How Often Should You Review and Update Your Financial Plan?

Not sure how often should you review and update your financial plan? Here’s a simple guide to keeping your goals, budget, and investments aligned with the life you’re living right now.

Your financial plan isn’t something you set once and forget—it’s more like that poor houseplant you keep meaning to water. Whether you’re saving for a home, planning for retirement, or just trying to figure out where your paycheck keeps disappearing to (seriously, it’s like magic), keeping your plan updated is what keeps you sane—and your money on track.

I’ve learned this the messy way. Life changes, goals shift, and unexpected expenses love to crash the party. So let’s talk about how often you should check in on your financial plan, why it matters, and how to make sure it actually fits the life you’re living—not the one you thought you’d have five years ago.

Why Reviewing Your Financial Plan Matters More Than You Think

Picture this: you’re heading out on a road trip with a GPS that hasn’t been updated since flip phones were cool. You’ll probably end up at a gas station that’s now a Starbucks, wondering how your “shortcut” turned into a scenic tour of every pothole in three counties. Your financial plan? Same energy.

I learned this the hard way when I realized my “aggressive growth” investment strategy made zero sense after I’d gotten married and suddenly had someone else’s student loans to consider. Life changes, markets do their weird market thing, and your goals evolve faster than your taste in music — so your plan should keep up, too.

Regular financial reviews help you:

- Stay on track with your financial goals (instead of wondering where all that money went)

- Adjust for life changes like a new job, a growing family, or that mid-life crisis car you’re definitely not buying

- Manage risks with updated insurance coverage that actually makes sense

- Keep your investment strategies aligned with your current “how much risk can I handle before I can’t sleep” tolerance

- Avoid those lovely surprises like cash flow issues or high interest debt that multiplies like rabbits

And here’s the thing — there’s actual research backing this up. The CFP Board did a study and found that people who review their financial plans regularly report higher confidence in their financial future and are more likely to actually hit their goals. It’s not just me being bossy — it’s science.

How Often Should You Review and Update Your Financial Plan?

Alright, here’s the question that keeps you up at night (or should): how often should you actually park yourself at the kitchen table and dive into your financial plan?

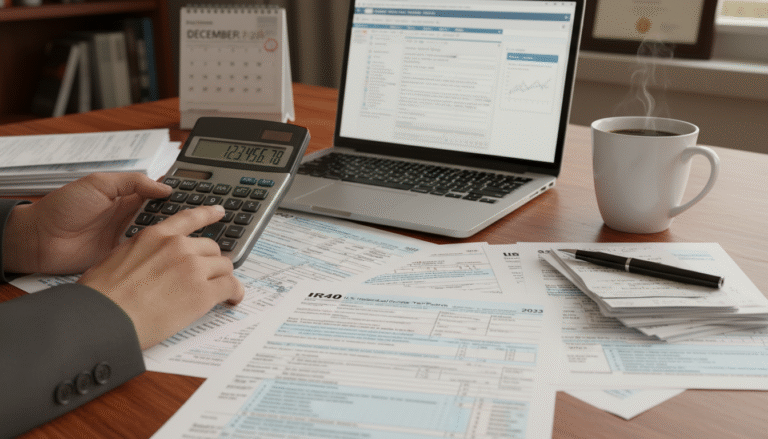

Annual Deep Dive: The Must-Do Financial Plan Review

Think of this as your yearly financial physical — except instead of someone telling you to eat more vegetables, you’re telling yourself to save more money. Once a year, I block out a weekend (usually with way too much coffee) to:

- Take another look at your financial goals — are they still realistic, or were they born out of a late-night burst of motivation after one too many YouTube pep talks?

- Go over your budget and spending — are you actually living within your means, or creeping into “Kardashian lifestyle on a regular paycheck” territory?

- Check in on your investments — is your portfolio still doing what it’s supposed to, or has it wandered off like a distracted cat chasing something shiny?

- And be honest about your debt — are you really paying it down, or just moving it around like deck chairs on the Titanic and hoping no one notices?

- Review your insurance. Do your life, health, and other insurance policies still fit your life, or are you paying to protect against a zombie apocalypse that’s probably not coming?

- Get organized. Keep your financial documents, account details, and passwords somewhere safe and easy to find—not scribbled on a napkin buried in your junk drawer.

This annual review is like the foundation of your house — boring but absolutely necessary. I’ve found that scheduling mine in fall works best because it’s after summer vacation spending but before holiday spending, which gives me time to course-correct before December happens to my budget.

Quarterly Check-Ins: Keep Your Finger on the Pulse

While the annual review is your financial system’s main event, quarterly check-ins are like those quick texts you send to make sure your friends are still alive. Every three months, take a casual glance at your:

- Budget vs. actual spending — Catch those cash flow issues before they turn into “why am I eating ramen again” situations.

- Progress toward short-term goals — Still on track for that vacation, or did you accidentally spend the fund on takeout and streaming services?

- Market trends affecting your investment strategy — Is your portfolio riding the waves like a pro surfer, or is it more like me on a boogie board (which is to say, not gracefully)?

These mini check-ins don’t need to be dramatic affairs. I usually do mine during Sunday morning coffee, and they take about as long as scrolling through social media — which is to say, longer than I planned but totally doable.

Life Happens: Review After Major Life Events

Here’s where it gets real. Your financial plan isn’t just about calendar dates — it’s about your actual life, which has a funny way of not following your carefully laid plans. When big changes hit, it’s time for an immediate review, even if you just did one last month.

Some major life events that require a financial plan intervention:

- Getting a new job or experiencing income changes (whether that’s a promotion celebration or an “oh no” moment)

- Marriage, divorce, or starting a family (because suddenly your money decisions affect tiny humans or former humans)

- Buying or selling a home — hello, down payment stress and mortgage paperwork that requires its own filing cabinet

- Retirement planning or the “I’m done with this, I’m moving to a cabin” early retirement fantasy

- Inheriting money or receiving a windfall (the good kind of surprise)

- Experiencing a natural disaster or other unexpected events that remind you why emergency funds exist

- Significant health changes that affect health insurance or medical expenses in ways that make your head spin

These moments often come with new financial priorities that can flip your plan upside down. When my first kid was born, I went from “I’ll probably be fine” to “I need enough life insurance to fund a small college” faster than you can say “diaper budget.”

Making Your Financial Plan a Living Document

The best financial plans aren’t carved in stone like ancient commandments — they’re more like that favorite recipe you keep tweaking until it’s perfect. Here’s how to keep yours flexible and actually useful:

Set Clear Review Goals

Before each review, ask yourself what you’re actually trying to accomplish.

- Are you focusing on debt management this quarter?

- Are you trying to figure out if your investment strategy still makes sense?

I’ve learned that trying to fix everything at once is like trying to organize your entire house in one weekend — ambitious but exhausting.

Automate What You Can

I’m basically the poster child for automation at this point. Setting up automatic transfers to savings, retirement accounts, or investment portfolios is like having a responsible adult handle your money while you deal with the rest of your life. It keeps your plan moving forward even when you’re too busy to think about it.

Use Technology to Your Advantage

There are apps and online tools that make financial reviews less painful than a root canal. Many platforms offer dashboards that track your net worth, spending, and investment performance in real-time, which means you can check in without drowning in paperwork. It’s like having a financial assistant who never judges your coffee spending.

Don’t Go It Alone: Work With a Financial Advisor

Sometimes, you just need someone who really knows their stuff. A good financial advisor is like a personal trainer for your money—they’ll help you make sense of the market, fine-tune your retirement plan, and spot the blind spots you didn’t even know existed. And honestly, having someone to keep you accountable? That’s half the battle right there.

Common Pitfalls to Avoid When Reviewing Your Financial Plan

Reviewing your financial plan is like going to the gym — great in theory, but easy to mess up if you don’t know what you’re doing. Here are the mistakes I’ve made (so you don’t have to):

- Reviewing too often: Checking your investments every day and making changes based on whatever the market did is like checking the weather every five minutes and changing your outfit accordingly. Stick to your schedule unless something actually major happens.

- Ignoring life changes: Waiting for your annual review when your life just got turned upside down is like waiting for your annual physical when you broke your leg. Some things can’t wait.

- Skipping the budget: Your budget is like the foundation of your house — if you don’t know where your money’s going, everything else is just wishful thinking built on quicksand.

- Neglecting insurance: Being under-insured is scary, but being over-insured is expensive. Both can mess with your financial goals in ways you didn’t see coming.

- Not updating documents: Outdated financial documents or lost account info is like having a map with half the street names missing — frustrating when you actually need to find something.

Wrapping It Up: Your Financial Plan’s Best Friend Is Regular Reviews

So, how often should you review and update your financial plan? At minimum, once a year — but throw in some quarterly check-ins and immediate reviews when life decides to get interesting, and you’ll stay ahead of the game.

Think of your financial plan like your personal GPS, but one that actually knows where you want to go and doesn’t try to route you through the most expensive toll roads. Regular reviews make sure you’re heading in the right direction and help you adjust when life throws you one of those “recalculating” moments.

If you haven’t started yet, don’t overthink it—just start small. Pick a date for your next review, grab your favorite coffee (or a glass of wine, I won’t judge), and treat it like a little catch-up with your future self. Before long, managing your money won’t feel like a chore—it’ll feel more like chatting with that one friend who always knows exactly what to say.

Here’s to your financial future — may it be bright, flexible, and reviewed just often enough to keep you on track without driving you crazy!

One Comment

Comments are closed.