Articles on Retirement Planning and Strategies: The Complete Guide That Actually Work

Explore comprehensive articles on retirement planning to secure your financial future. Get expert advice on savings strategies, investment options, and retirement income planning.

Key Takeaways

- Start retirement planning in your 20s to harness the power of compound interest – even $100 monthly can grow to over $300,000 by retirement (yes, really – math doesn’t lie even when your bank account feels like it does)

- Aim to save 10-15% of your income through employer 401k plans, IRAs, and catch-up contributions after age 50 (because apparently turning 50 comes with perks beyond questionable fashion choices)

- Diversify your retirement income sources between social security, employer plans, and personal savings to create a stable financial foundation (think three-legged stool, but for money instead of sitting)

- Plan for healthcare costs that can consume up to 15% of retirement income, and consider long term care insurance between ages 55-65 (because bodies are basically cars that depreciate faster and cost more to maintain)

- Create a tax-efficient withdrawal strategy that balances traditional and Roth accounts to minimize your lifetime tax burden (outsmarting the IRS legally? Yes, please)

Why Retirement Planning Articles Matter More Than Ever

Here’s a sobering statistic that should make you spit out your coffee: only 36% of Americans feel confident they’re on track for retirement. That means nearly two-thirds of us are basically playing financial Pin the Tail on the Donkey while blindfolded, spinning around, and hoping we land somewhere in the vicinity of “comfortable golden years.”

No wonder retirement planning articles have become some of the most searched content online. People are desperately googling “how not to eat cat food when I’m 80,” but here’s the thing—most retirement planning content has all the personality of a wet napkin and about as much clarity as mud. You know the ones: they essentially tell you to “save money and cross your fingers real hard.”

But what if retirement planning didn’t have to feel like deciphering ancient hieroglyphics? What if you could actually understand this stuff without getting a finance degree or selling your firstborn to afford a financial advisor? The difference between actually helpful retirement planning articles and the usual snooze-fest lies in one simple truth: actionable strategies backed by real numbers that won’t make your brain leak out your ears.

This guide cuts through the fluff with concrete strategies that actually work in the real world. We’re talking specific dollar amounts, proven timelines, and mathematical proof that starting early isn’t just good advice—it’s basically magic. Because let’s be honest—your financial future deserves better than vague platitudes about “putting money aside” (which is about as helpful as telling someone to “just be happy”).

Articles on Retirement Planning: Age-Based Retirement Strategies

Your 20s and 30s: The “I’ll Think About It Tomorrow” Decades

Your twenties and thirties are when retirement feels about as relevant as planning your zombie apocalypse survival strategy. But here’s the thing—this is actually when financial magic happens. Starting early doesn’t just give you a head start; it’s like getting a rocket ship while everyone else is walking.

Let me blow your mind with numbers that might make you reconsider that daily $6 latte habit. A 22-year-old who saves $100 monthly until age 32 (that’s just $12,000 total over 10 years) and then never saves another penny will have more money at retirement than someone who starts saving $100 monthly at age 32 and continues faithfully until age 65 ($39,600 total). The early starter wins by about $25,000 thanks to compound interest basically being a time machine for money.

Your employer’s 401k match is literally free money—imagine your boss saying, “Hey, I’ll double everything you spend on lunch” and you responding with “Nah, I’m good.” Most employers match 3-6% of your salary, which means you should contribute at least that much or you’re basically leaving cash on the table. If your employer matches 4% and you’re making $50,000, that’s $2,000 annually in free money. FREE. MONEY.

Before you start aggressively throwing money at investments like you’re feeding a slot machine, build an emergency fund covering 3-6 months of expenses. This prevents you from raiding your retirement accounts when life inevitably throws you curveballs (and it will, because life has terrible aim but great persistence). Keep this money in a high-yield savings account where it can earn some interest while staying more accessible than your dignity after a karaoke night.

Debt management doesn’t mean choosing between paying off loans and saving for retirement like you’re on some terrible game show. It means being strategic about it. Pay minimums on low-interest debt (like mortgages under 4%) while maximizing retirement contributions. High-interest debt above 6-7% should typically get the boot before investing, since you’re unlikely to earn enough in the market to offset those interest rates (unless you’ve discovered some secret investment strategy, in which case, please share).

Look, if you’re stuck with one of those high-deductible health plans (you know, the ones where you basically pay for everything until you hit some ridiculously high number), then Health Savings Accounts are honestly a game-changer. They’re like getting three tax breaks rolled into one: you don’t pay taxes when you put money in, it grows tax-free while it’s sitting there, and you don’t pay taxes when you take it out for medical stuff. It’s basically the IRS being nice to you for once. After age 65, you can withdraw money for anything (paying regular income tax), making HSAs basically retirement accounts disguised as healthcare accounts. Sneaky and brilliant.

Your 40s and 50s: The “Oh Wait, This Is Actually Happening” Phase

Welcome to your peak earning years, when retirement transforms from some vague future concept to that thing that’s actually going to happen to you. The good news? You probably make more money now than your 25-year-old self could’ve imagined. The slightly less good news? Time isn’t as much on your side anymore, though it’s not exactly working against you either.

Once you hit the big 5-0, the government basically pats you on the back and says, “Hey, we get it, time’s getting short,” by allowing catch-up contributions. For 2025, you can stuff an extra $7,500 into your 401k (bringing your total to $31,000) and an additional $1,000 into IRAs (total $8,000). These catch-up contributions exist because even lawmakers understand that most people don’t hit their financial stride until their forties (better late than never, right?).

This decade often brings the classic parental dilemma: fund your kids’ college or your retirement? Here’s some tough love that might sting a little—your children can borrow money for college, but nobody’s offering retirement loans. I mean, have you seen the terms on student loans? Now imagine trying to get a loan when you’re 70 with no income. A general rule: contribute enough to snag your full employer match, then consider college funding, then maximize retirement contributions.

Career peak earnings can be sneakily deceiving because lifestyle inflation often grows right along with your paycheck. Making $100,000 instead of $60,000 doesn’t automatically translate to retirement success if your expenses upgraded themselves too. The key is actually banking those raises and bonuses instead of immediately upgrading to the fancier everything (though that nicer coffee maker might be worth it—we’re not monsters here).

Long term care insurance deserves some serious thought between ages 55-65. According to the Department of Health and Human Services, about 70% of Americans will need some form of long term care, and these costs can absolutely demolish retirement savings faster than a toddler with a credit card. A semi-private nursing home room averages $108,405 annually according to Healthview Services research. Long term care insurance purchased in your fifties typically runs $2,000-$3,000 annually but can protect hundreds of thousands in assets.

Estate planning isn’t just for rich people with trust funds and fancy lawyers—it’s for anyone who wants some say over their money and healthcare decisions instead of letting the government figure it out. Basic documents include wills, powers of attorney for finances and healthcare, and beneficiary designations on retirement accounts. Pro tip: those beneficiary forms actually trump whatever’s in your will, so keep them updated (unlike your Facebook relationship status).

Your 60s and Beyond: The “Show Me the Money” Years

Your sixties bring retirement from theoretical planning to “holy moly, this is really happening” reality. This is when you shift from accumulating money to creating retirement income that’ll last the rest of your life—a transition that requires completely different strategies (and probably some antacids).

Social security optimization can literally add hundreds of thousands to your lifetime benefits, which makes it worth understanding even if the rules seem designed by people who enjoy making things unnecessarily complicated. The difference between claiming at age 62 versus waiting until age 70 is massive. Someone entitled to $2,000 monthly at full retirement age would receive only about $1,400 if they claim at 62 (because patience, apparently), but $2,480 if they wait until 70. Over a 20-year retirement, that’s a difference of nearly $260,000. Yeah, you read that right.

Medicare enrollment requires paying attention to timing because the government loves its penalties almost as much as it loves bureaucracy. You get a 7-month window around your 65th birthday to enroll without penalties. Miss this window, and you’ll pay 10% more for Part B premiums for every 12-month period you delayed—for the rest of your life. That’s not a typo; it’s a permanent penalty for being late to the Medicare party.

Required Minimum Distributions (RMDs) kick in at age 73 for traditional IRAs and 401k accounts because the IRS has finally decided it wants its tax money from those accounts you’ve been hiding from them. RMD amounts get calculated based on your account balance and life expectancy, typically starting around 3.65% of your balance and increasing each year (because apparently the government thinks you should spend faster as you age).

Withdrawal rate strategies determine whether your money lasts through retirement or runs out while you’re still using it. The famous “4% rule” suggests withdrawing 4% of your portfolio in year one, then adjusting for inflation annually. However, modern research suggests more flexible approaches, like adjusting withdrawals based on whether the market’s having a good year or a temper tantrum, or using “bucket strategies” that divide investments by time horizon.

Tax-efficient distribution planning becomes crucial when you’ve got multiple account types—it’s like playing financial chess, but the pieces are your actual money. Generally, you’ll want to tap taxable accounts first (they don’t have RMDs), then tax-deferred accounts, and finally Roth accounts (which grow tax-free and have no RMDs during your lifetime). However, managing tax brackets might suggest different strategies in specific years because the tax code apparently enjoys keeping us on our toes.

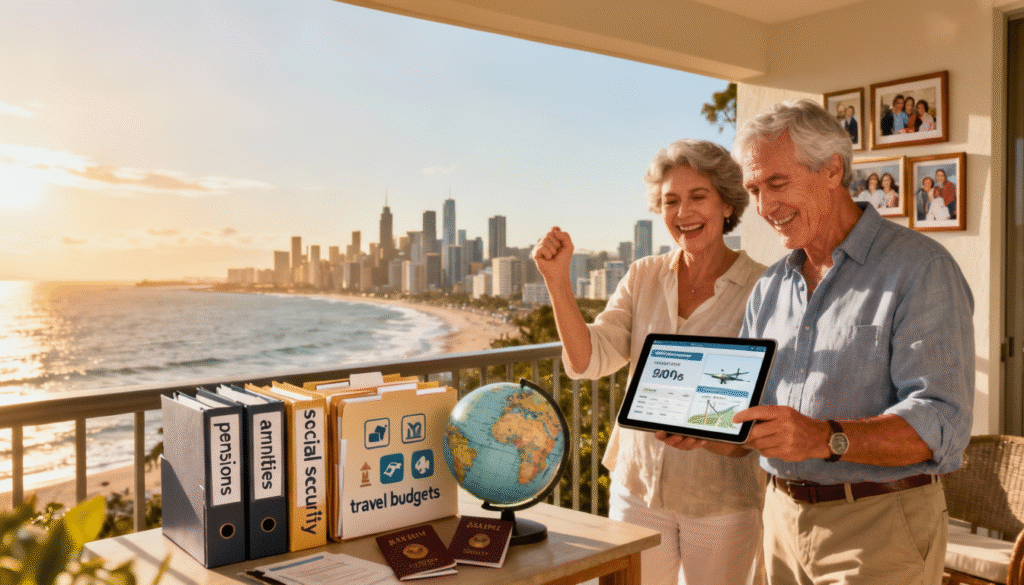

Building Your Retirement Savings and Retirement Income Streams

Creating multiple income streams in retirement isn’t just smart—it’s essential for managing risk. Relying on just one source is like building a house on a single foundation post and hoping for the best. Let’s talk about constructing a retirement paycheck that won’t collapse when life gets interesting.

Social security benefits form the foundation for most retirees, providing inflation-adjusted income for life (one of the few things that actually keeps up with inflation without you having to fight for it). Your benefit gets calculated using your highest 35 years of earnings, so working longer can bump up your benefit if you’re still earning more than your lowest years. The Social Security Administration provides online calculators that’ll show you exactly how different claiming strategies affect your lifetime benefits—it’s like a crystal ball, but for money.

Traditional vs. Roth retirement accounts create different tax scenarios in retirement, kind of like choosing between paying taxes now or later (spoiler: the government gets their money either way). Traditional accounts give you tax deductions now but make you pay ordinary income tax on withdrawals later. Roth accounts use after-tax money but grow tax-free forever, which is basically the closest thing to free money you’ll find. Many financial advisors recommend having both to provide tax diversification in retirement.

Pensions are increasingly rare in the private sector—like finding a unicorn that also does your taxes. But if you’re lucky enough to have one (hello, government employees and some union workers), understand your options for survivor benefits and lump-sum distributions. Sometimes taking a reduced benefit that continues for your spouse’s lifetime makes more sense than going for the full amount.

Annuities can provide guaranteed income, but they come with enough fine print to wallpaper a small house and fees that’ll make you wonder if insurance companies have discovered how to print money. Immediate annuities convert a lump sum into lifetime income, while deferred annuities grow money tax-deferred until you need income. Just remember, you’re depending on the insurance company’s ability to pay claims for potentially decades.

Part-time work during early retirement can significantly extend your savings while keeping you from going stir-crazy and driving your spouse nuts. Many retirees discover “encore careers” that are actually more fulfilling than their original jobs (funny how that works when you’re not desperate for the paycheck). Income from work also lets you delay social security, boosting your eventual benefits.

Real estate can provide rental income, but it also makes you a landlord, which means dealing with 2 AM phone calls about broken toilets (glamorous, right?). Real Estate Investment Trusts (REITs) offer real estate exposure without the landlord headaches. Dividend-paying stocks from established companies can provide growing income, though dividends aren’t guaranteed (because apparently nothing in finance is).

Investment Strategies That Actually Make Sense in Your Retirement Age

Modern portfolio theory sounds intimidating, but the core principle is basically “don’t put all your eggs in one basket” dressed up with fancy academic language. However, that old rule of “120 minus your age in stocks” oversimplifies today’s reality where people live longer and markets do whatever they want regardless of old rules.

Asset allocation should reflect your entire financial picture, not just how many candles were on your last birthday cake. A 60-year-old with a pension and substantial savings might keep a more aggressive portfolio than a 40-year-old with limited savings and no pension. The key is matching your risk capacity (how much you can afford to lose) with your risk tolerance (how much volatility you can handle without losing sleep or your mind).

Low-cost index funds have basically revolutionized investing by providing broad market exposure without fees that’ll slowly bleed your account dry. Actively managed funds typically charge 0.5-2% annually while most fail to beat their index benchmarks over time (awkward). A simple portfolio of total stock market and total bond market index funds gives you global diversification at costs under 0.1% annually—that’s less than what you probably spend on coffee in a week.

Target-date funds offer hands-off investing that automatically adjusts allocation as you approach retirement, like having a financial autopilot. These funds typically start aggressive (90% stocks) and gradually shift toward conservative (40% stocks) by your target retirement date. While convenient, they may not fit everyone’s unique situation and often use higher-cost fund options (because convenience sometimes costs extra).

Rebalancing forces to sell high and buy low by maintaining your target allocation—it’s like having a built-in system that makes you do the smart thing even when it feels weird. If stocks perform well and increase beyond your target percentage, you sell some and buy bonds or other assets that haven’t been performing as well. Most investors rebalance annually or when allocations drift more than 5% from targets.

International diversification provides exposure to different economies and currencies, because betting everything on one country’s economy (even ours) is like putting all your dating apps on one phone. While U.S. stocks have been on a tear recently, history shows periods when international markets outperform. Most advisors recommend 20-40% international exposure through developed and emerging market funds.

Bond strategies become more important as you approach retirement because bonds are supposed to be the boring, stable part of your portfolio (though they can surprise you too). Traditional bonds provide steady income but suffer when interest rates rise. Treasury Inflation-Protected Securities (TIPS) adjust for inflation, while Series I Bonds offer government-guaranteed inflation protection (though with purchase limits that’ll remind you the government doesn’t want you having too much of a good thing).

The Biggest Retirement Planning Mistakes to Avoid

Learning from other people’s financial face-plants is way cheaper than creating your own, especially when it comes to retirement planning. These costly errors can derail decades of careful saving, but they’re totally preventable if you know what to watch out for.

Starting too late is hands-down the most expensive mistake because you can’t fix it by just throwing more money at the problem later. A 45-year-old who hasn’t started saving would need to contribute about $1,500 monthly to accumulate what someone could achieve with $200 monthly starting at age 25. The mathematical penalty for procrastination is brutal and completely unforgiving—like compound interest running in reverse.

Cashing out your 401k when changing jobs might feel like getting an unexpected bonus, but it’s actually stealing from your future self (and your future self will not be amused). A 35-year-old who cashes out $20,000 instead of rolling it over loses about $160,000 by retirement age. Plus, you’ll pay taxes and a 10% penalty, turning that $20,000 into about $13,000 after Uncle Sam takes his cut. Ouch.

Underestimating healthcare costs is a mistake that literally compounds throughout retirement. Fidelity estimates that a couple retiring at 65 will need $315,000 just to cover healthcare costs throughout retirement, and that doesn’t even include long term care services (because apparently regular healthcare isn’t expensive enough). Healthcare costs typically consume 10-15% of retirement income and grow faster than general inflation, because bodies are basically expensive machines that break down more as they age.

Ignoring inflation’s long-term impact is like pretending that dollar you saved in 1990 still buys the same thing today (spoiler: it doesn’t). At just 3% annual inflation, costs double every 24 years. A $50,000 lifestyle today will cost $100,000 in 24 years and $200,000 in 48 years. Fixed incomes like pensions become less valuable over time unless they include inflation adjustments, which most don’t because that would be too convenient.

Prioritizing your kids’ education over retirement savings feels like good parenting but often backfires spectacularly. Your kids can borrow for college through federal student loan programs with reasonable interest rates and payment options. Nobody offers retirement loans at any interest rate (have you tried asking? It’s awkward). Plus, having strong retirement savings often enables grandparents to help with education costs later without jeopardizing their own security.

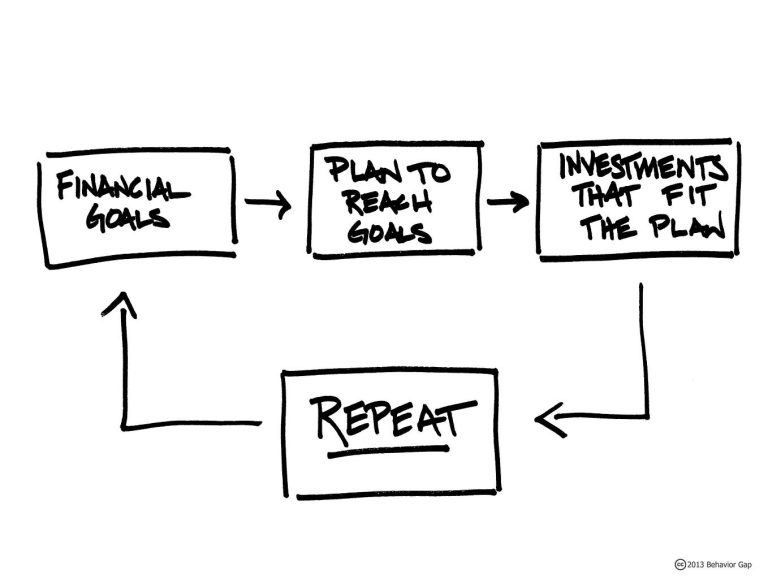

Not having a written retirement plan with specific goals leads to what financial advisors politely call “wishful thinking” and what I call “crossing your fingers and hoping math works differently for you.” “Save as much as possible” isn’t a plan—it’s a hope dressed up as a strategy. Calculate your actual retirement expenses, estimate your income sources, and figure out the gap your savings need to fill. Without specific numbers, you’re basically hoping everything magically works out (spoiler: magic isn’t a retirement strategy).

Advanced Retirement Planning Strategies

Once you’ve mastered the basics and stopped making rookie mistakes, advanced strategies can help optimize your retirement outcome and potentially save substantial amounts in taxes. These techniques often require professional guidance because they’re complicated enough to make your head spin, but they can provide significant benefits for those in higher income brackets.

Backdoor Roth IRA conversions allow high earners to access Roth benefits despite income limits that basically tell successful people “you make too much money to save efficiently” (because that makes total sense). If your income exceeds Roth IRA contribution limits, you can contribute to a non-deductible traditional IRA and immediately convert it to a Roth. This strategy requires careful attention to the pro-rata rule if you have other traditional IRA balances, because the IRS loves their complicated rules.

Tax-loss harvesting in taxable accounts involves selling investments at losses to offset gains and reduce current taxes—it’s like finding the silver lining in your investment losses. You can deduct up to $3,000 in net losses against ordinary income annually, carrying forward additional losses to future years. However, the wash sale rule prevents you from buying the same investment within 30 days, because the IRS isn’t completely naive about tax strategies.

Qualified Charitable Distributions (QCDs) allow individuals over 70½ to donate up to $100,000 annually from IRAs directly to qualified charities. This counts toward your RMD requirement but doesn’t increase your taxable income, effectively making the donation tax-free. It’s basically the IRS being nice about charitable giving, which doesn’t happen often.

Business succession planning becomes crucial for entrepreneurs approaching retirement who’ve spent decades building something valuable. Options include selling to business employees through Employee Stock Ownership Plans (ESOPs), selling to family members with installment payments, or selling to third parties. Each strategy has different tax implications and income potential, plus varying levels of complexity that’ll make your accountant either very happy or very stressed.

Multi-generational wealth transfer strategies help preserve assets for the next generation while providing current tax benefits. Techniques include charitable remainder trusts, grantor retained annuity trusts (GRATs), and strategic use of lifetime gift tax exemptions. These strategies often require substantial assets to justify their complexity and costs—we’re talking about your serious financial resources here, not your average 401k balance.

Geographic arbitrage involves retiring in areas with lower costs of living to stretch your retirement dollars, basically moving somewhere your money goes further. Moving from high-cost cities to lower-cost states can effectively increase your income by 20-40% without changing your savings balance. However, consider factors like healthcare quality, family proximity, and state tax policies on retirement income before you pack up for that cheap little town in the middle of nowhere.

Healthcare and Long-Term Care Planning

Healthcare costs represent one of the largest and least predictable expenses in retirement. Unlike other retirement expenses that you control (like whether you really need that daily Starbucks), the rising costs of healthcare needs can happen unexpectedly and can’t be delayed, reduced, or negotiated with. Proper planning can protect your retirement savings from medical emergency devastation.

Medicare parts A, B, C, and D each cover different aspects of healthcare because apparently having one simple system would be too easy. Part A covers hospital stays and is premium-free for most people (one of the few free things left in healthcare). Part B covers doctor visits and outpatient services, costing $174.70 monthly in 2025 for most people. Part C (Medicare Advantage) replaces Parts A and B with private insurance, while Part D covers prescription drugs, because medications need their own special category.

Medigap insurance fills the gaps in Medicare coverage, such as deductibles and coinsurance that can add up faster than your grocery bill. While optional, Medigap can prevent large out-of-pocket costs from serious illnesses that could otherwise drain your savings. You have guaranteed issue rights during specific enrollment periods, regardless of health conditions. Miss these windows and you’ll face medical underwriting and potential denial of coverage, because timing is everything in the insurance world.

Long term care insurance should be evaluated between ages 55-65 when you’re healthy enough to qualify and young enough for premiums that won’t require selling a kidney. Traditional policies provide benefits for nursing home care, assisted living, and home care services. Hybrid life insurance policies with long term care riders offer benefits whether you need care or not—like insurance with a backup plan.

Health Savings Accounts become powerful retirement tools after age 65, transforming from healthcare accounts into stealth retirement accounts. While you can no longer contribute once you enroll in Medicare, existing HSA money can pay Medicare premiums, deductibles, and other qualified medical expenses tax-free. After age 65, non-medical withdrawals are permitted but taxed as ordinary income, making HSAs triple-tax-advantaged accounts in disguise.

Long term care alternatives deserve consideration beyond traditional nursing homes, because there are more options than just “expensive facility” or “hope for the best.” Aging in place modifications, adult day care programs, and continuing care retirement communities offer different levels of care and cost structures. Many retirees find that planning for aging in place provides better quality of life at lower costs, plus you get to keep your own stuff.

Estate Planning Integration

Aside from mutual funds, estate planning and retirement planning intersect in more ways than a highway interchange, affecting both your lifetime financial security and what your family inherits after you’re gone. Proper coordination ensures your money serves your needs first while preserving wealth for the next generation (instead of accidentally giving it all to the government).

Will and trust basics form the foundation of estate planning, like the frame of a house that nobody sees but everything depends on. Wills direct asset distribution and name guardians for minor children, while trusts can provide more control over how and when beneficiaries receive money. Revocable living trusts avoid probate but don’t provide tax benefits, while irrevocable trusts can reduce estate taxes but limit your control—because nothing in finance is simple.

Beneficiary designation importance cannot be overstated—these forms determine who gets your retirement accounts and life insurance proceeds regardless of what your will says (yes, really). Outdated beneficiaries are shockingly common problems; divorced people often forget to remove former spouses (awkward), and people who remarry forget to add new spouses (even more awkward). Keep these updated like you update your phone.

Power of attorney documents authorize others to handle your finances and healthcare decisions if you become incapacitated, because someone needs to pay bills and make medical decisions even when you can’t. Financial powers of attorney should be durable (remain valid after incapacity) and may be immediate or springing (activated only after incapacity). Healthcare directives specify your medical preferences and name healthcare proxies for when you can’t speak for yourself.

Retirement account inheritance strategies changed significantly under the SECURE Act, because Congress apparently decided the old rules were too generous. Most non-spouse beneficiaries must now withdraw inherited retirement accounts within 10 years instead of stretching distributions over their lifetimes. This accelerates taxes and reduces the accounts’ growth potential for beneficiaries, because the government wants its tax money sooner rather than later.

Tax implications of inherited retirement accounts vary by beneficiary type and account type, creating a fun maze of rules that’ll make your head spin. Surviving spouses can roll inherited accounts into their own IRAs, maintaining tax-deferred growth. Non-spouse beneficiaries face the 10-year rule for traditional accounts but inherit Roth accounts tax-free. These rules affect both estate planning and retirement spending strategies, because everything in finance is connected.

Frequently Asked Questions

How much do I need to retire comfortably?

The traditional rule suggests 10-12 times your annual income by retirement, but this varies based on whether you want to eat ramen or lobster in retirement. A couple earning $100,000 annually might need $1-1.2 million, assuming social security covers about 40% of expenses and you don’t develop any expensive hobbies like collecting vintage cars.

Should I pay off my mortgage before retiring?

It depends on your mortgage rate versus expected investment returns and whether you like having a monthly payment hanging over your head. With rates below 4%, investing extra payments in tax-advantaged accounts often provides better long-term outcomes, especially if you itemize deductions. Plus, there’s something to be said for having that mortgage interest deduction in retirement.

Can I retire early without penalties on my retirement accounts?

Yes, through strategies that are perfectly legal but sound like loopholes—like SEPP (Substantially Equal Periodic Payments), Roth IRA contribution withdrawals, or having sufficient taxable account funds to bridge you to age 59½ when penalty-free withdrawals begin. Early retirement is possible; it just requires more creative planning.

How does divorce affect retirement planning?

Divorce can significantly impact retirement savings through asset division that nobody enjoys and potential spousal social security benefits that might actually be helpful. Former spouses married 10+ years may claim benefits on their ex-spouse’s record without affecting the ex-spouse’s benefits, which is probably the only good thing about divorce paperwork.

What happens to my retirement plan if I become disabled?

Most employer plans allow early withdrawals without penalties for permanent disability, because the government recognizes that life sometimes throws curveballs. Social Security Disability Insurance may provide some help in your personal finance, though typically less than pre-disability earnings (because apparently being disabled doesn’t increase your cost of living). Disability insurance becomes crucial for protecting retirement savings during your working years, since becoming disabled doesn’t pause your need for money.

One Comment

Comments are closed.