Comprehensive Guide to Government Retirement Annuity Benefits and Eligibility

A clear, friendly guide to government retirement annuity benefits—FERS, CSRS, TSP, eligibility, and how to apply without the headaches.

Government retirement annuities play a crucial role in ensuring financial security for federal employees after their service. If you’ve ever sat at your kitchen table (or, let’s be real, at your desk on a slow Friday afternoon) staring at retirement paperwork and thinking, “Why does this feel like it was written for robots?”, you’re not alone. I’ve talked with a lot of federal employees who are great at their jobs but feel oddly unprepared when it comes to the government retirement annuity—mostly because the information is scattered, acronym-heavy, and allergic to plain English.

This comprehensive guide walks through the benefits of a government retirement annuity, who qualifies, how the numbers are calculated, and what the application process looks like in the real world (not the fairy-tale version where every form is magically complete on the first try). Understanding these elements matters because confusion can lead to missed opportunities—like retiring earlier than necessary, underestimating income, or overlooking survivor options that affect your family.

By the end, you’ll have a practical roadmap for navigating federal employee retirement benefits, the calculation of FERS annuities, the role of the Thrift Savings Plan, eligibility criteria, and the steps to apply for a government retirement annuity.

What Are Federal Employee Retirement Benefits and How Do They Work?

Federal employee retirement benefits are designed to provide financial support to people who have dedicated their careers to public service. In everyday terms, they’re meant to keep retirement from feeling like jumping off a cliff and hoping your savings sprout wings.

Most federal retirement packages include a pension-style benefit (your government retirement annuity), Social Security (for many employees), and a retirement savings plan (the Thrift Savings Plan, or TSP). Together, these create a more stable income picture than relying on one single source.

Here’s the key idea: your government retirement annuity is the predictable, steady piece of the puzzle. It’s not the only piece, but it’s often the one that helps people sleep at night.

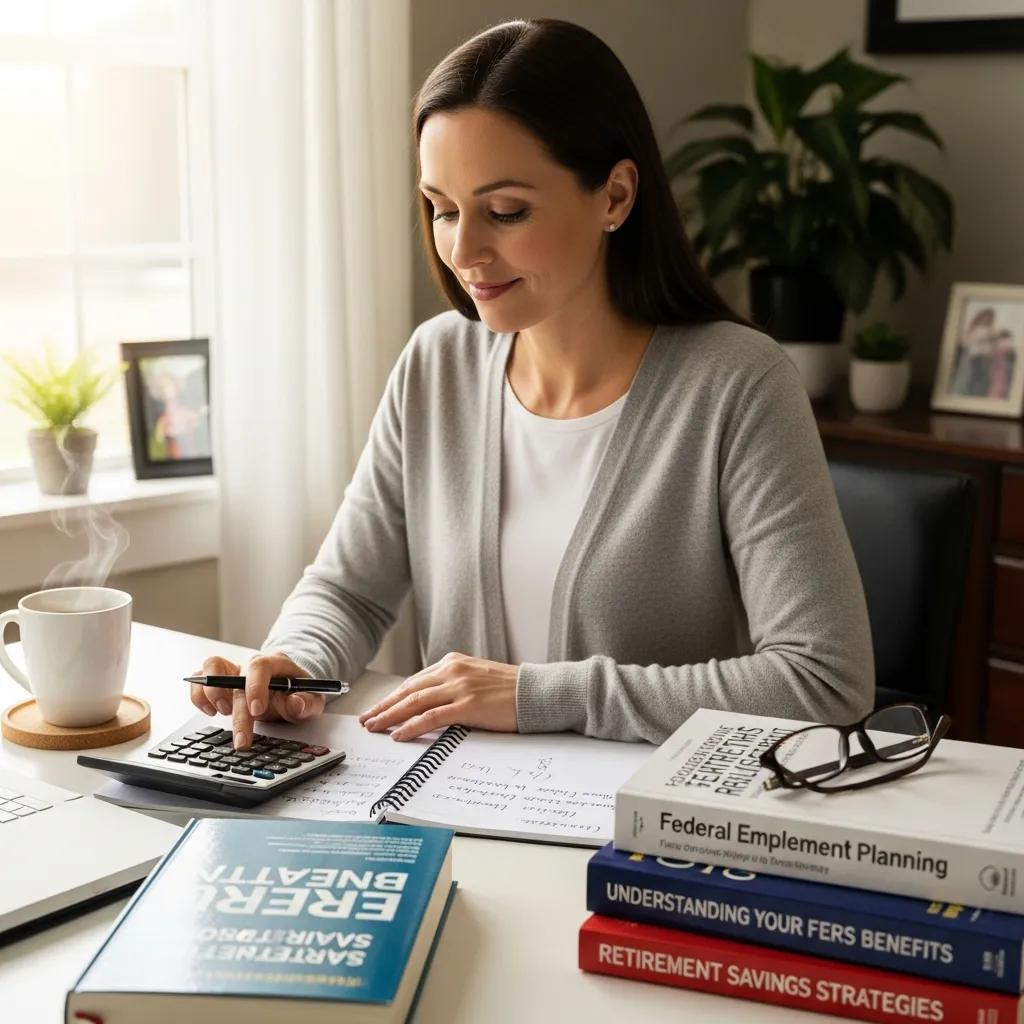

Understanding the Federal Employees Retirement System Annuity

The Federal Employees Retirement System (FERS) annuity is a major component of retirement benefits for many federal employees. It’s calculated based on your years of service and your highest average salary over a specific period, known as the “high-3” average salary. In other words: the longer you serve and the higher your top earnings window, the stronger your annuity.

I like to explain it this way: a FERS government retirement annuity is basically your “thanks for showing up for decades” payment—built on a formula instead of market mood swings.

A reliable annuity can help federal employees maintain their standard of living after leaving the workforce. But it’s also where people get tripped up, because small details (like when you retire, or how your high-3 is calculated) can make a bigger difference than you’d think.

Further research has also examined specific parts of FERS benefits—like survivor annuities—and what those decisions can mean financially.

FERS Survivor Annuity Benefits: Maximizing Retirement Income

The Federal Employees Retirement System (FERS) provides survivor annuity benefits for employees who forfeit a portion of their annuity as a premium. In a study that used Monte Carlo simulation to analyze joint and survivor annuity elections, researchers found the survivor benefit program can be quite lucrative for many male retirees, while it may be less rewarding for female retirees—especially if the retiree is younger than her spouse. In some scenarios, the program could even produce a negative return for many female retirees.

Source: “An examination of the Federal Employee Retirement System (FERS) survivor annuity benefit” (2018). The practical takeaway isn’t “never choose survivor benefits.” It’s: don’t choose on autopilot. If you’re making this decision, it’s worth running the numbers for your situation—ages, health, other income sources, and what your spouse would realistically need.

Overview of the Civil Service Retirement System and Its Annuity Benefits

The Civil Service Retirement System (CSRS) is the older retirement plan that applies to many federal employees who were hired before 1984. Unlike FERS, CSRS generally does not include Social Security as part of its core retirement design, but it offers a more generous pension formula.

If FERS is the “three-part retirement combo meal,” CSRS is the “big entrée” retirement plan. Employees under CSRS can often expect a higher percentage of their salary as a pension, which can be a real advantage for long-term employees.

Understanding whether you’re under FERS or CSRS matters because it impacts your government retirement annuity calculation, your planning assumptions, and how much you may need to lean on the TSP.

How Is the FERS Annuity Calculated for Federal Employees?

Calculating your FERS government retirement annuity isn’t complicated once you know the formula—but it’s easy to get wrong if you miss a detail. And yes, I’ve watched smart people confidently calculate an annuity… and accidentally use the wrong “high-3” window. (Retirement math is humbling like that.)

Key Factors Influencing FERS Annuity Calculation

The FERS annuity calculation depends on three core factors:

- Years of service (creditable federal service)

- High-3 average salary (your highest average basic pay over three consecutive years)

- Retirement age

Under the standard formula, employees earn 1% of their high-3 average salary for each year of service. That multiplier increases to 1.1% if you retire at age 62 or older with at least 20 years of service.

This is one of those “small percentage, big lifetime impact” moments. A 0.1% increase doesn’t sound exciting—until you realize it applies to every year of service and every year of retirement income.

Examples of FERS Annuity Calculation Scenarios

To make the math feel less abstract, here are examples using the standard FERS government retirement annuity formula:

Scenario 1: An employee with 30 years of service and a high-3 average salary of $60,000 would receive an annual annuity of $18,000 (1% of $60,000 multiplied by 30).

Scenario 2: An employee retiring at age 62 with 25 years of service and a high-3 average salary of $80,000 would receive an annual annuity of $22,000 (1.1% of $80,000 multiplied by 25).

Scenario 3: An employee with 20 years of service and a high-3 average salary of $50,000 would receive an annual annuity of $10,000 (1% of $50,000 multiplied by 20).

These examples show why the timing of your retirement matters. Retiring a little later (or hitting that 62-and-20-years threshold) can noticeably improve your government retirement annuity.

What Is the Role of the Thrift Savings Plan in Federal Retirement?

The Thrift Savings Plan (TSP) is the retirement sidekick to your government retirement annuity. If the annuity is the dependable “base salary in retirement,” the TSP is the flexible “we can actually take that trip” money.

I’ve seen two types of retirees: the ones who treated the TSP like an afterthought, and the ones who treated it like a quiet superpower. The second group tends to look a lot more relaxed when they talk about retirement.

How the Thrift Savings Plan Supplements Government Pension Benefits

The TSP allows federal employees to contribute a portion of their salary into a retirement account that can grow tax-advantaged until withdrawal. It’s similar to a 401(k) and includes investment options such as government securities, stocks, and bonds.

Because your government retirement annuity is based on a formula, it may not fully replace your working income—especially if you’re used to overtime, locality pay differences, or a lifestyle that includes things like “eating out occasionally.” That’s where the TSP helps fill the gap.

Contribution Options and Withdrawal Rules for Federal Employees

Federal employees can contribute up to the IRS annual limit to the TSP, which for 2024 is $23,000 for those under 50, and $30,500 for those 50 and older (including catch-up contributions). The government may also provide matching contributions (often up to 5% of the employee’s salary, depending on participation rules).

Withdrawal rules depend on age and employment status, with options like loans, hardship withdrawals, and distributions. This is one area where it’s smart to double-check the latest IRS and TSP guidance before making a big move—rules can evolve, and the cost of guessing wrong is… not fun.

Who Is Eligible for Government Pension and Retirement Annuities?

Eligibility for a government pension and retirement annuities is determined by specific criteria. Translation: you don’t just wake up one day and get handed a government retirement annuity like it’s a participation trophy. (Though honestly, some days in federal service feel like you deserve one.)

Understanding eligibility is essential so you can plan when retirement is possible and what your annuity might look like.

Eligibility Criteria for FERS and CSRS Retirement Systems

To qualify for FERS retirement benefits, employees generally need at least five years of creditable service and must meet age requirements depending on the type of retirement.

Immediate retirement eligibility under FERS often includes:

- Age 62 with 5 years of service

- Age 60 with 20 years of service

- Minimum Retirement Age (MRA) (ranges from 55 to 57 depending on birth year) with 30 years of service

For CSRS, employees generally need at least 5 years of service and be age 55 or older for immediate retirement.

If you’re not sure which system you’re in, don’t guess. Check your personnel records or ask HR. Your government retirement annuity depends on it.

Special Considerations for Federal Employee Retirement Eligibility

Certain situations can change your retirement eligibility and how your government retirement annuity works:

- Disability retirement: May allow retirement with fewer years of service if you meet disability requirements.

- Early retirement options: Sometimes available during agency downsizing or special authority windows, but often come with reduced annuity amounts.

If there’s one theme here, it’s this: early retirement can be a gift… with a price tag. Make sure you know what you’re paying for.

What Are the Steps to Apply for a Government Retirement Annuity?

Applying for a government retirement annuity is a process—one that rewards planning and punishes procrastination. If you’re the type who likes to “just wing it,” retirement paperwork will cure you of that habit.

Required Documentation and Application Process Overview

To apply for a government retirement annuity, employees typically gather documentation such as:

- Proof of service

- Pay records

- Any relevant medical records (for disability claims)

The application process usually involves submitting forms to the Office of Personnel Management (OPM). Depending on your circumstances—survivor benefits, prior service, military buyback, name changes—you may need additional forms and verification.

A practical tip I always share: keep a retirement folder (digital or paper) with your key documents. Future-you will be grateful, and present-you will feel oddly accomplished.

Common Challenges and How to Avoid Application Delays

Common challenges include incomplete documentation, misunderstanding eligibility requirements, and processing delays.

To reduce the odds of delays:

- Review your package carefully before submission (yes, even the boring pages)

- Ask HR to confirm your service history and retirement coverage

- Submit well in advance of your intended retirement date

The retirement finish line is exciting. But the paperwork on the way there? It’s like a final boss battle—annoying, but beatable.

Retirement System

Key Features

Eligibility Criteria

FERS

Includes Social Security, TSP

5 years of service, age 62 or older (or other age/service combinations for early/retirement eligibility)

CSRS

More generous pension formula, no Social Security

5 years of service, age 55 or older

TSP

Tax-advantaged savings plan

Open to all federal employees

Federal employees must navigate a complex landscape of retirement benefits, but understanding the various components can empower them to make informed decisions. By familiarizing yourself with FERS and CSRS systems, the Thrift Savings Plan, and the application process, you can set yourself up for a smoother transition.

Conclusion: Building Confidence in Your Government Retirement Annuity Plan

A government retirement annuity isn’t just a line item in a benefits brochure—it’s the backbone of many federal retirements. The more you understand it, the better choices you can make about when to retire, how to estimate your income, and how to coordinate your annuity with TSP savings.

If I could leave you with one friendly nudge, it’s this: don’t wait until the year you want to retire to learn how your government retirement annuity works. Give yourself time to ask questions, check your records, and run realistic scenarios. Retirement planning doesn’t need to be scary—it just needs to be intentional.

And when you finally do retire? I hope you celebrate in a way that feels right for you. Some people book a trip. Others buy a fishing boat. Me, I’d probably start with a long breakfast and the joy of not checking email before 8 a.m. Either way, you earned it.