (up to a limit)

This isn’t just theory. Research on claiming behavior and delayed retirement credits has emphasized how meaningful the increases can be when delaying (for those who can). For example, a 2025 paper by David Tharp discusses behavioral reasons people claim early even when delayed credits can significantly improve payouts (“Revisiting the Social Security Claiming Puzzle…”). The point isn’t that everyone should delay—it’s that claiming is a strategy, not a checkbox.

Practical tip: calculate Social Security in today’s dollars

When modeling retirement income, make sure you know whether your estimate is:

- Nominal (future dollars), or

- Real (today’s dollars, adjusted for inflation)

Mixing these is one of the easiest ways to get a plan that looks great on paper and confusing in real life.

Step 4: Account for Inflation (Because Future You Still Needs Groceries)

Inflation is the silent pickpocket of retirement planning. You can save a lot and still feel squeezed if prices rise faster than expected.

If you’re learning how to calculate your retirement, here’s the key: you must decide whether you’re planning in:

- Today’s dollars (real planning): easier to think about

- Future dollars (nominal planning): closer to what statements show

Either is fine. Just don’t mix them.

A practical inflation approach

Many planners assume 2%–3% inflation long-term. But you should run scenarios:

- A “normal” inflation scenario

- A “higher inflation” scenario

- A “bad timing” scenario (high inflation early in retirement)

If you’ve lived through even one weird economic period, you know why this matters.

Step 5: Choose Realistic Investment Return Assumptions

This part can feel like trying to predict the weather five years from now. But how to calculate your retirement requires return assumptions—so we do the best we can.

Nominal vs. real returns (the quick clarity)

- Nominal return = what your account might show (e.g., 8%)

- Real return = nominal return minus inflation (e.g., 8% − 3% = 5%)

A lot of long-term market history discussions reference U.S. stock returns around ~10% nominal and ~7% real over very long periods—but planning on the high end is like planning your retirement on the assumption that every year will be a tailwind year. It’s optimistic. And optimism is great—until it’s expensive.

Planning tip: use conservative returns

If you want a plan you can live with, consider:

- Using a slightly lower return assumption

- Stress-testing with a “bad decade” scenario

- Thinking in ranges, not one magic number

Step 6: Calculate Your Retirement Savings Target (Two Common Methods)

Now we bring it together. There are two popular ways to calculate a retirement number.

Method A: The income gap approach (most intuitive)

- Estimate annual retirement spending (in today’s dollars)

- Subtract reliable income (Social Security, pension)

- The remainder is what your portfolio must fund

Example (simple):

- Spending: $80,000/year

- Social Security + pension: $35,000/year

- Portfolio needs to cover: $45,000/year

Then you decide a withdrawal approach (next step) to convert that income need into a savings target.

Method B: The “safe withdrawal rate” approach (classic planning)

This is where the well-known 4% rule enters.

Step 7: Pick a Withdrawal Strategy (The 4% Rule—and What to Do With It)

The “4% rule” is often summarized as:

- Withdraw 4% of your portfolio in year one

- Then adjust that dollar amount for inflation each year

So if you have $1,000,000:

- Year-one withdrawal ≈ $40,000

This guideline became popular because it worked across many historical market periods for a 30-year retirement under certain assumptions. More recent research continues to explore retirement spending strategies and ways to reduce longevity/sequence risk—some papers in 2025 have discussed “insurance overlays” and protected income approaches that can make retirement income more stable (“Insurance Overlays and Retirement Spending: The Case of Protected Lifetime Income,” 2025). Translation: there are ways to add guardrails, and not everything has to be pure DIY investing.

When the 4% rule is a decent starting point

- Retirement horizon around ~30 years

- A diversified portfolio (often stock/bond mix)

- Willingness to adjust spending if markets get ugly

When you might need a lower withdrawal rate

- You’re retiring early (40+ years)

- You want very stable spending and hate adjusting

- You have high fixed costs and low flexibility

- Valuations/return expectations look lower (depends on your assumptions)

Common retirement withdrawal strategies (that don’t feel like gambling)

1) Fixed real withdrawals (classic “4% style”)

Predictable spending, but can strain the portfolio in rough markets.

2) Guardrails (my “sleep better” favorite)

You start with a target but adjust spending if the portfolio drops past certain thresholds.

3) Percentage withdrawals

You withdraw a percentage each year. Income fluctuates, but portfolio longevity improves.

4) Bucket strategy

Keep 1–3 years of spending in cash/short-term bonds, invest the rest for growth. It’s partly math, partly emotional comfort—and honestly, emotional comfort matters.

5) Annuities / protected income

Not for everyone, but converting part of savings into lifetime income can reduce the risk of outliving assets.

Step 8: Factor in Life Expectancy (Yes, This Is Awkward—Do It Anyway)

Here’s the uncomfortable truth: if you underestimate longevity, you might overspend early. If you overestimate, you might underspend and miss out on life.

So how to calculate your retirement should include a time horizon.

A practical way to plan for longevity

Instead of picking one age, use a range:

- Base plan: to age 90

- Stress test: to age 95 or 100

If you’re partnered, plan for the longer-lived spouse. Someone will be the final person holding the remote. Plan for that person.

Step 9: Don’t Forget Taxes (They Can Move the Needle)

Taxes aren’t just an April annoyance—they affect how much spendable income you actually have.

How retirement withdrawals are commonly taxed (high-level)

- Traditional

401(k)/ traditional IRA withdrawals: usually taxed as ordinary income - Roth IRA qualified withdrawals: generally tax-free

- Taxable brokerage accounts: capital gains/dividends rules apply

- RMDs: required minimum distributions begin at a specific age (often cited as 72 in many discussions, though rules can change—always verify current requirements)

A tax-smart retirement plan might include:

- A mix of account types (taxable, tax-deferred, Roth)

- Roth conversions in lower-income years (for some people)

- Planning withdrawals to manage tax brackets

If taxes feel like a maze, that’s because they are.

Step 10: Use a Retirement Calculator the Right Way (So It Doesn’t Gaslight You)

A retirement calculator can be incredibly helpful—or incredibly misleading—depending on inputs.

If you’re using tools as part of how to calculate your retirement, do this:

What to enter (accurately)

- Current age, retirement age

- Current savings + annual contributions

- Expected Social Security and/or pension

- Investment return assumptions

- Inflation assumptions

- Retirement spending target

- One-time expenses (new roof, car replacement, travel splurges)

What to look for in the results

- Are projections in today’s dollars or future dollars?

- Does it model bad market sequences, or only “average returns”?

- What happens if you live longer?

- What happens if you retire 2 years earlier?

Run at least 3 scenarios

- Base case (reasonable assumptions)

- Conservative case (lower returns, higher inflation, higher healthcare)

- Optimistic case (for motivation, not denial)

I’m not saying you should emotionally bond with a spreadsheet. I’m saying you should date it casually and check its references.

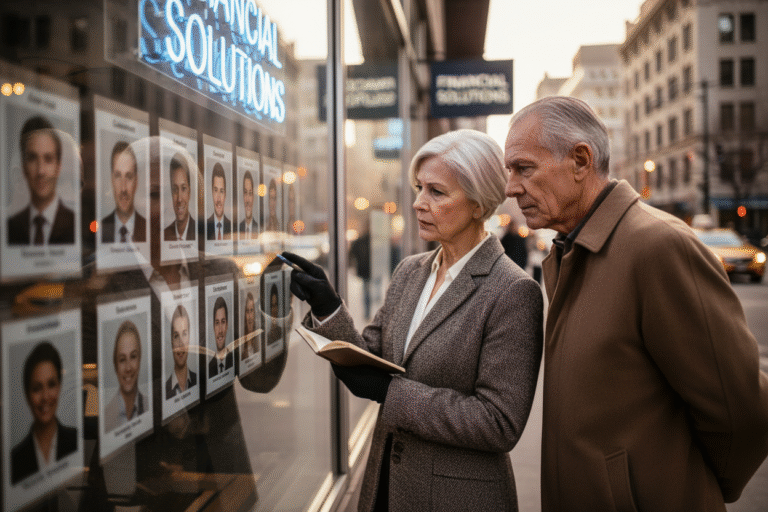

How to Calculate Your Retirement If You Have Multiple Income Streams

Most retirees don’t live on one source of income. The key is to stack them in a clean order.

Common retirement income sources to combine

- Social Security (timing matters)

- Pension (if applicable)

- Portfolio withdrawals (IRAs, 401(k)s, brokerage)

- Part-time work (often underestimated and very flexible)

- Rental income

- Annuity income (if used)

A good planning model shows:

- Income by year (especially early retirement vs later retirement)

- Which accounts fund the gap and when

- How taxes change as income sources kick in

Retirement Accounts: Why IRAs and 401(k)s Matter (And a Quick Research Nod)

Tax-advantaged accounts like IRAs and 401(k)s are popular because they can increase long-term accumulation. Economists have studied whether these incentives actually create additional saving or simply reshuffle it. For instance, economist Jonathan Skinner discussed retirement saving incentives and how even conservative assumptions can show substantial capital accumulation relative to foregone tax revenue (Skinner, 1996). In plain English: these accounts are often worth using because the tax structure can help you build more retirement capacity over time.

So if you’re figuring out how to calculate your retirement, don’t just calculate the final number—use the best containers available for saving toward it.

Common Mistakes People Make When Calculating Retirement (So You Can Avoid Them)

1) Planning with one “average return” line

Markets aren’t average in the order they happen. Sequence of returns risk is real.

2) Ignoring inflation

A retirement budget without inflation is basically a budget for an alternate universe where prices behave.

3) Underestimating healthcare and “later-life” costs

Even healthy retirees often see costs rise later.

4) Treating retirement as a finish line, not a phase

Spending often changes over time:

- Early retirement: more active, more travel

- Mid retirement: steadier

- Late retirement: healthcare and support costs may rise

5) Not updating the plan

A plan you don’t revisit is like a GPS you never reroute while driving. You can still arrive… but you might take the scenic route through Stressville.

A Quick, Practical Retirement Calculation Example (Putting It All Together)

Let’s do a simple illustration of how to calculate your retirement:

- You estimate retirement spending at $75,000/year (today’s dollars).

- Social Security at your intended claiming age is $30,000/year.

- Your portfolio must cover: $45,000/year.

- You choose a conservative withdrawal guideline of 3.5%.

Portfolio target:

- $45,000 ÷ 0.035 = $1,285,714

That’s your rough savings target to fund the gap (not counting other assets or additional income). Then you stress-test:

- What if inflation is higher?

- What if you retire 3 years earlier?

- What if you need $10,000/year more for healthcare?

This is how retirement planning becomes a system, not a guess.

Conclusion: How to Calculate Your Retirement Without Losing Your Mind

How to calculate your retirement isn’t about chasing a perfect number—it’s about building a flexible plan that can handle real life. Estimate your spending honestly, factor in Social Security strategically, use conservative assumptions for returns and inflation, and choose a withdrawal approach that fits your risk tolerance and your personality.

And here’s the part I wish more people said out loud: you’re allowed to revise the plan. Retirement planning isn’t a one-time exam you either pass or fail. It’s more like adjusting a recipe as you cook—taste, tweak, repeat.

If you want, tell me your age, target retirement age, current savings, annual contributions, and desired annual retirement spending—and I’ll walk you through a clean, personalized framework for how to calculate your retirement (with a couple scenario options, not just one fragile forecast).