Future Financial Planners in 2025: A Vanika Retirement Guide

Discover how future financial planners are reshaping money advice with tech, empathy, and holistic strategies for the next decade.

In a world where your phone can order dinner, call a ride, and accidentally buy a $200 candle at 2 a.m., money has never been more convenient—or more confusing. That’s exactly why future financial planners are about to matter a whole lot more.

They’re not just here to pick mutual funds and nod solemnly at spreadsheets. They’re blending tech, psychology, coaching, and good old-fashioned common sense to help people build lives they actually want to live—not just portfolios they’re vaguely scared of.

And honestly? I love that. Because I’ve always believed your money plan should feel less like a math exam and more like a conversation with a really sharp friend who actually listens.

In this guide, we’ll walk through what’s changing, what skills future financial planners need, why the next decade is such a big deal, and what it all means if you’re either looking for an advisor or thinking, “Hey, maybe that could be my career.”

Why Future Financial Advisors Matter More Than Ever

Let’s start with the obvious: money has gotten complicated.

We’ve got:

- Volatile markets

- Crypto and digital assets

- Student debt that looks like a mortgage

- Longer life expectancies

- Gig work, side hustles, and non-traditional careers

Trying to navigate all that alone is like trying to assemble IKEA furniture without instructions. Possible? Technically. Enjoyable? Absolutely not.

Future financial planners step into this mess as translators and guides. They help people:

- Turn vague goals (“I should probably save more?”) into concrete plans

- Balance retirement, debt payoff, and investing without burning out

- Understand tradeoffs: house vs. travel; now vs. later; safety vs. growth

And here’s something important: the best planners going forward won’t just be experts in investment management. They’ll be:

- Fiduciaries (legally required to act in your best interest)

- Educators (breaking down complex stuff in plain language)

- Coaches (helping you actually stick with the plan)

I’ve seen people go from total money anxiety to genuine confidence simply because someone sat down with them, asked good questions, and built a plan that made sense in their real life—not some textbook version of it. That’s the power future financial planners bring to the table.

The New World of Financial Industry: Beyond Just Investments

There was a time when “financial planning” basically meant:

Pick some stocks. Buy some bonds. Cross your fingers.

Those days are over. Future financial planners are shifting from product-pushers to life planners who look at money as one piece of a bigger puzzle.

From Transactions to Transformations

Modern financial planning increasingly includes:

- Cash flow and budgeting: Not shame-based budgeting, but “how can we make your money reflect your priorities?”

- Debt strategy: Student loans, credit cards, medical bills—how to handle them without losing your mind

- Tax planning: Legally keeping more of what you earn (which, let’s be honest, feels amazing)

- Retirement and longevity planning: Planning for 30+ years after your last paycheck

- Estate and legacy planning: Wills, trusts, and making sure your money goes where you want, not wherever the system decides

One of my favorite shifts in how future financial professionals think is the move toward behavioral finance—understanding that people don’t always make decisions based on pure logic. We’re emotional. We panic. We get FOMO. We chase hot stocks, then swear off investing when things drop.

Instead of judging that, good planners account for it. They help set up systems that keep you from blowing up your long-term goals during a short-term freakout.

ESG, Values, and “Does This Align With My Life?”

Younger generations especially care about ESG investing (Environmental, Social, Governance):

- Is this company treating people well?

- Is it wrecking the planet?

- Does investing here align with my values?

Financial advisors who understand ESG and impact investing will be better equipped to serve clients who don’t just want returns—they want meaningful returns.

How Technology Is Reshaping Future Financial Planners

Let’s talk tech.

If you’ve ever opened a robo-advisor app and thought, “Wait, is this replacing humans?”—you’re not alone. Robo platforms automate:

- Portfolio allocation

- Rebalancing

- Tax-loss harvesting

They’re efficient, often low-cost, and great for simple situations. But here’s the twist: instead of eliminating human advisors, they’re actually making the best ones even more valuable.

Tech as a Co‑Pilot, Not a Replacement

Financial planners are learning to treat technology like a brilliant assistant:

- Software runs the numbers.

- AI analyzes patterns and scenarios.

- Automation handles routine tasks and paperwork.

That frees planners to focus on what tech still struggles with:

- Nuanced judgment calls

- Emotional support during market drops

- Complex, multi-layered life decisions

- Helping clients clarify what they honestly want

Cerulli Associates has found that firms effectively blending digital tools with human advice see higher client satisfaction and retention, because advisors can spend more time on strategy and less time on manual admin. Technology doesn’t steal the job—it changes the job.

Personally, I’m all for this. If software can fill out 43 forms while a planner talks you off the ledge during a market dip, that’s a win for everyone.

Hybrid Advice for Your Financial Needs: The New Normal

We’re moving toward a hybrid model where:

- Some people start with robo platforms and “graduate” to full-service planning

- Others work with advisors who incorporate robo tools behind the scenes

- Digital dashboards give clients real‑time insights into their financial lives

For future financial advisors, being tech‑comfortable is no longer optional. It’s table stakes. The ones who can blend empathy with efficiency will stand out.

Career Paths for Future Financial Planners: A Growing Opportunity

If you’re thinking, “This actually sounds like a pretty cool career,” you’re right—and you’re also very on‑trend.

The Core Path (And Why It’s Not Just for Math Nerds)

Most advisors start with:

- A bachelor’s degree in finance, accounting, economics, business, or a related field

- Relevant exams and licenses (like Series 7, Series 65/66, insurance licenses, depending on role)

- Professional certifications—especially the CFP® (Certified Financial Planner) credential from the CFP Board

The CFP® mark is a strong signal that an advisor:

- Has completed rigorous education

- Passed a comprehensive exam

- Has real-world experience

- Agrees to ethical standards, including putting clients’ interests first

But here’s the part I wish more people knew: the best financial advisors are not just spreadsheet geniuses. They’re:

- Curious

- Good listeners

- Comfortable having real conversations about financial needs, money, fear, family, and goals

If you’ve ever been the “friend who explains money stuff” without making people feel dumb, this field might fit you better than you think.

Specializations: Finding Your Niche

As the industry matures, future financial advisors can carve out niches such as:

- Retirement income planning for people nearing or in retirement

- Tax planning and coordination with CPAs

- Estate and legacy planning for families or business owners

- Planning for physicians, tech workers, small business owners, or creatives

- Sustainable and impact investing

- Student loan and young professional planning

Niche specialization and their combined experience in financial services, helps advisors stand out in a crowded market and attract clients who feel, “Oh, this person gets people like me.”

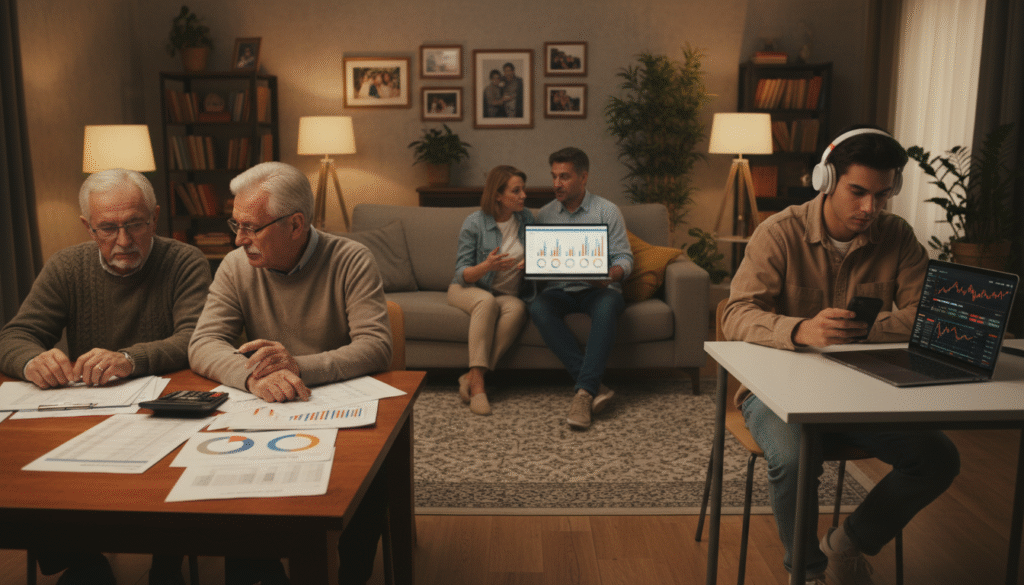

Serving the Next Generation: Millennials, Gen Z, and the Great Wealth Transfer

Here’s one of the biggest reasons future financial advisorswill be in demand: a massive transfer of wealth is underway.

Baby Boomers hold a huge share of U.S. assets, and that money is gradually moving to heirs—many of them Millennials and Gen Z. On top of that, women are projected to control an increasingly large share of investable assets by 2030.

That changes everything.

Different Generations, Different Expectations

Younger clients often:

- Want digital access and flexible communication (yes to Zoom, text, client portals)

- Care deeply about values-aligned investing

- Have non-linear careers—gig work, job hopping, side businesses

- Juggle student loans, housing costs, and lifestyle goals

A retirement plan for a 30‑year‑old freelancer with student debt and a startup idea looks nothing like the plan for a 64‑year‑old corporate exec with a pension. Future financial planners must be fluent in both worlds.

I remember talking to a planner who said half her meetings with younger clients are, “Okay, let’s figure out how to afford your life now without wrecking Future You.” That’s the sweet spot.

Staying Connected: From One‑Off Meetings to Ongoing Guidance

Instead of one-time “here’s your plan, good luck” binders, future financial advisors are:

- Meeting regularly (quarterly, semiannually)

- Adjusting plans as life changes—new job, baby, move, market shift

- Using apps and dashboards to keep clients engaged between meetings

The relationship becomes more like a long‑term partnership than a one‑time client service consult. And honestly, in a world where everything changes fast, ongoing guidance just makes sense.

The Advisor Shortage: A Problem and an Opportunity

Now for a surprising plot twist: just as demand for advice is rising, the supply of advisors is struggling to keep up.

- The U.S. wealth management industry is projected to face a shortage of around 100,000 financial advisors by 2034 if productivity doesn’t change.

- The advisor workforce has barely grown—about 0.3% per year over the last decade—and is expected to decline slightly in coming years.

- Roughly 38% of current advisors (about 110,000 people) are expected to retire in the next decade.

That’s… a lot of empty chairs.

What This Means for Future Financial Planners

Firms and institutions are responding by:

- Investing in training and development programs

- Encouraging team-based models where senior advisors mentor newer ones

- Leaning harder into technology to boost productivity

For anyone considering this career, it’s basically a giant flashing sign that says:

“We need you. And we need you soon.”

If future financial advisors can become 10–20% more productive through better tools and smarter processes—as some industry analyses suggest they must—that gap becomes less scary and more manageable. But the human piece is non‑negotiable: the industry needs fresh talent and new voices.

Soft Skills That Define Future Financial Planning Services

Here’s where it gets interesting. We talk a lot about credentials, portfolios, and tech—but the magic of future financial planners often shows up in the soft skills.

Emotional Intelligence (Yes, Really)

Money is emotional.

People bring their:

- Childhood money stories

- Fears about scarcity

- Fights they’ve had with partners

- Regrets about past mistakes

A study by the CFP Board and Morningstar has highlighted how behavioral coaching is one of the biggest drivers of advisor value—helping clients avoid panic-selling, stay committed to long-term strategies, and make more rational decisions even when emotions run high.

The best future financial advisors will:

- Ask thoughtful, sometimes uncomfortable questions

- Listen more than they talk (at least at first)

- Normalize the fact that most people were never really taught how this works

- Help couples get on the same page without taking sides

I’ve sat in conversations where a good planner turned what could’ve been a tense, defensive discussion into a moment of genuine relief and alignment. That’s not about picking the right ETF. That’s about emotional intelligence.

Communication That Doesn’t Make Your Eyes Glaze Over

Future financial planners also need to be great translators. No one wants to be buried in jargon like “standard deviation” and “Sharpe ratio” when they really just want to know, “Will I be okay if the market drops?”

Strong planners will:

- Use plain language

- Provide context: “Here’s what this means for you”

- Focus on stories and examples, not just charts

- Deliver bad news honestly, but with a plan attached

In other words: less lecture, more conversation.

Holistic Planning: Seeing the Whole Person, Not Just the Portfolio

One of the defining traits of future financial planners is how holistic they’ll need to be. The job is shifting from “manage assets” to “help manage a life.”

Holistic planning can include:

- Health and longevity: How do healthcare costs, aging, and long life expectancies affect your savings?

- Career planning: How do job changes, sabbaticals, or starting a business fit into your financial picture?

- Family dynamics: Supporting parents, kids, or both; planning for special needs; blended families

- Purpose and meaning: How do you want your money to feel in your life? Security? Freedom? Generosity?

This is where empathy and strategy collide. Future financial planners who embrace this broader view will build deeper, stickier client relationships—and honestly, they’ll probably find their work a lot more rewarding.

How Future Financial Planners Will Use Research and Data (Without Losing the Human Touch)

Don’t worry, this isn’t the part where I bury you in citations. But real research matters.

For example:

- Vanguard has published research showing that working with a skilled human advisor can add significant “advisor alpha”—extra value beyond basic investment returns—through behavioral coaching, tax-efficient strategies, and disciplined rebalancing.

- Studies in behavioral economics (think Richard Thaler, Daniel Kahneman) have shown how consistently human biases affect decision-making—confirmation bias, loss aversion, overconfidence, all the hits.

Future financial planners will increasingly rely on:

- Data analytics to identify risks and opportunities in a client’s plan

- Scenario modeling to test “what ifs” (market drops, job loss, longevity, etc.)

- Evidence-based strategies instead of hunches or trends

But the key is this: data supports the conversation—it doesn’t replace it. A Monte Carlo simulation might say you have an 85% chance of meeting your retirement goal. A human planner will explain what that means, how to improve it, and how to sleep at night knowing life is never 100% predictable.

What This Means If You’re Looking for a Financial Planner

If you’re not trying to be a planner but just want help from one, here’s how all this future‑focused stuff helps you right now.

When you’re evaluating future financial planners, you can look for people who:

- Are fiduciaries and can explain exactly how they’re compensated

- Use technology, but don’t hide behind it

- Talk about holistic planning, not just “beating the market”

- Ask questions about your values, not just your balance sheet

- Are comfortable working with your age group, life stage, and complexity

Honestly, if a planner doesn’t ask you at least a few “big picture” questions—about what you want your life to look like, not just your assets—you might want to keep looking.

What This Means If You Want to Become a Future Financial Planner

If you’re considering this as a career, the next decade is full of opportunity. You’ll need:

- Education: A relevant degree helps but isn’t strictly everything.

- Licensing and certification: CFP®, investment licenses, etc.

- Soft skills: Communication, empathy, confidence under pressure.

- Tech literacy: Comfort with planning software, CRMs, digital tools.

You’ll likely:

- Start in a support or junior role

- Learn from senior advisors and mentors

- Build your own book of clients gradually

- Decide whether to specialize or stay more generalist

It’s not an overnight success story career. But it is one where you can make a clear, measurable difference in people’s lives—and get paid to help them stop stressing about money so much. That’s a pretty good gig.

Wrapping It Up: Why the Financial Future Planning Is Worth Paying Attention To

So why should you care about future financial planners?

Because the way we handle money is changing, fast. And the next wave of planners will be the ones helping people:

- Navigate more complex markets

- Balance competing financial priorities

- Align money with values and lifestyle

- Use technology without losing the human element

The next decade will belong to future financial planners who can:

- Blend data and empathy

- Integrate tech and human wisdom

- Offer holistic, values-driven planning

- Serve both retiring Boomers and emerging Millennial/Gen Z investors

Whether you’re searching for your own advisor or thinking about joining the profession, understanding these shifts puts you ahead of the curve. You’re not just reacting to change—you’re anticipating it.

And honestly, that’s what good planning is all about.

If you’re curious about diving deeper into how future financial planners work—or you’re toying with the idea of becoming one yourself—stick around. I’ll be sharing more insights, stories, and practical tips to help you navigate this world with a little less stress and a lot more clarity.

Because your financial life deserves more than generic advice. It deserves thoughtful, forward‑looking guidance from someone who sees you as a whole person—not just an account balance—with a little personality and humor thrown in for good measure.

2 Comments

Comments are closed.