Optimize High Net Worth Retirement in 2025: Vanika’s Guide

High net worth retirement planning helps you reduce taxes, protect wealth, and build sustainable income so your money lasts for decades.

If you’ve ever looked at your balance sheet and thought, “Well… this is a good problem to have,” welcome to the world of high net worth retirement planning. It’s retirement planning, yes—but with extra layers. More accounts. More tax rules. More decisions that can save (or cost) you a genuinely offensive amount of money.

And here’s the twist: wealth doesn’t automatically equal simplicity. In fact, the bigger the portfolio, the easier it is to accidentally leak money through taxes, poor account sequencing, concentrated positions, sloppy estate documents, or one of those “we’ll deal with it later” decisions that quietly turns into “we should’ve dealt with it five years ago.”

I’ve also noticed something else: affluent people often get more anxious about retirement, not less. Because once you’ve built meaningful wealth, you don’t just want to retire. You want to protect what you’ve built, fund a long life (possibly a very long one), and leave a legacy without creating a mess for your family. That’s exactly what high net worth retirement planning is designed to do—preserve capital, minimize taxes, and create sustainable income streams that can hold up through markets, life changes, and tax law curveballs.

Let’s walk through the strategies wealthy families and their advisors use to keep retirement strong, flexible, and—dare I say it—enjoyable.

What Makes High Net Worth Retirement Planning Different?

Most retirement advice online is built for the “save consistently, invest in index funds, don’t panic” crowd. Great advice. Also, incomplete when your financial life includes things like:

- Business ownership (or a big equity comp package)

- Multiple properties

- A seven-figure taxable brokerage account

- Private equity or private credit commitments

- Charitable goals beyond “round up at checkout”

- A real desire to transfer wealth responsibly, not just dump it on heirs like a financial piñata

High net worth retirement planning is different because it has to coordinate more moving parts—and because mistakes get magnified. A 1% “oops” on $250,000 is annoying. A 1% “oops” on $25 million is… a very expensive learning experience.

The good news: the same complexity that creates risk also creates opportunity. With the right planning, you can reduce lifetime taxes, improve after-tax returns, protect your estate, and design income that works even if you live to 100 (and still want to travel).

The Five Pillars of High Net Worth Retirement Planning

If you want a clean framework, I like to anchor high net worth retirement planning in five pillars. Think of them as the load-bearing beams of the whole plan.

1) Tax Optimization and Account Sequencing

Goal: minimize lifetime tax drag and prevent income spikes (especially around RMDs and Medicare premiums).

2) Estate and Legacy Planning

Goal: transfer wealth efficiently, avoid probate chaos, protect beneficiaries, and reduce estate tax exposure where applicable.

3) Portfolio Construction (Including Alternatives)

Goal: diversify beyond public markets without sacrificing liquidity needed for retirement spending, taxes, and opportunistic moves.

4) Retirement Income Strategy and Liquidity Planning

Goal: create a withdrawal plan that funds lifestyle needs, handles irregular big expenses, and keeps the portfolio durable.

5) Longevity and Healthcare Planning

Goal: plan for long horizons, inflation, long-term care risk, and the reality that medical costs can be the stealth “budget buster.”

None of these pillars works in isolation. Great high net worth retirement planning is integrated—tax strategy supporting estate goals, investments supporting spending, charitable giving supporting tax management, and so on.

Tax Optimization: The Quiet Superpower of High Net Worth Retirement Planning

Taxes are one of the few expenses you can plan proactively—before they happen. That’s why tax strategy is often the “engine” behind high net worth retirement planning.

And the key idea is simple: taxes compound like a negative return. Reducing tax drag doesn’t just save money today—it preserves more capital to grow tomorrow.

How to Think About Your Three “Tax Buckets”

Most affluent households have money in three places:

- Taxable accounts (brokerage, trust accounts, real estate income, business distributions)

- Tax-deferred accounts (traditional IRA/401(k), SEP, SIMPLE)

- Tax-free accounts (Roth IRAs, Roth 401(k), some life insurance cash value strategies depending on structure)

High net worth retirement planning is about managing which bucket you pull from and when, so you’re not accidentally creating a tax spike that triggers higher marginal rates, net investment income tax, or Medicare IRMAA surcharges.

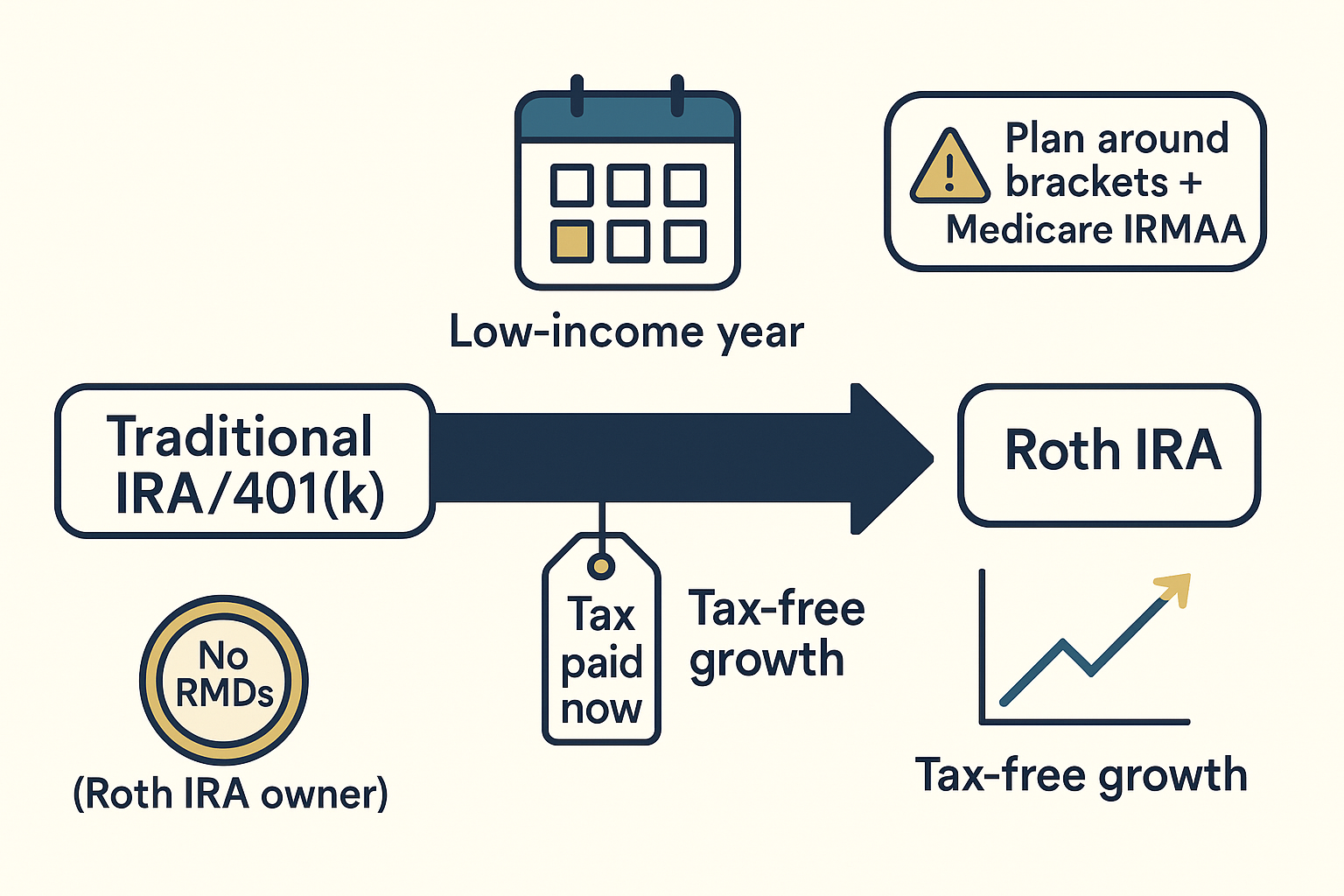

Roth Conversions: Paying Taxes on Purpose (Yes, Really)

Roth conversions are a cornerstone strategy in high net worth retirement planning because they buy you something precious: tax certainty.

You pay tax now to move money from a traditional IRA/401(k) into a Roth IRA. In exchange, you potentially get:

- Tax-free growth

- Tax-free withdrawals later (subject to rules)

- No RMDs from Roth IRAs for the original owner

- A cleaner asset to leave heirs (still subject to distribution rules, but often more tax-friendly)

The best time to convert is often during what I call the “gap years”—after you stop working but before RMDs and full Social Security benefits pile on. Those years can be a goldmine for conversions because your taxable income may temporarily drop.

A practical “don’t mess this up” note: conversions work best when you can pay the conversion tax from outside the retirement account. If you pay the tax using the converted funds, you shrink the amount that gets tax-free compounding. It’s like paying for a gym membership and then only going once a month. Technically you’re doing it, but… come on.

RMD Management: Avoiding the Tax Avalanche

Required Minimum Distributions are where many high net worth retirees get surprised. RMDs force taxable income at a stage of life when you may not need extra income—yet you still need to report it.

RMDs can also trigger Medicare premium surcharges (IRMAA), which is basically the government saying, “Congrats on your success—now pay more for the same thing.”

Smart high net worth retirement planning often includes:

- Conversions before RMD age to reduce future RMDs

- Coordinating charitable giving with RMD years (more on QCDs below)

- Monitoring how RMD income interacts with capital gains and dividends

Qualified Charitable Distributions (QCDs): A Clean Win (If You’re Charitable Anyway)

If you’re charitably inclined, QCDs can be one of the most elegant tools in high net worth retirement planning. A QCD lets you donate directly from an IRA to a qualified charity (once eligible), and that distribution generally doesn’t count as taxable income.

That matters because keeping income lower can help reduce tax bracket creep and Medicare surcharges. It’s giving… with math.

Tax-Loss Harvesting: Turning Market “Ow” Into Tax “Ahh”

In taxable accounts, tax-loss harvesting can offset gains and reduce taxes—without abandoning your investment strategy.

The key is to stay aware of wash-sale rules and avoid harvesting losses in a way that breaks your portfolio structure. Done properly, it’s a long-term tax efficiency tool that supports the bigger mission of high net worth retirement planning: maximizing after-tax wealth.

Charitable Planning That Actually Fits Your Life

Charitable giving can be more than “write a check in December.” In high net worth retirement planning, it can be an intentional part of the tax and legacy strategy.

Donor-Advised Funds (DAFs): The “Plan Now, Give Later” Tool

DAFs are popular because they’re simple and flexible:

- You contribute cash or appreciated assets

- You may get a tax deduction in the year of the contribution

- You recommend grants to charities over time

A DAF is especially useful in a high-income year—maybe you sold a business, received a large bonus, or had a big capital gain. You can “front-load” your giving for tax purposes while taking your time deciding where the money goes.

Charitable Remainder Trusts (CRTs): Income + Giving + Tax Planning

CRTs are more advanced, but they can be powerful when you have highly appreciated assets and want income.

Conceptually:

- You contribute appreciated assets into the CRT

- The CRT sells them (potentially with more favorable tax handling than if you sold personally)

- You receive income for a term or life

- The remainder goes to charity

CRTs can support high net worth retirement planning by combining income planning with charitable intent and potential tax benefits. They are irrevocable, though—so this is a “measure twice, cut once” move.

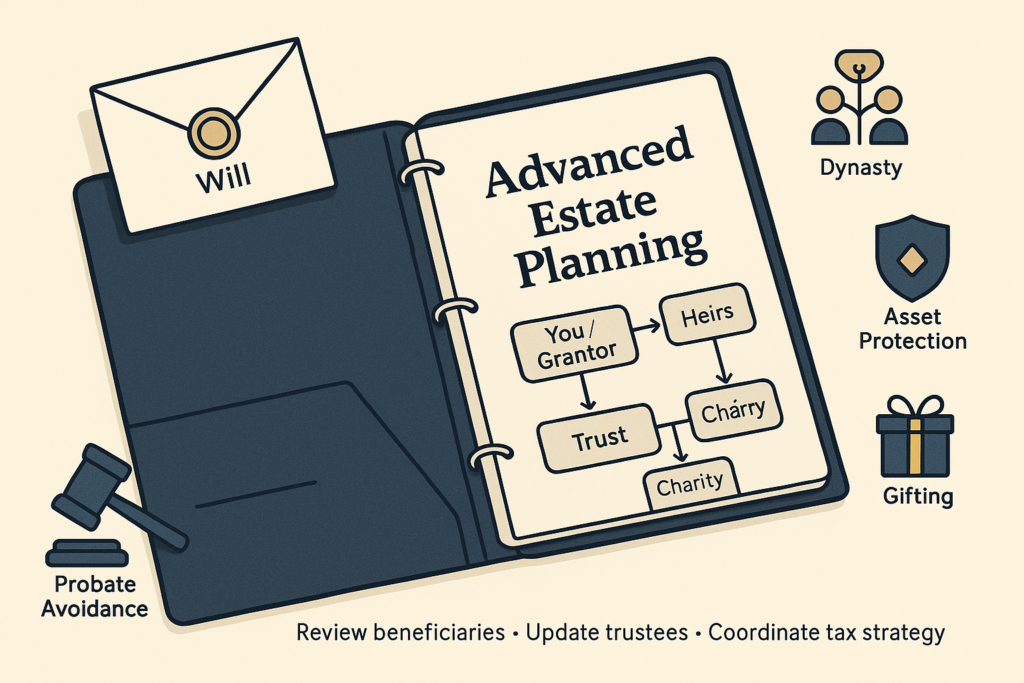

Advanced Estate Planning: Where High Net Worth Retirement Planning Becomes Legacy Planning

If tax strategy is the engine, estate planning is the steering wheel. Without it, you might still go somewhere… but maybe not where you intended.

High net worth retirement planning often includes estate considerations such as:

- Probate avoidance

- Beneficiary protections

- Business succession

- Estate tax planning (federal and state)

- Family governance and reducing conflict risk

And yes, part of estate planning is paperwork. But the best estate plans are more than documents—they’re systems.

Trusts: Control, Protection, and (Sometimes) Tax Strategy

A few common trust frameworks used in high net worth retirement planning:

Revocable Living Trust

Often used for probate avoidance and continuity if you become incapacitated. It’s not primarily an estate tax tool, but it can make administration smoother and more private.

Irrevocable Trust

Used to remove assets from the taxable estate and/or protect assets. Once funded, control is limited—by design.

Dynasty Trust (Where Allowed)

Designed to keep assets compounding across generations, potentially avoiding estate tax at each generational transfer. It can also protect assets from creditors and divorces (because life happens, and sometimes it happens with lawyers).

Trustee and Governance: The Part Everyone Skips (And Regrets Later)

Here’s my friendly warning: picking a trustee is not a “last five minutes” decision.

A strong trustee structure can:

- Reduce family conflict

- Provide guardrails for beneficiaries

- Maintain investment discipline

- Ensure distributions match your intent

This is the human side of high net worth retirement planning—because wealth transfer is rarely just a math problem.

Gifting Strategies That Move Wealth Efficiently

If your estate could be taxable (or you simply want to transfer wealth while you’re alive), gifting strategies matter.

Annual Exclusion Gifting

Annual exclusion gifts are the simple, repeatable habit of gifting within annual limits to reduce estate size over time. This is often used for:

- Helping family members now

- Funding education plans

- Seeding investment accounts for younger generations

Larger Strategic Transfers

For more substantial shifts, high net worth retirement planning can incorporate vehicles designed to transfer future appreciation efficiently—often while keeping some economics or control structures in place.

One example you’ll hear about is GRATs (Grantor Retained Annuity Trusts), commonly used when:

- You have assets expected to appreciate

- You want to transfer that appreciation with potentially reduced gift tax impact

- You’re comfortable with the legal and administrative complexity

These strategies are sensitive to interest rates, valuation, and timing—so they’re typically coordinated closely with estate attorneys and tax professionals.

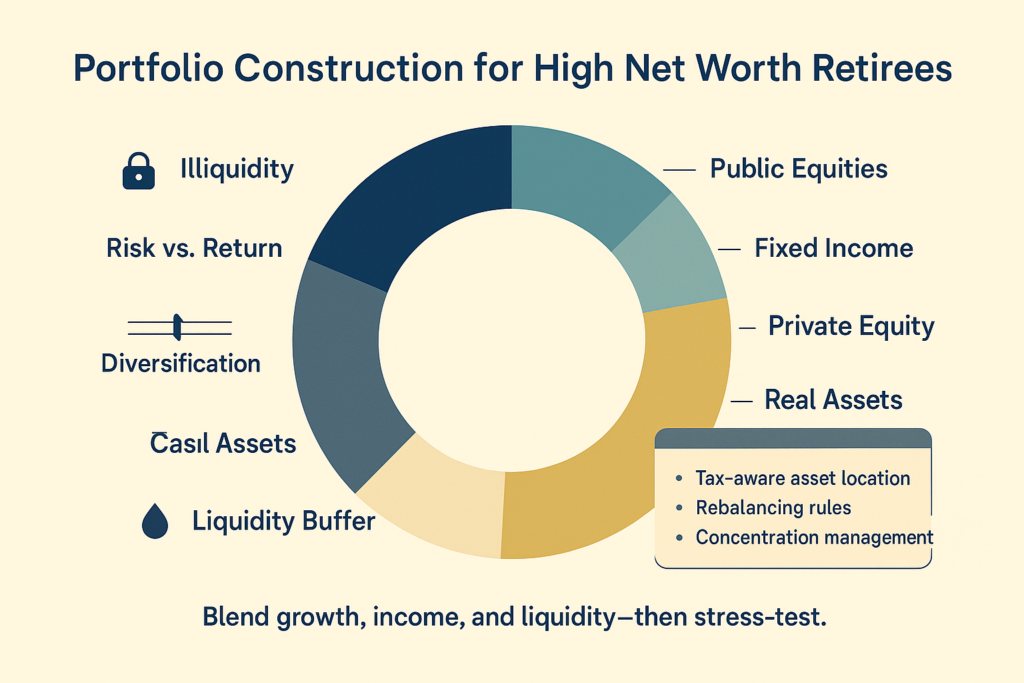

Portfolio Construction for High Net Worth Retirees (Including Alternatives)

A high net worth retirement portfolio has one job: fund your life without breaking under pressure. That means balancing growth, liquidity, and risk management—while keeping taxes in mind.

The Real Challenge: Liquidity vs. Opportunity

High net worth investors often have access to private markets:

- Private equity

- Private credit

- Real estate syndications

- Infrastructure

- Hedge strategies

These can offer diversification and return potential, but they come with:

- Lockups

- Capital call schedules

- Layered fees

- Valuation opacity (you don’t get a real-time price every second, which is either calming or terrifying depending on your personality)

A smart high net worth retirement planning approach doesn’t just “add alternatives.” It creates a liquidity plan first, then allocates to illiquids in a way that won’t force you to sell good assets at bad times.

Concentration Risk: The “I Got Rich This Way” Problem

A lot of high net worth people are concentrated in:

- Company stock

- A family business

- A single real estate market

- One sector that treated them very well (until it doesn’t)

Concentration is tricky because it often created the wealth. So reducing it can feel emotional—like you’re betraying the thing that worked.

But high net worth retirement planning asks a blunt question: Do you want to stay wealthy, or do you want to stay nostalgic?

Strategies may include:

- Gradual sales plans

- Tax-aware diversification

- Charitable gifting of appreciated shares

- Hedging approaches (case-specific and complex)

- Coordinating diversification with estate planning (so the plan fits the bigger legacy picture)

Withdrawal Sequencing: The “Hidden Lever” in High Net Worth Retirement Planning

A sustainable retirement isn’t only about investment returns. It’s also about how you take money out.

A common sequencing framework in high net worth retirement planning looks like this:

- Taxable assets first (often), managing gains intentionally

- Tax-deferred strategically, especially before RMDs build up

- Roth assets last, using them for flexibility and late-retirement tax control

But sequencing isn’t a rule—it’s a strategy. You want to keep your taxable income in a reasonable range over time, not accidentally create:

- a low-tax decade followed by a high-tax disaster

- unnecessary IRMAA surcharges

- avoidable net investment income tax

- estate outcomes that force heirs into ugly tax situations

This is where year-by-year planning matters. I know, I know—everyone wants a “set it and forget it” retirement plan. Unfortunately, taxes did not get that memo.

Longevity, Healthcare, and Inflation: The Real-World Stress Tests

High net worth retirement planning has to plan for a longer horizon than most people expect. And it has to plan for healthcare, which is a category that tends to show up uninvited and stay too long.

Planning for a Long Life (Even If You Don’t “Feel Like It”)

The Society of Actuaries has long published longevity research showing that many retirees—especially couples—have a meaningful chance that one spouse lives into their 90s. That’s not a scare tactic; it’s a planning reality.

So the plan needs:

- enough growth to maintain purchasing power

- enough liquidity to handle shocks

- a spending strategy that flexes in down markets without wrecking your lifestyle

Healthcare Costs: Real Money, Not Pocket Change

Fidelity’s long-running retiree health care cost estimate has repeatedly highlighted that medical spending in retirement can be significant even before long-term care enters the picture. For high net worth households, the solution isn’t panic—it’s planning:

- choosing how to fund healthcare (HSAs, taxable, cash reserves)

- assessing long-term care risk

- stress-testing the plan against higher inflation

Long-Term Care: Insure, Self-Insure, or Hybrid?

There’s no one-size-fits-all answer. Options often include:

- Traditional long-term care insurance

- Hybrid life/LTC policies

- Self-insuring with earmarked assets

- Annuity structures with care riders (case-specific)

The best high net worth retirement planning approach usually comes down to your goals:

- Are you trying to protect the estate?

- Are you comfortable earmarking assets for potential care?

- Is insurability an issue?

- Do you want certainty or flexibility?

A Simple Decision Framework (So This Doesn’t Become a 96-Tab Spreadsheet)

Here’s a practical way to prioritize high net worth retirement planning decisions:

Step 1: Clarify the “why”

- What lifestyle do you want?

- What legacy do you want?

- What do you not want (tax surprises, forced sales, messy probate, family conflict)?

Step 2: Build the tax map

- Current bracket and projected future bracket

- RMD projections

- Medicare IRMAA risk

- State residency/tax considerations

Step 3: Align estate plan with reality

- Review beneficiaries (seriously—old forms cause chaos)

- Update trust structures if needed

- Confirm trustee choices and successor plans

- Coordinate with business succession planning

Step 4: Engineer the portfolio and liquidity plan

- Define liquid “runway” for spending and taxes

- Decide on alternative allocation based on liquidity tolerance

- Reduce concentration risk in a tax-aware way

Step 5: Implement a withdrawal strategy

- Decide on sequencing

- Plan conversions (if appropriate)

- Coordinate charitable giving with tax years

Step 6: Stress-test

- Inflation spike

- Market drawdown early in retirement

- Long-term care event

- Longevity scenario (one spouse lives to 95+)

This is high net worth retirement planning in the real world: not perfect forecasts, but resilient design.

Common Mistakes I See in High Net Worth Retirement Planning

Let’s keep this fun and useful—because learning from other people’s mistakes is cheaper.

Mistake #1: Treating taxes like an April problem

Taxes are a year-round strategy issue in high net worth retirement planning. Waiting until filing season is like trying to meal prep after you’re already hungry and standing in front of the fridge.

Mistake #2: Ignoring concentration risk because it “worked before”

Past success is great. Overconfidence is expensive.

Mistake #3: Estate plan mismatch

Your trust says one thing, your beneficiary forms say another, and your family says “wait, what?” at exactly the wrong time.

Mistake #4: Too much illiquidity

Alternatives are powerful—until you need liquidity at the wrong moment.

Mistake #5: Not updating the plan

Your life changes. Tax laws change. Markets change. Your plan should change, too.

Conclusion: The Real Goal of High Net Worth Retirement Planning

If you take nothing else from this, take this: high net worth retirement planning is about control. Not control in a “micromanage every penny” way—more like control in a “my wealth should serve my life, not run my life” way.

Done well, high net worth retirement planning helps you:

- Keep more of what you’ve built by reducing lifetime taxes

- Create reliable income streams without draining growth capital

- Protect your family from avoidable chaos (probate, taxes, disputes)

- Diversify wisely—including alternatives—without getting trapped by illiquidity

- Build a plan sturdy enough to handle long retirements, inflation, and healthcare surprises

And honestly? That’s the dream. Not just retiring with wealth, but retiring with confidence—knowing your plan isn’t held together by hope and a spreadsheet.

If you want, I can also tailor this into a version optimized for a specific audience (business owners, executives with equity comp, real estate-heavy families, or multigenerational wealth households) while keeping the same SEO structure and tone.

One Comment

Comments are closed.